As usual, bad news was released over the weekend when the least number of people are paying attention. In this particular instance the bad news was:

1) S&P downgrading nine EU countries, including France and Austria which both lost AAA status

2) S&P downgrading the EFSF to AA

3) S&P’s head of sovereign ratings stating that a Greek default is coming soon

4) Germany giving a definitive “NO” to the ECB on the option of Quantitative Easing (QE)

None of these should be a surprise to anyone who’s been paying attention. Germany signaled that it was against QE months ago. Having already experienced the end result of monetization (hyperinflation), German voters and courts are completely opposed to this option.

As for the numerous downgrades… these are just a natural consequence of EU leaders failing to face the facts. The facts are that Europe is insolvent and the only possible outcome for most EU members is to default.

However, because EU leaders continue to play for time by “kicking the can” down the road with half measures and pseudo-solutions, the debt contagion has spread rapidly from the PIIGS countries to other more stable members like France and Austria.

Put another way, by failing to address the core issues Europe faces (too much debt, too little capital, far too many entitlement programs relative to taxes), EU leaders are simply letting the debt contagion spread unchecked.

As a result of this, the Euro has broken into the gap down formed during the May 2010 Crisis. We now have one primary line of support before things get really ugly.

Indeed, the long-term chart of the Euro shows us in a massive downward channel that predicts the Euro breaking below 118.

Elsewhere in the world, traders gunned the S&P 500 to 1,300 in the overnight session. At that point buying power dropped and the market has begun to correct.

Truthfully the only reason to be long stocks right now is in anticipation of more QE from the Fed at its January 25 FOMC meeting. However, the likelihood of more QE being announced at that time is slim to none.

For starters, interest rates are already at record lows, so the Fed cannot use that excuse. Secondly the latest economic data out of the US, while heavily massaged, is showing some signs of improvement, which negates the need for more QE. And finally, Bernanke and the Fed are far too politically toxic for the Fed to begin another massive round of QE (the last one of $600 billion accomplished nothing) just for the sake of it.

Indeed, I fully believe that the Fed will not engage in another massive stimulus move until the financial system is in full-scale Crisis mode again.

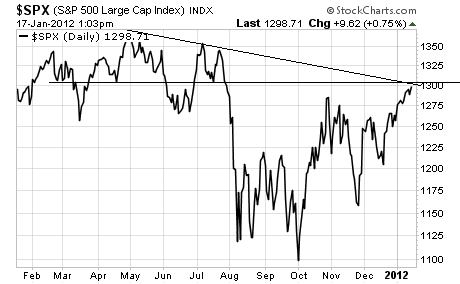

With that in mind, this latest low volume melt-up on hype and hope has brought the S&P 500 up against the trendline formed during the summer top, as well as resistance at 1,300.

Whenever a market rallies hard based on hype and hope, the chance for a violent reversal increases dramatically. And given just how bad the fundamentals are for the US and Europe at this time, we could see a very sharp collapse in no time.

The only thing holding the system together is hope of more QE from the Fed/ additional measures by other Central Banks. However, at this point it’s clear that the impact of Central Bank intervention is lessening with every new move. Consider the coordinated intervention that involved seven Central Banks in late November: the positive effects of that move were completely undone within a month.

And what happens when the Central Banks finally lose control of this mess (and they will, just as they did in 2008). The answer is a Crisis that will make 2008 look like a picnic.

This is coming… it’s only a matter of when.

On that note, if you have not already taken steps to prepare for the next round of the Crisis now is the time to do so while the system is still holding together.

I can show you how with my Private Wealth Advisory newsletter.

Private Wealth Advisory is my bi-weekly investment advisory designed to help investors outperform the market and avoid critical portfolio risks at all times.

Case in point, my clients MADE money in 2008. They also profited beautifully from the May 2010 Euro Crisis, outperforming the S&P 500 by 15% at that time.

And in last six months, while most investors were whipsawed this way and that, my Private Wealth Advisory subscribers locked in 34 straight winners. In fact, we haven’t closed a single losing trade since July 2011.

Every annual Private Wealth Advisory subscription comes with 26 bi-weekly investment reports (usually 15-20 pages each). These reports all feature my best research regarding macroeconomics, financial developments and geopolitical impact on the markets.

In plain terms I lay out what’s really happening in the markets as well as which investments to buy and sell to insure you’re maximizing your returns.

In this manner, my clients are always abreast of what’s happening behind the scenes in the markets. Even more importantly they’re making REAL money on their investments, while avoiding risk (again, we’ve just closed out 34 straight winners).

To find out more about Private Wealth Advisory and how it can help you grow your portfolio during these trying times…

Graham Summers