Graham’s note: this is an excerpt of a client letter I sent out to subscribers of Private Wealth Advisory regarding the real threats Greece poses to the world financial system. The primary point is that the mainstream media is massively underplaying the true threats here. To learn more about Private Wealth Advisory, CLICK HERE.

Now let’s take our analysis from yesterday a step further.

Deutsche Bank trades on US stock exchanges and so has to publish SEC filings on its balance sheet risk. Well, according to Deutsche Bank’s own filings, it had 1.6 billion Euros’ worth of credit exposure to Greece at the end of 2010. True, this is credit exposure not direct exposure to sovereign debt… but it’s still four times what the Guardian claims to the case.

More interesting that this, the term “Greece” is only mentioned twice in Deutsche Bank’s 2010 416-page annual report. Remember, this was the year in which the Greek Euro Crisis nearly took the system down: between January 2010 and June 2001, when the first Greek bailout was announced, the Euro lost 17% if its value. Worldwide, stock markets cratered despite central bank intervention. And it was only the Fed’s promise of QE lite and QE 2 that got the global equity rally rolling again.

So it’s a bit odd that Deutsche Bank’s 2010 416-page annual report would only mention the term “Greece” two times. Regardless, let’s fast forward to Deutsche Bank’s Third Quarter 2011 filing (its most recent) for some more recent data.

This time around, the term “Greece” shows up six times in the 100-page report. And this time around Deutsche Bank states it has 881 million Euros’ worth of exposure to Greek sovereign debt (TWO TIMES what The Guardian claimed).

By the way, Deutsche Bank has only 59 billion Euros’ worth of shareholder equity, so this position alone is worth roughly 1.5% of the banks’ equity. True, this is not a huge percentage, but if Greek creditors take a 70-80% haircut, Deutsche Bank would need to raise capital.

On a side note, I want to point out that we’re completely ignoring the fact that if Greece defaults so will Italy and Spain whose sovereign debt and financial institutions Deutsche Bank has 14.8 BILLION EUROS worth exposure to: an amount equal 23% of Deutsche Bank’s TOTAL EQUITY.

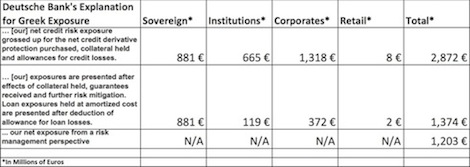

But let’s just focus on Deutsche Bank’s exposure to Greece for now. According to its Third Quarter 2011 filing, aside from the 881 million Euros’ worth of exposure to Greek sovereign debt, Deutsche Bank also has 665 million Euros’ worth of exposure to Greek financial institutions, and a whopping 1.3 BILLION Euros’ worth of exposure to Greek corporates (plus a negligible 8 million Euros’ worth of exposure to Greek retails) for a total of 2.8 BILLION Euros’ worth of exposure to Greek debt and businesses.

So… having taken our analysis one step further, we find that one single German bank, one of the alleged strongest I might add, has in fact, far, far more exposure to Greece and its economy than both the Bank of International Settlements and the mainstream financial press indicates.

Bear in mind, the numbers presented in Deutsche Bank’s are simply those that Deutsche Bank’s executives have told the company’s accountants are acceptable for public disclosure (we have no clue about the banks off-balance sheet risk).

It’s also worth noting that in 2010 Deutsche Bank claimed to have only 1.6 billion Euros’ worth of credit exposure to Greece, whereas by late 2011 the number has swelled to 2.8 billion Euros.

I have to ask… how exactly does a bank, which is supposedly managing its risk levels and adjusting its exposure accordingly, manage to increase its credit exposure to something as financially toxic as Greece by 75% in a nine month period?

This hardly strikes me as good risk management. But here’s how Deutsche Bank’s accountants try to explain that none of this (even the 2.8 billion Euros’ worth of exposure) is a big deal (click on image for larger version).

If the above chart sounds like it’s written in obfuscating language, let me translate it for you. According to Deutsche Bank’s accountants, once you include collateral held (likely garbage assets valued at mark to model fantasy land valuations), guarantees received (from GREEK institutions!?!?!), and “risk mitigation”, Deutsche Bank’s “actual” exposure to Greece drops from 2.8 billion Euros to only 1.2 billion Euros.

So… this is a bank whose credit exposure to Greece increased by 75% as the Greek Crisis worsened from 2010 to 2011… now claiming that thanks to their risk management, their “real” exposure to Greece is only 1.2 billion Euros.

Ok, well if we’re going to play by those rules, let’s consider that when we include the rest of the PIIGS countries, Deutsche Bank’s “actual” exposure (as downplayed as it might be) is still 35 BILLION Euros, an amount equal to 60% of the banks’ total equity.

At these levels, and using the currently proposed Greek 50% haircuts as a model for future defaults in the EU, Deutsche Bank could very easily see 10-15 billion in write-downs from its PIIGS’ exposure. This would wipe out 16%-25% of the bank’s entire equity and render it borderline insolvent.

And we’re talking about one of the biggest, most “solvent” banks in Germany here.

Make no mistake, the situation in Europe is far far worse than 99% of investors realize. Even if the second Greek Bailout is finalized (the details are still emerging) we’ve still got Italy and Spain to deal with: two problems that are far too big for any of the current troika (ECB, IMF, and EU) to handle.

On that note, if you have not already taken steps to prepare for the next round of the Crisis now is the time to do so while the system is still holding together.

I can show you how with my Private Wealth Advisory newsletter.

Private Wealth Advisory is my bi-weekly investment advisory designed to help investors outperform the market and avoid critical portfolio risks at all times.

Case in point, my clients MADE money in 2008. They also profited beautifully from the May 2010 Euro Crisis, outperforming the S&P 500 by 15% at that time.

And in 2011, while most investors were whipsawed this way and that, the Private Wealth Advisory model portfolio returned 9%, crushing the S&P 500’s 0%.

Every annual Private Wealth Advisory subscription comes with 26 bi-weekly investment reports (usually 15-20 pages each). These reports all feature my best research regarding macroeconomics, financial developments and geopolitical impact on the markets.

In plain terms I lay out what’s really happening in the markets as well as which investments to buy and sell to insure you’re maximizing your returns.

In this manner, my clients are always abreast of what’s happening behind the scenes in the markets. Even more importantly they’re making REAL money on their investments, while avoiding risk (again, we’ve just closed out 34 straight winners).

To find out more about Private Wealth Advisory and how it can help you grow your portfolio during these trying times…

Graham Summers