One of the biggest issues facing investors today is finding reliable income.

Unbeknownst to most folks, most of stocks’ returns come from dividends, NOT capital gains.

Indeed, according to a study performed by the London Business School, when you remove dividends, stocks have returned a mere 1.7% in average annual gains over the last 109 years.

To put this into perspective, this is less than you’d make from owning long-term US Treasury bonds (2.1%) over the same time period.

Indeed, if you’d invested $1 in stocks in 1900 and reinvested your dividends, by 2009, you’d have made $582 (adjusted for inflation). Take out dividends and you’d have only seen $6 from price appreciation. Yes, $6 from 109 years’ worth of capital gains.

The fact of the matter is that most businesses fail overtime. Trying to pick winners (stocks that will rally) is extremely hard.

So by focusing on those companies that pay dividends, you’re effectively focusing on those that have already succeeded because:

1) The company has to have generated some kind of cash flow to pay the dividend in the first place

2) The company has exhibited a commitment to shareholder returns by paying dividends (at the end of the day management’s culture sets apart winners from losers.

This is why I like big dividend companies so much… you KNOW you’re going to get paid for putting your capital to good use!

With my Big Dividends Investor newsletter, I show investors how to lock in BIG dividends for HUGE returns.

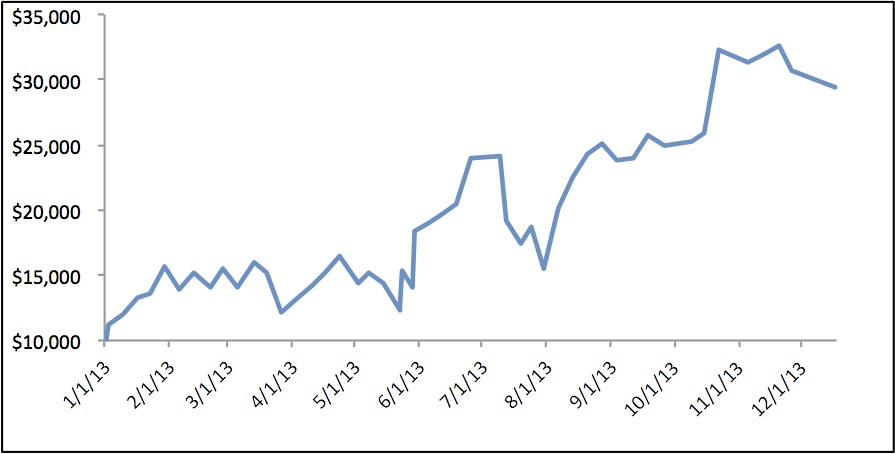

Already our two most recent picks are cranking out cash for our subscribers. One sports a massive 7% yield that is virtually tax free. The other pays out a whopping 12% dividend in monthly payments.

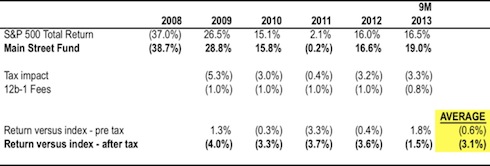

As a result, we’re crushing the market AND lock in massive dividend payments to secure their retirement.

If you’re an investor looking for a second stream of income to grow your wealth during retirement, you simply couldn’t ask for a better newsletter than Big Dividend Investor.

For just $99 a year, you get:

- 12 issues of Big Dividend Investor featuring at least 12 investment ideas

- All of Buck’s Special Investment Reports outlining special situations.

- Real time email alerts when it’s time to sell

- The peace of mind knowing that your retirement is secure

To sign up for Big Dividend Investor… and take action to start receiving massive dividend payments as soon as this month…

Buck Wilson