Last year, 2013, will likely go down as the beginning of the end for the bull market in stocks.

Since the market bottom in 2009, stocks have rallied over 170%. It’s been an incredible run, but I fear that we’re nearing the end.

From 2009-late 2012, most of the rally was driven by mutual funds and other large institutional investors. During this period, individual or “Mom and Pop” investors were largely investing in bonds.

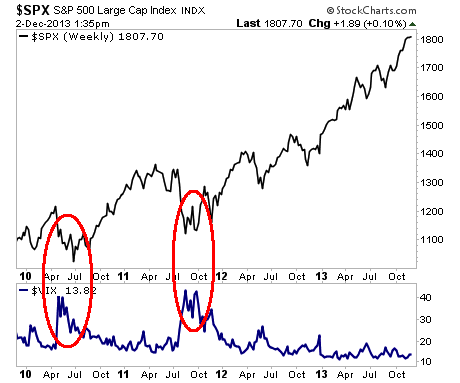

This changed in late 2012. At that point, individual investors joined in and stocks entered a mania. You can see it clearly in the chart above.

You can also see this in fund flows movements: from 2009-early 2013, individual investors shunned stock-based mutual funds and poured their money into bonds instead.

This changed in early 2013, as investors suddenly found an appetite for stocks again, pouring a RECORD $324 BILLION into US stock mutual funds.

To put this into perspective, this means investors put more money into stocks this year than they did in 2000: at the very peak of the TECH BUBBLE!

Which brings us to today.

Today investors are more bullish than at any point in 20 years. In fact, they are so bullish they are borrowing money (called margin debt) to BUY stocks at fastest pace in history.

Companies like Twitter, which have never made a penny in profit, are valued at tens of billions of Dollars.

In short, the market, taken as a whole, is overbought, overvalued, and overextended.

Now, this doesn’t mean that stocks cannot go higher from here. After all, market manias always tend to last long than you expect.

However, it does mean that “the good times” are ending. And the likelihood of stocks posting another massive up year is very slim indeed.

In this environment, it’s wise to lighten up on ownership to the longside. It’s even wiser to look for beaten down undervalued companies that offer you good down side protection: companies that will weather any market environment, good or bad.

Companies like ones we single out in our premium value-investing newsletter, Cigar Butts & Moats.

Cigar Butts & Moats follows the investment strategies of value investing legends Benjamin Graham and his famed student Warren Buffett.

That is to say, we look to make a fortune by buying incredible companies that are trading at fantastic prices and holding them for the long-term.

Indeed, our latest pick is already up 3% from last week.This comes on the heels of a 28% winner from August and more! All in less than six months.

If you’re looking for a long-term deep value investing newsletter, you simply cannot do better than this. Our investment analysis is second to none… which is why we have clients in over 56 countries and on four continents.

To take out a trial subscription to Cigar Butts and Moats (a $79.99 cost)…

Phoenix Capital Research