Traders have gunned the market higher over the last two weeks courtesy of:

1) Short covering

2) The Euro rally on French liquidity concerns

3) Rumors of yet another Euro bailout

Regarding #1, short interest on the NYSE was at March 2009 levels going into this rally. With this kind of short interest, even a small rally will become explosive as the shorts cover (buy stocks)… which sends the market higher… which in turn results in more shorts cover.

This same dynamic is playing out for large financial institutions in France resulting in #2. French banks are facing major short-turn funding shortages. As a result they are selling long positions and covering shorts to free up capital. Because of this, the Euro is rallying hard, just as the US Dollar did in 2008 when the US banking system was in collapse.

Because stocks are moving in lock-step with the Euro, the Euro move has pushed stocks higher in a big way.

Finally, regarding #3, it is obvious to anyone that the EU is completely out of ideas that will possibly work. The kick the can mentality is ending. I know Merkel and Sarkozy claim to be working on some great plan to fix things… but the reality is that if those countries do go for the leveraged EFSF then they will lose their AAA status… which comes with its own set of major problems.

Finally, regarding #3, it is obvious to anyone that the EU is completely out of ideas that will possibly work. The kick the can mentality is ending. I know Merkel and Sarkozy claim to be working on some great plan to fix things… but the reality is that if those countries do go for the leveraged EFSF then they will lose their AAA status… which comes with its own set of major problems.

Will France and Germany go “all in,” and choose to lose their AAA status to bailout Greece again? Hard to believe that will be the case. And we see reports emerging of Germany preparing for a Greek default and bondholders taking a 60% haircut.

It is literally a case of “pick your poison.” If Germany and France backstop Greece again with the leveraged EFSF, they will lose their AAA statuses and we’ll see a bloodbath in Europe. If they don’t backstop with the leveraged EFSF, we’ll see a bloodbath in Europe.

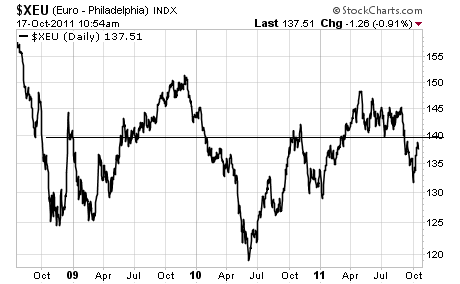

With that in mind, the Euro is coming up against major resistance at 140:

We’re facing a quick correction here to 135 if not 130 in short order. Long-term I expect we’ll see Greece default followed by a domino effect in which all bankrupt European nations restructure. When this occurs the Euro will break below the 2010 lows of 118.

We’re facing a quick correction here to 135 if not 130 in short order. Long-term I expect we’ll see Greece default followed by a domino effect in which all bankrupt European nations restructure. When this occurs the Euro will break below the 2010 lows of 118.

In terms of stocks, we’ve been in a large trading range between 1,125 and 1,220 on the S&P 500. We’re now testing the upper end of this range, which sets us up for a return to the low end of the range.

Given the economic backdrop in the US and Europe, I remain convinced we’re breaking out of this range to the down side. I’ve warned to get defensive for over a month now. This week looks to be a good time to add to shorts as I expect we’re going to likely see a top put in as earnings season kicks into higher gear and the usual options expiration nonsense ends.

However, larger picture, I believe we’re facing systemic risk… as in another 2008 event. The most likely culprit for this will be Europe, which is literally on the ledge of a cliff.

Indeed, the facts remain that Greece will default. End of story. Greece is broke. The market knows this which is why it’s pricing a Greek default at 100% guaranteed.

Once Greece defaults, Spain and Italy will follow suit. When that happens we’re facing a situation that will make 2008 look like a picnic. The powers that be know this… which is why the IMF has warned we are facing a “global financial meltdown.” And the Bank of England says we’re facing the “worst financial crisis in history.”

Folks, these are the guys in charge of holding the financial system together… warning that we’re facing a meltdown. Did they do that in 2008? Nope. So how bad are things going to be? BAD.

If you have yet to prepare yourself for what’s coming, now is the time to do so. I can show you how. Indeed, my clients MADE money in 2008, outperforming every mutual fund on the planet as well as 99% of investment legends.

We also outperformed the market by 15% during the Euro Crisis of 2010. And in the last month and a half, while every one else lost their shirts, we’ve locked in 14 winners.

So if you’re looking for a guide to get you through the coming disaster, I’m your man.

I’ve been helping investors, including executives at many of the Fortune 500 companies, navigate their personal portfolios through the markets for years.

I can do the same for you with my Private Wealth Advisory newsletter.

The minute you subscribe to Private Wealth Advisory you’ll be given access to my

Protect Your Family, Protect Your Savings, and Protect Your Portfolio reports telling you precisely which steps to take to prepare your loved ones and your personal finances for what’s coming.

You’ll also join my private client list in receiving my bi-weekly market updates outlining what’s really happening behind the scenes in the markets and which investments will profit in the coming months.

And when it’s time to pull the trigger on a given investment, I’ll send you real-time trade alerts.

All of this is yours for just $199 per year.

In fact, if you subscribe now, you’ll receive my latest issue of Private Wealth Advisory detailing four investments that are poised to produce enormous profits in the next month.

We just opened these trades late last week. Already all four of them are up. And we’re going to be seeing MAJOR gains from them in the coming weeks.

The time for dilly dallying is over. Failing to take action now means risking HUGE losses as the Great Collapse snowballs.

To take action to protect yourself… and insure that the coming weeks and months are a time of profit and safety, NOT losses and pain…

Best Regards

Graham Summers