Yesterday I told you about my bi-weekly investment newsletter, Private Wealth Advisory and how it has helped our clients (all of them Phoenixes: people who are aware of the economic/financial cycles and are taking action to insure that they and their wealth emerge victorious from them), profit from the markets on a regular basis. As a quick review, we’ve now seen 72 straight winners (we locked in another 9% gain this morning) and not a single closed losing trade in the last 12 months.

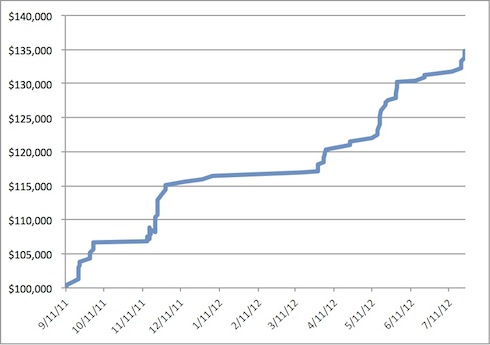

They say a picture’s worth a 1,000 words. Here’s the performance of Private Wealth Advisory’s investment recommendations over the last 12 months assuming the following:

1) A portfolio of $100,000

2) Putting $5,000 (5% of the portfolio) into each recommendation (we can’t account for how people position size so we chose a fixed amount per investment).

As you can see, Private Wealth Advisory has shown investors a return of 34% over the last 12 months. Compare that to the S&P 500 which is essentially flat and you’ll see the quantifiable benefit of a Private Wealth Advisory subscription.

As you can see, Private Wealth Advisory has shown investors a return of 34% over the last 12 months. Compare that to the S&P 500 which is essentially flat and you’ll see the quantifiable benefit of a Private Wealth Advisory subscription.

I say quantifiable because Private Wealth Advisory offers much more than simply saying “Buy XYZ at this price” and “Sell XYZ at this price;” Private Wealth Advisory offers my proprietary analysis of the capital markets and financial system as well as the socio-economic, cultural, political and financial forces driving them.

Here’s what a few of our happy clients have had to say about this:

Your level of understanding of the markets is astounding!

Bob S.

Thank you for your knowledge and insights and cautions and for sharing them to the public!

~Sarah P.

…what allows me to sleep at night is not your picks, it’s you. I’ve subscribed to a half-dozen paid sites and I’ve felt burned on almost all of them. Even after two months, I’m convinced you are several steps above the rest.

~Frank W.

So with Private Wealth Advisory you’re not just getting profitable investments (take a look at that chart again); you’re getting a private look inside the workings of my mind: how I see the markets and the global economy, where I see capital moving to next, and the unquantifiable risks and opportunities that I see, which you won’t find in any press release, financial statement, or public policy change.

No one else in the world gets access to this.

I like to think of Private Wealth Advisory as a ship that helps our clients navigate the capital markets. However, sometimes there are opportunities that go beyond regular investment strategies.

I’m talking about Crisis Investments: the sorts of targeted, specialized investments that offer huge rewards to those who make them. A good example would be the trades I recommended to clients before the 2008 Crash: those who followed my advice saw triple digit gains in a matter of weeks.

Well, I have to say that the opportunity for such gains is higher today, than it was even before the 2008 Crash. Europe’s banking system, which I’ve analyzed more than anyone I know, prevents investors today with a truly unique opportunity…

Because 99% of people don’t understand the real and unquantifiable risk to the EU banking system (it’s not sovereign debt), we can establish trades well in advance of the collapse to see truly stupendous returns.

This is why I’ve developed a Special One Time EU CRISIS Portfolio comprised of six options trades for my other, options trading-based newsletter The Perfect Trade.

Already, these five of these positions are up 41%, 44%, 48%, 66% and 91%. This is in less than ONE month.

I’m not cherry picking these returns based on the best prices possible. Yesterday morning (before today’s action tacked on even more gains to these positions), I receive the following email:

“Hi Graham – just wanted to see what your current thoughts are on

the open position in the EU Crisis Portfolio because mine are all

green, some by quite a bit… as of today, personally, my positions

are as follows… 50%, 10%, 13%, 51%, 81% Thanks in advance!”

~ Robert E.

Now, these are options trades. So if you cannot trade options, you won’t be able to make them. However, if you’re willing to try trading options, and have a brokerage account that will allow you, these trades could very likely show you some incredible results (The Perfect Trade’s model portfolio is up 84% year to date in 2012).

Indeed, I fully expect ALL SIX of these trades to be up in the triple, if not QUADRUPLE digits in the coming months (we’re holding them through September).

So if you’re looking for a special one-time chance to make some HUGE returns based on a REAL Crisis… this is IT!

To find out more about my trading newsletter The Perfect Trade and the special EU Crisis Portfolio I’ve put together…

Graham Summers