After this weekend, the summer session for the markets will be winding down.

August historically is a listless time for the markets. In the US, Congress is closed so there are fewer major announcements regarding public policy.

In Europe entire companies and Governments will close down for a month as the continent goes on vacation.

Traders take advantage of the lull in action to hit the Hamptons. The end result is a quiet time for the markets with low volume.

Adding to the doldrums this year is the fact that Bernanke didn’t attend the Fed’s Jackson Hole meeting, so there were no new major announcements from the Fed this month. On top of this, Angela Merkel is seeking real election in Germany in September, so there has been a concentrated effort to keep things “quiet” over there.

But none of this means that everything has been resolved. Indeed, over the last week we’ve seen a number of major issues resurfacing. Investors need to be aware of the following:

- Germany’s finance minister Wolfgang Schauble has state that Greece would need yet another bailout.

- Italy’s bonds have plunged again as the Italian Government is beginning to fall to pieces.

- Brazil officially entered the currency wars launching a new $60 billion currency intervention, its largest in history.

- The NASDAQ was shut down for several hours last week due to a “glitch.”

- China’s economy is lurching towards deflation with even the Government admitting that its recently published great data were bogus.

These issues did not simply go away based on the fact that people were on vacation. So expect volatility to increase going forward.

This is not to say that there will not be ample opportunities for investors to make money. There is always a trade or investment to be made. And provided you follow the right strategies, even volatile times can pay out wonderfully.

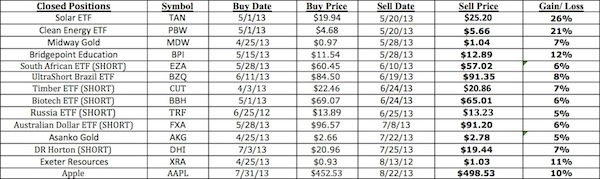

Case in point, over the last two months, Private Wealth Advisory subscribers have locked in 14 straight winner trades. During this period, we haven’t closed a single loser.

See for yourself:

On that note, I’ve already prepared readers of my Private Wealth Advisory newsletter with a number of targeted investment strategies designed to help them not only manage risk, but produce outsized profits during the coming market volatility.

Already we’ve locked in 13 straight winners over the last two months. More are coming.

Indeed, during the first round of the Euro Crisis we locked in 73 straight winning trades and not one single closed loser. That was during a time when the market went nowhere.

So we’re getting ready for another similar winning streak during this next round of economic contraction. You can make money during times of slow growth, but you need the right investment strategies.

If these sound like the kind of investment strategies you could use for your portfolio, I suggest taking out a trial subscription to Private Wealth Advisory. You’ll immediately begin receiving my bi-weekly investment reports outlining the most important developments in the market.

You’ll also receive my real-time trade alerts, telling you the minute it’s time to open or sell a trade.

All just for $299 a year.

You get:

- 26 bi-weekly investment reports (ranging from 15-30 pages in length)

- Six Special Reports outlining unique opportunities and risks in the markets that 99% of investors don’t know about.

- 30-50 trades per year provided to you in real time

- The sense of calm in knowing that you’ve got your financial house in order.

To sign up for Private Wealth Advisory…

Yours in Profits,

Graham Summers

Chief Market Strategist

Phoenix Capital Research