I’ve received a number of emails regarding the fact that stocks continue to rally despite Europe being on the verge of Collapse. Once again, investors are forgetting that stocks are the most clueless asset class on the planet.

Indeed, here are three reasons why this latest stock market rally isn’t to be trusted.

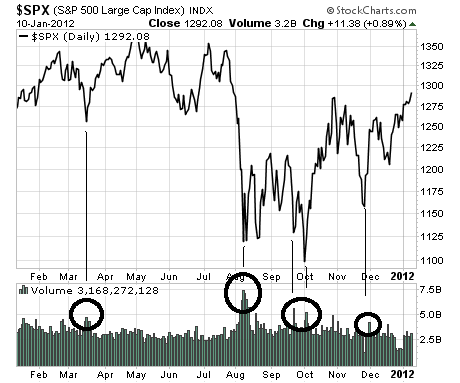

1) Volume has fallen from awful to absolutely horrendous.

Stocks traded roughly nine billion shares on the second trading session of 2012. This marks a 36% decrease from trading volume for the second day of 2011 (nearly 14 billion shares).

Put another way, stocks are levitating on lower and lower volume. Indeed, volume on Monday of this week was the lowest volume of the year so far, even lower than that of last week.

This flies in the face of conventional market action (bull markets are marked by increasing volume) as well as the usual start of the year buying. And it serves as a major red flag that all is not well with the financial system.

Indeed, one wonders what the market would look like if volume were to pick up (hint every time that it has in the last year stocks have collapsed).

2) Bonds are forecasting an event worse than 2008

2) Bonds are forecasting an event worse than 2008

As I’ve noted countless times before, the bond market is much larger, much more liquid, and much better at forecasting developments than the stock market.

With that in mind, I’d like to point out that US Treasuries have in fact already exceeded their all time highs established during the 2008-2009 Crash. In fact, they’ve bounce off of their former all-time highs, indicating that former resistance is now support:

Mind you, Treasuries aren’t the only “safe haven” bond to be exploding higher: German bonds have actually gone negative indicating that investors are actually willing to pay to have their capital parked with the German government, based on it reputation for fiscal strength.

By the way… this has never happened before.

3) The likelihood of more juice coming from the Fed is getting lower by the day.

The number one driving force behind every stock market rally in the last two years has been the assumption that the US Federal Reserve will pump the system with more liquidity.

The only problem with this assumption is that it’s been dead wrong for over six months. Indeed, not only has the Fed disappointed at every FOMC since July (while always promising to do more, the Fed has in fact done next to nothing), but as far back as May 2011, Bernanke himself admitted that QE has become less “attractive” as a monetary policy.

See for yourself…

Q. Since both housing and unemployment have not recovered sufficiently, why are you not instantly embarking on QE3? — Michael A. Kamperman, Waco, Tex.

Mr. Bernanke: “Going forward, we’ll have to continue to make judgments about whether additional steps are warranted, but as we do so, we have to keep in mind that we do have a dual mandate, that we do have to worry about both the rate of growth but also the inflation rate…

“The trade-offs are getting — are getting less attractive at this point. Inflation has gotten higher. Inflation expectations are a bit higher. It’s not clear that we can get substantial improvements in payrolls without some additional inflation risk. And in my view, if we’re going to have success in creating a long-run, sustainable recovery with lots of job growth, we’ve got to keep inflation under control. So we’ve got to look at both of those — both parts of the mandate as we — as we choose policy”

http://economix.blogs.nytimes.com/2011/04/28/how-bernanke-answered-your-questions/

Pessimistic Bernanke Fed Admits QE Has Failed In FOMC Statement

In its latest FOMC statement, the Bernanke Fed has admitted the economy continues to remain depressed, essentially admitting that both programs of long-term asset purchases, or quantitative easing, have failed to prop up output after what has been the worst recession since the Great Depression.

“Monetary policy can do a lot, but monetary policy is not a panacea.” — Ben Bernanke 9/29/11

U.S. “close to faltering,” Fed ready to act: Bernanke

Asked whether another round of bond purchases, known as quantitative easing, was in store, Bernanke was noncommittal.

“We never take anything off the table because we don’t know where the economy is going to go. We have no immediate plans to do anything like that,” he said.

http://www.reuters.com/article/2011/10/04/us-usa-fed-bernanke-idUSTRE79337C20111004

Central banks may need to burst bubbles: Bernanke

Federal Reserve Chairman Ben Bernanke said on Tuesday that central banks may need to resort to monetary policy to combat asset bubbles, although regulation should be a first line of defense.

http://www.reuters.com/article/2011/10/18/us-usa-fed-bernanke-idUSTRE79H5IR20111018

Look at the progression there. As far back as May 2011, Bernanke admitted the benefits of QE were less attractive. He’s since not only admitted that asset bubbles exist (something Greenspan never admitted) but that Central Banks may even need to “burst” them!?!?

And somehow, the Fed is going to reverse this attitude and unleash some mega-new QE effort… during an election year in which the Fed has become one of THE hot topics for the GOP?

The reality is that the financial system is once again teetering on the brink of collapse. The only thing holding stocks up is misguided hope that EU leaders will somehow solve a debt crisis with more debt (how’d that work out the last two years?) or that the Fed will somehow be able to print our way to growth (again, how’d that work out over the last two years?).

Look at the bond markets: they’re forecasting something worse than 2008. Look at commodities: they’re breaking down just as they did before the 2008 Crash. Look at stock market volume: it’s falling dramatically during rallies just as it did in 2008.

And people still believe that things are alright?

The reality is that we are rapidly heading into a Crisis that will make 2008 look like a picnic. It could erupt tomorrow or next week, or even in a month’s time. But the fact remains that there is no possible happy ending for the current EU Crisis. Interbank liquidity is drying up and banks are parking record amounts of cash at the ECB in anticipation of widespread bank failures.

Many people will lose everything in this mess. Yes, everything. However, you don’t have to be one of them. With the right set-up, the coming Collapse could be a time of profits and good fortunes… not pain.

So if you’ve not already taken steps for what’s coming, the time to do so is NOW before the real mess begins.

On that note, I’ve already alerted my Private Wealth Advisory clients to open 7 CRISIS trades in anticipation of the next leg down. Already several of them are up. And I fully expect we’ll see ALL of them in the double digits in the coming weeks.

We’ve also taken steps to prepare our loved ones and personal finances for systemic risk with my Protect Your Family, Protect Your Savings, and Protect Your Portfolio Special Reports.

With a total of 20 pages, these reports outline:

1) how to prepare for bank holidays

2) which banks to avoid

3) how much bullion to own

4) how much cash is needed to get through systemic crises

5) how much food to stockpile, what kind to get, and where to get it

And more…

I can do the same for you. All you need to do is take out a subscription to my Private Wealth Advisory newsletter.

You’ll immediate be given access to the Private Wealth Advisory archives, including my Protect Your Family, Protect Your Savings, and Protect Your Portfolio reports.

You’ll also join my private client list in receive my bi-weekly market commentaries as well as my real time investment alerts, telling you exactly when to buy and sell an investment and what prices to pay (we’ve recently closed out 34 straight winners including gains of 12%, 14%, 16%, 18% and more… all in a matter of days (using stocks and ETFs).

To join us in profiting from this next leg down (it’s going to be the BIG one)…

Best Regards,

Graham Summers