The primary myth being perpetuated by the Central Banks of the world is the belief that loose monetary policy and money printing will lead to economic growth.

This is the reason why Central banks have cut interest rates more than 511 times since June 2007. It’s also why they’ve expanded their balance sheets by over $10 trillion (this doesn’t count unofficial lending windows and off balance sheet programs).

It’s a strange idea, especially when you consider that there is literally no evidence that printing money creates jobs. Look at Japan, they have and continue to maintain QE efforts equal to 40+% of their GDP and unemployment hasn’t budged in 20 years. The UK has engaged in QE equal to over 20% of GDP with no success.

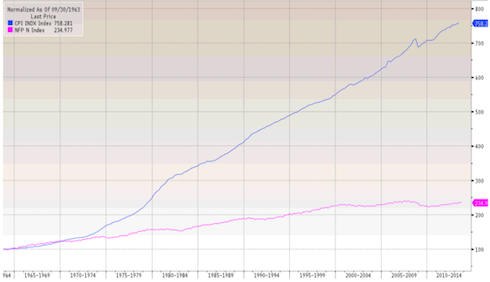

If you need further proof that money printing and inflation don’t create jobs take a look at the below chart from Bill King’s The King Report. The blue line is CPI. The pink line is non-seasonally adjusted non-farm payroll (jobs). In the last 50 years, inflation has dramatically outperformed job creation.

Since Bernanke took over at the Fed, the US hasn’t experienced a single year of 3% GDP growth. All the talk of jobs coming back courtesy of the Fed is ridiculous. The employment population ratio peaked in 2000. Since that time jobs have not kept up with population growth, let alone grown.

Indeed, all that’s grown is inflation, the one thing the Fed is great at creating.

According to Harvard Professor Ken Rogoff in the 138 years leading up to the Fed’s founding in 2013, inflation rose a mere 20%.

Yes, you read that correctly, inflation rose just 20% over a period of 138 years. However, in the 100 years since the Fed came into existence, inflation has risen by 3,000%. The US dollar has lost between 96-98% of its value since 1913.

And yet despite the preponderance of evidence that money printing doesn’t create jobs, Bernanke and his Central Banker colleagues continue to perpetuate the myth that the recovery is just around the corner, as long as we continue to print money.

It’s complete and utter insanity. And all it will accomplish is bankrupting the US, resulting in higher costs of living (again inflation has risen 3,000% since the Fed’s creation in 1913) and lower quality of life for all of us.

Folks, there is no other way to put this… the markets are in a massive bubble. And when it bursts, things will get ugly very FAST.

With that in mind, I’ve already urged my Private Wealth Advisory clients to start prepping. We’ve opened six targeted trades to profit from the stock bubble bursting.

We’ve also taken care to prepare our finances and our loved ones for what’s coming, by following simple easy to follow steps concerning our savings, portfolios, and personal security via my Protect Your Family, Protect Your Savings & Protect Your Portfolio reports.

I’ve helped thousands of investors manage their risk and profit from market collapses. During the EU Crisis we locked in 72 straight winning trades and not one loser, including gains of 18%, 28% and more.

In fact, we’re currently on another winning streak having locked in ELEVEN winning trades in the last two months, including gains of 21% and 25%.

All for the small price of $299: the annual cost of a Private Wealth Advisory subscription.

To take action to prepare for what’s coming… and start taking steps to insure that when this bubble bursts you don’t lose your shirt.

Yours in Profits,

Graham Summers