Anyone who believes that housing is back in a big way needs to take a look at homebuilder stocks.

Here’s DR Horton (DHI) which is down over 30% from its recent highs.

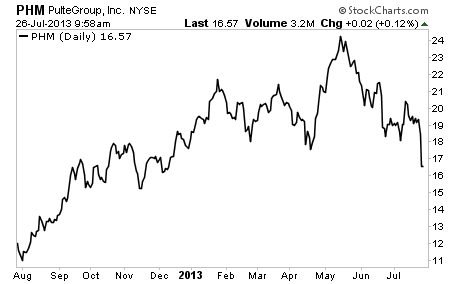

The same can be said for Pulte Homes (PHM)

The problem with the housing industry was and remains the Fed. By keeping interest rates at zero and giving institutions access to various lending windows, the Fed gave large financial firms like Blackrock to opportunity to snatch up tens of thousands of homes.

This has put a false floor beneath housing prices. Historically, housing busts in the OECD countries last 6-7 years peak to trough. But by giving certain players in the market (institutions) the opportunity to buy up vast swaths of homes, the Fed didn’t allow this natural process to take place.

The end result is that housing is once again unaffordable for most folks. Prices are surging across the board at the precise time that mortgage applications are collapsing (in part based on the rise in rates and based on housing becoming too pricey).

It’s just like 2007 all over again. Only this time around, we know for a fact that the Fed hasn’t fixed things and has bankrupted itself and the financial system pretending that it can.

This is not doom and gloom. This is a fact. The Fed has created an even bigger bubble than the 2007 one.

The time to prepare for this is not once the collapse begins, but NOW, while stocks are still rallying. Stocks take their time moving up, but when they crash it happens VERY quickly.

With that in mind, I’ve already urged my Private Wealth Advisory clients to start prepping. We’ve opened six targeted trades to profit from the stock bubble bursting.

We’ve also taken care to prepare our finances and our loved ones for what’s coming, by following simple easy to follow steps concerning our savings, portfolios, and personal security via my Protect Your Family, Protect Your Savings & Protect Your Portfolio reports.

I’ve helped thousands of investors manage their risk and profit from market collapses. During the EU Crisis we locked in 72 straight winning trades and not one loser, including gains of 18%, 28% and more.

In fact, we’re currently on another winning streak having locked in nine winning trades in the last two months, including gains of 21% and 25%.

All for the small price of $299: the annual cost of a Private Wealth Advisory subscription.

To take action to prepare for what’s coming… and start taking steps to insure that when this bubble bursts you don’t lose your shirt.

Yours in Profits,

Graham Summers