This act is getting old.

Almost every other day we’re getting rumors about new bailouts and interventions in Europe. All of these rumors turn out to be total lies as they are refuted usually within a day and sometimes within a few hours.

Case in point, stock futures erupted overnight on Sunday on rumors that Italy would be getting a 600 billion euro bailout from the IMF. Just a few hours later this story came out:

IMF denies in Italy aid talks

However, an IMF spokesperson poured cold water on a report in the Italian daily La Stampa that said up to 600 billion euros could be made available at a rate of between 4-5 percent to give Italy breathing space for 18 months.

“There are no discussions with the Italian authorities on a program for IMF financing,” an IMF spokesperson said.

http://www.reuters.com/article/2011/11/28/us-italy-idUSTRE7AQ0GU20111128

Is this what the markets have devolved to? The equivalent of gossip that borders on “he said, she said” nonsense? Also, why is it no one even checks with the reporters who publish the initial rumor-based news? Can reporters simply publish total lies these days and no one cares (that’s a rhetorical question, we already know the answer).

The whole thing just reminds us of the core issue pertaining to this Crisis: values.

This is not a monetary Crisis; it is a Crisis of values and morals. It is a Crisis caused by the notion that you can lie about virtually everything pertaining to a business deal (the quality of the assets, who owns them, whether they’re even legitimate, etc) and get away with it.

To review how we go into this mess, Wall Street and other industries lobbied Congress to loosen regulations. However, the secondary nature of those lobbying efforts was it trained Congress to see Wall Street as the hand that feeds, thereby making it unlikely for Congress to prosecute or pursue any criminal activity on the part of the bankers.

Take away consequence and rules and you have anarchy. And that’s virtually what we had in the Financial System leading up to the Crisis. Looking back on some of the more glaring situations (AIG, Goldman Sachs, etc) it’s simply amazing the whole mess didn’t blow up sooner.

The Federal Reserve and regulators then blew a one in 100 years opportunity to reform the system. We’re now finding out that instead of doing anything positive, Bernanke literally gave away TRILLIONS of Dollars to the banks.

In simple terms, the Fed engaged in the exact same business practices that blew up the mortgage lenders: giving money away without inquiring as to the borrowers real financial position or needs.

By doing this, the Fed spread the lies (and toxic debts) onto the public’s balance sheet, thereby compromising the Republic’s creditworthiness.

In plain terms, Bernanke extended the Big Lie: that those working in the financial sector are the smartest, most capable people on earth and that they know what they’re doing (even though they almost blew up the system).

Which brings us to today.

The whole system is now built on lies. The lie that banks are solvent. The lie that the Federal Reserve actually cares about regulating the financial system. The lie that crimes will be punished. The lie that Congress will reform Wall Street. The lie that we’ll get “change” at the ballot box.

And on and on.

You cannot build a financial system on lies. It simply doesn’t work. All it does is breed distrust and resentment. And as any businessperson can tell you, without trust business cannot work.

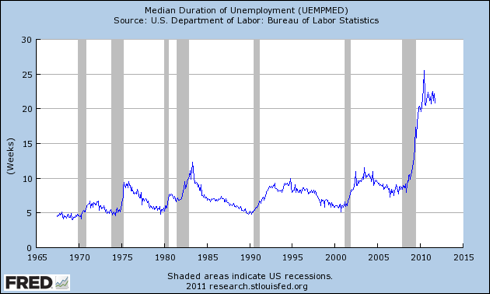

Small wonder then that the private sector won’t hire and the economy won’t recover. Debt only becomes a problem when the person who borrows can no longer be trusted to pay you back. We’ve now crossed that line and are trying to prop things up with more lies and more easy credit.

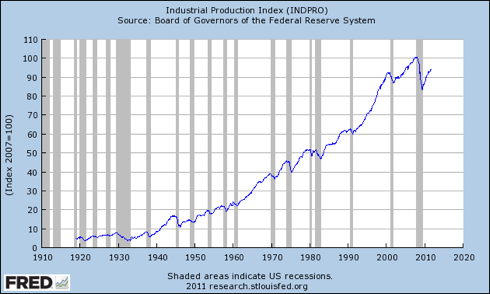

Neither math nor common sense indicate that this will turn out well. Indeed, when this mess finally comes undone, it’s going to make Lehman look like a joke. We’re now talking about entire countries collapsing, not just private institutions

Many people will lose everything in this mess. Yes, everything. However, you don’t have to be one of them. Indeed, I can show you how to turn this time of collapse into a time of profits.

Few people on the planet can match my ability to return a profit during times of Crisis.

To whit, my clients made money in 2008 outperforming every mutual fund on the planet as well as 99% of investment legends.

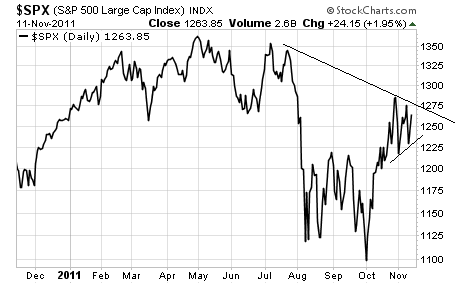

We also outperformed the market by 15% during the Euro Crisis of 2010. And since the latest round of the Euro Crisis began in July 2011, we’ve locked in not 10, not 20, but 32 Straight Winners including gains of 12%, 14%, 16% and 18%,

So if you’re looking for a guide to get you through the coming disaster, I’m your man.

I’ve been helping investors, including executives at many of the Fortune 500 companies, navigate their personal portfolios through the markets for years.

I can do the same for you with my Private Wealth Advisory newsletter.

The minute you subscribe to Private Wealth Advisory, you’ll be given access to my Protect Your Family, Protect Your Savings, and Protect Your Portfolio reports telling you precisely which steps to take to prepare your loved ones and your personal finances for what’s coming.

You’ll also join my private client list in receiving my bi-weekly market updates outlining what’s really happening behind the scenes in the markets and which investments will profit in the coming months.

And when it’s time to pull the trigger on a given investment, I’ll send you real-time trade alerts.

All of this is yours for just $249 per year.

In fact, if you subscribe now, you’ll receive my latest issue of Private Wealth Advisory hot off the press when it’s published tomorrow evening after the market closes.

In it I detail six investments that are poised to produce enormous profits in the next month when the next leg down begins…

The time for dilly dallying is over. Europe is literally on the eve of systemic failure. Even the IMF has warned we’re facing a global collapse.

To take action to protect yourself… and insure that the coming weeks and months are a time of profit and safety, NOT losses and pain…

Best Regards

Graham Summers