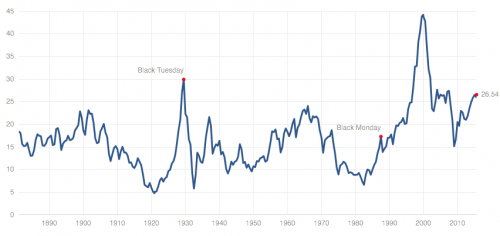

Earlier this week I outlined how the next Crash will play out.

Today we’ll assess why this Crisis will be worse than the 2008 Crisis.

By way of explanation, let’s consider how the current monetary system works…

The current global monetary system is based on debt. Governments issue sovereign bonds, which a select group of large banks and financial institutions (e.g. Primary Dealers in the US) buy/sell/ and control via auctions.

These financial institutions list the bonds on their balance sheets as “assets,” indeed, the senior-most assets that the banks own.

The banks then issue their own debt-based money via inter-bank loans, mortgages, credit cards, auto loans, and the like into the system. Thus, “money” enters the economy through loans or debt. In this sense, money is not actually capital but legal debt contracts.

Because of this, the system is inherently leveraged (uses borrowed money).

Consider the following:

1) Total currency (actual cash in the form of bills and coins) in the US financial system is little over $1.2 trillion.

2) If you want to include money sitting in short-term accounts and long-term accounts the amount of “Money” in the system is about $10 trillion.

3) In contrast, the US bond market is well over $38 trillion.

4) If you include derivatives based on these bonds, the financial system is north of $191 trillion.

Bear in mind, this is just for the US.

Again, debt is money. And at the top of the debt pyramid are sovereign bonds: US Treasuries, German Bunds, Japanese Government Bonds, etc. These are the senior most assets used as collateral for interbank loans and derivative trades. THEY ARE THE CRÈME DE LA CRÈME of our current financial system.

So, this time around, when the bubble bursts, it won’t simply affect a particular sector or asset class or country… it will affect the entire system.

So…. the process will take considerable time. Remember from the earlier pages, it took three years for the Tech Bubble to finally clear itself through the system. This time it will likely take as long if not longer because:

1) The bubble is not confined to one country (globally, the bond bubble is over $100 trillion in size).

2) The bubble is not confined to one asset class (all “risk” assets are priced based on the perceived “risk free” valuation of sovereign bonds… so every asset class will have to adjust when bonds finally implode).

3) The Central Banks will do everything they can to stop this from happening (think of what the ECB has been doing in Europe for the last three years)

4) When the bubble bursts, there will very serious political consequences for both the political elites and voters as the system is rearranged.

First of all, this bubble is larger than anything the world has ever seen. All told, there are $100 trillion in bonds in existence.

A little over a third of this is in the US. About half comes from developed nations outside of the US. And finally, emerging markets make up the remaining 14%.

The size of the bond bubble alone should be enough to give pause.

However, when you consider that these bonds are pledged as collateral for other securities (usually over-the-counter derivatives) the full impact of the bond bubble explodes higher to $555 TRILLION.

To put this into perspective, the Credit Default Swap (CDS) market that nearly took down the financial system in 2008 was only a tenth of this ($50-$60 trillion).

Moreover, you have to consider the political significance of this bubble.

For 30+ years, Western countries have been papering over the decline in living standards by issuing debt. In its simplest rendering, sovereign nations spent more than they could collect in taxes, so they issued debt (borrowed money) to fund their various welfare schemes.

This was usually sold as a “temporary” issue. But as politicians have shown us time and again, overspending is never a temporary issue. This is compounded by the fact that the political process largely consists of promising various social spending programs/ entitlements to incentivize voters.

In the US today, a whopping 47% of American households receive some kind of Government benefit. This type of social spending is not temporary… this is endemic.

The US is not alone… Most major Western nations are completely bankrupt due to excessive social spending. And ALL of this spending has been fueled by bonds.

This is why Central Banks have done everything they can to stop any and all defaults from occurring in the sovereign bonds space. Indeed, when you consider the bond bubble everything Central Banks have done begins to make sense.

1) Central banks cut interest rates to make these gargantuan debts more serviceable.

2) Central banks want/target inflation because it makes the debts more serviceable and puts off the inevitable debt restructuring.

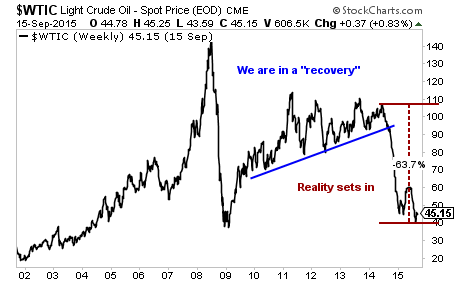

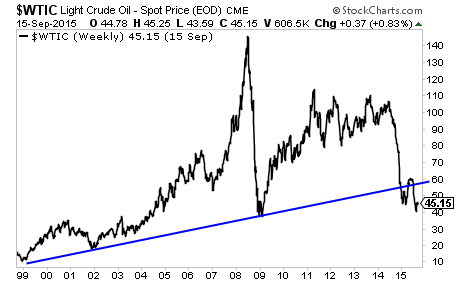

3) Central banks are terrified of debt deflation (Fed Chair Janet Yellen herself admitted that oil’s recent deflation was economically positive) because it would burst the bond bubble and bankrupt sovereign nations.

So how will all of this play out?

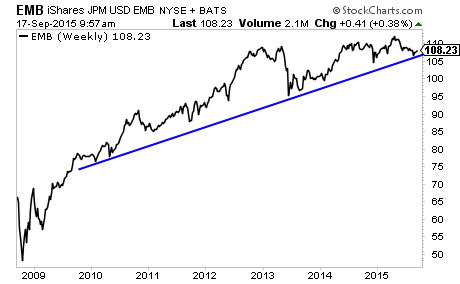

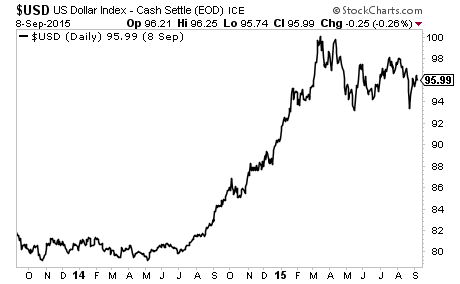

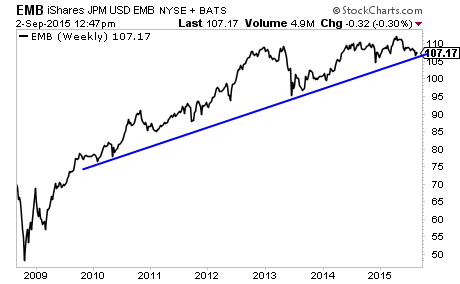

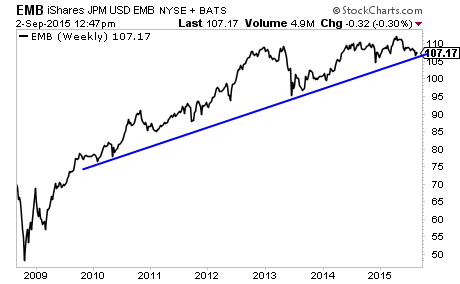

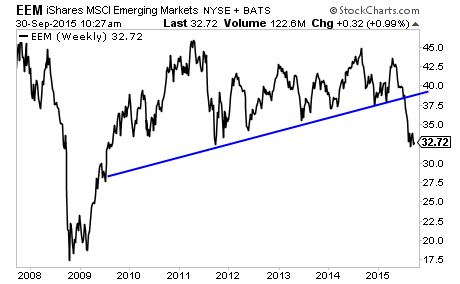

The bond markets have already begun a revolt in the Emerging Market space. There we are on the verge of taking out the bull market trendline dating back to 2009.

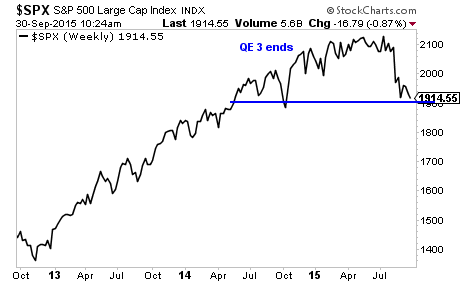

When this hits, capital will fly to high quality bonds particularly US treasuries. However as the bond market crisis accelerates eventually it will envelope even safe haven bonds (including Treasuries).

At that point the bad debts in the financial system will finally clear and we can begin to see real sustainable growth

If you’re looking for actionable investment strategies to profit from this trend we highly recommend you take out a trial subscription to our paid premium investment newsletter Private Wealth Advisory.

Private Wealth Advisory is a WEEKLY investment newsletter that can help you profit from the markets: we just closed TWO new double digit winners yesterday.

This brings us to a TWENTY NINE trade winning streak… and 35 of our last 36 trades have been winners!

Indeed… we’ve only closed ONE loser in the 12 months.

You can try Private Wealth Advisory for 30 days (1 month) for just $0.98 cents

During that time, you’ll receive over 50 pages of content… along with investment ideas that will make you money… ideas you won’t hear about anywhere else.

To take out a $0.98 30-day trial subscription to Private Wealth Advisory…

CLICK HERE NOW!

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

.

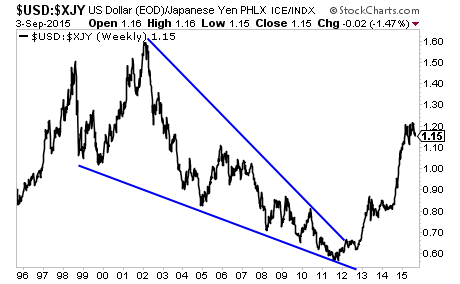

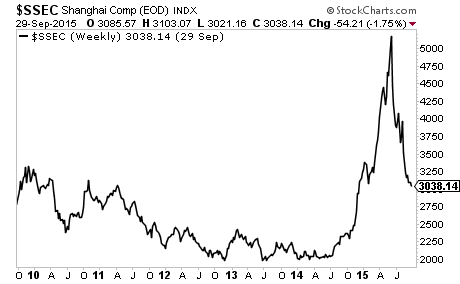

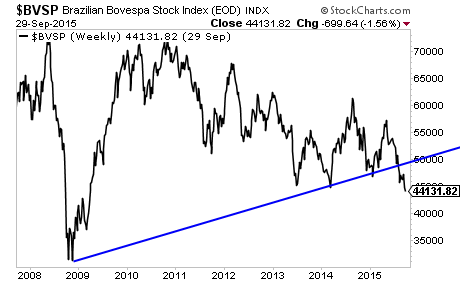

Abroad, the damage has been even worse with China, Brazil, and the Emerging Market complex as a whole imploding.

Abroad, the damage has been even worse with China, Brazil, and the Emerging Market complex as a whole imploding. Brazil has taken out its bull market trendline.

Brazil has taken out its bull market trendline. As have the Emerging Markets as a whole.

As have the Emerging Markets as a whole. The hype and hope of more QE misses the point…

The hype and hope of more QE misses the point…