The markets have been extremely quiet the last few days. With the exception of the hard selling that occurred on Thursday it’s been a snooze fest.

The reason for this is that no one wants to commit heavily to a position at the moment. We’re all well aware of the negatives the market is facing, namely declining earnings, a weakening economy, the decreasingly marginal effect of Fed intervention, etc.

However, no one wants to commit heavily to shorting the markets because they’re all too afraid that the Fed or “someone” will step in to prop up the markets should any significant drop occur.

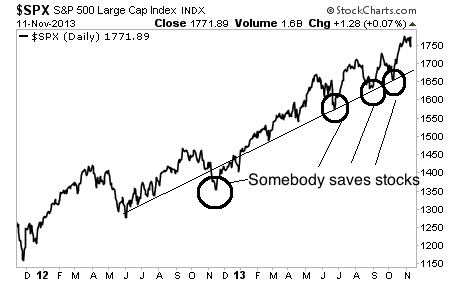

This has happened repeatedly in the last year: every time the market began to crumble and take out support, “someone” stepped in a started buying. And soon stocks were back off to the races.

At this point we all know that the “someone” is the Fed. Numerous Fed officials have pointed to the rising stock market as a sign that Fed intervention has been “successful.”

Moreover, the Fed has barely left the markets alone since 2008.

If you go back to the first announcement of QE 1 in November 2008, there have only been two periods in which the Fed wasn’t engaging in direct monetary interventions its balance sheet between the end of QE 1 and the launch of QE 2 (June 2010-November 2010) and from the end of QE 2 until the launch of Operation Twist (June 2011-September 2011).

A total of 60 months have passed since the Fed announced QE 1. The Fed was not engaged in major monetary interventions in only six months out of these 60. Put another way, the Fed has been actively intervening to the tune of billions of dollars in 90% of ALL months since it began QE 1.

Even during the brief periods in which the Fed wasn’t officially engaging in a major monetary program, it still routinely expanded its balance sheet during options expiration week every month.

If you remove those weeks from the periods in which the Fed wasn’t officially engaging in a program, you’re left with a total of just 4.5 months in which the Fed wasn’t actively pumping the markets.

That’s 4.5 months out of 60, or less than 8%.

However, this is not to say that this Fed intervention is not creating tremendous opportunities for stock pickers. After all with the Fed juicing stocks to this degree, there is no shortage of mis-pricings in high quality companies.

Indeed, recently, subscribers of our value stock picking newsletter Cigar Butts & Moats locked in a 28% gain on our latest stock pick in less than one month.

We did this by buying a deeply undervalued business. Based on its market valuation, this company could easily take itself private, using the cash generated from operations to pay the loan required to buyback all of its shares on the open market.

In fact, this business was so cheap that it could do this even if its earnings fell in HALF.

That’s one heck of a margin of safety. We bought on October 3 2013. And we closed out on October 23 2013 for a 28% gain.

Over the same time period, the S&P 500 rose just 4%.

This is how to make a killing in the market today: by focusing on value stock picking. It’s the very reason we launched Cigar Butts & Moats.

The price of an annual subscription to Cigar Butts & Moats is just $79.99.

For that price you get:

- 12 monthly issues of Cigar Butts & Moats

- Our proprietary deep value Investment Special Report How to Make a Fortune With Value Investing (a $199 value) which outlines specifically how Warren Buffett made his fortune investing in stocks.

- All of our other Special Investment Reports outlining special investment opportunities.

- Real time investment updates as needed (like the one that told investors to lock in a 28% gain).

All of this for just $79.99.

To take out an annual subscription to Cigar Butts & Moats…

Best Regards

Phoenix Capital Research