This is a trader’s market.

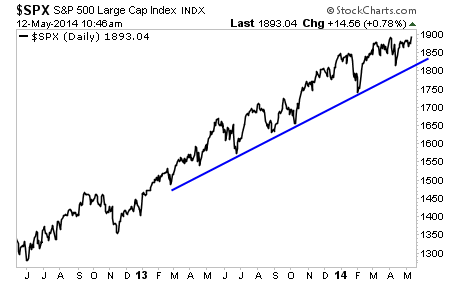

The markets are showing us sharp moves up and down. And while “buy and hold” investors might find this a unpleasant, short-term trades can use moves like this for large gains.

Consider the last four months. Overall, the market has barely budged higher… but if you’d used this volatility to trade the market… you could have made a killing.

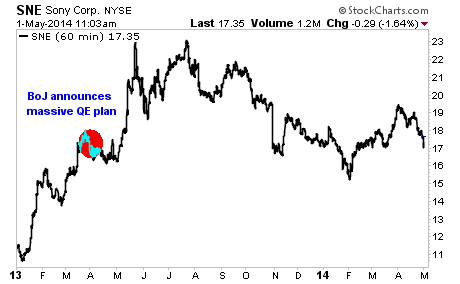

This situation is not unique to the US. Emerging markets are currently even MORE attractive for traders.

Take a look at China’s ETF… we’ve had sharp moves up and down that have allowed short-term trades to see some extraordinary gains!

Anyone who times these moves well with options trades could have literally DOUBLED their money.

On that note, if you’re looking for short-term trades with BIG upside, I strongly urge you to check out our options trading service Options 1-1-1.

Options 1-1-1 uses options exclusively on short-term trades (think 1-3 days) to lock in gains ranging from 30% to 100%.

The secret to our trading success is to focus on short-term high probability trades: trades that have a 70% chance or greater of making money.

We then use options to juice our gains.

Just last year, Options 1-1-1 subscribers saw an incredible 198% return on invested capital.

We made money on 32 trades (out of 46) with an average gain of 20%.

And because we limited our losses… we nearly TRIPLED our money that year,

We’re on track for a similar year this year… already Options 1-1-1 subscribers have locked in gains of 17%, 18%, 35%, and even a massive 48%…

ALL IN JUST ONE DAY’S TIME!

If this sounds like the kind of success you’d like to see from your trades, we offer a 90-day risk free trial to Options 1-1-1.

So you can sign up today… and if you find it’s not what you’re looking for at any point in the next 90 days, just drop us a line and we’ll issue a full refund!

To take out a 90-day risk free trial to Options 1-1-1…

Phoenix Capital Research