Something absolutely astounding has happened.

Two weeks ago, the head of the Bank of Japan, Haruhiko Kuroda stated that Japan has a “potential growth rate of 0.5% or lower.”

By way of context, remember that the Bank of Japan has been at the forefront for ALL monetary policy for decades. The US Federal Reserve launched its first QE program in 2008. The European Central Bank launched its first QE program in 2015. The Bank of Japan first launched QE back in 2001.

In short, the Bank of Japan has two decades of experience with QE. Indeed, Japan is responsible for the single largest QE program in history, its “Shock and Awe” program launched in April 2014 which equaled over 25% of Japan’s GDP.

Which is why when Kuroda admitted that Japan’s GDP growth “potential” is limited to 0.5% or lower, he was implicitly admitting that QE cannot generate growth.

Remember, Central Bankers speak in half measures. They NEVER admit failure directly. Their primary job is to maintain confidence in the financial system even if it entails lying.

In Central Banker speak, Haruhiko Kuroda has admitted that there is a limit to potential GDP growth regardless of how much QE and Central Bank employs. He has admitted that Central Bankers might not have the tools required to generate growth.

———————————————————————–

The Single Best Options Trading Service on the Planet

Our options service THE CRISIS TRADER is absolutely KILLING it.

We have a success rate of 72% meaning we make money on more than seven out of 10 trades.

Even if you include ALL of our losers, we are up 17% year to date.

Over the same time period, the S&P 500 DOWN 8%.

That’s correct, with minimal risk, we are outperforming the S&P 500 by 25%… and the year only just started!

Our next goes out tomorrow morning… you can get it and THREE others for just 99 cents.

To take out a $0.99, 30 day trial subscription to THE CRISIS TRADER…

———————————————————————–

Even more that this, his actions SUPPORT this claim.

Last Friday, the Bank of Japan announced that it would be implementing Negative Interest Rate Policy or NIRP.

This change in policy was incredible. But what’s even more incredible is the fact that the Bank of Japan did NOT increase its QE program when it announced NIRP.

Put another way, the head of the Bank of Japan announced that QE cannot generate GDP growth, and then DIDN’T increase the Bank of Japan’s QE program when it came time to announce a new policy.

In short, Haruhiko Kuroda’s actions are supporting his words.

This is the single most important development in the monetary world. The head of a MAJOR Central Bank announced that QE cannot create economic growth and then refused to increase his bank’s QE program.

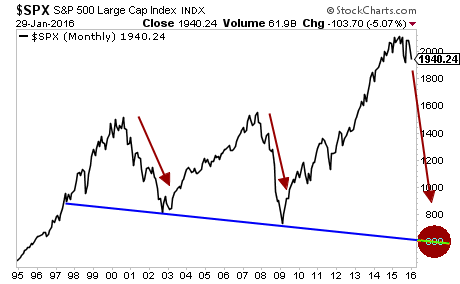

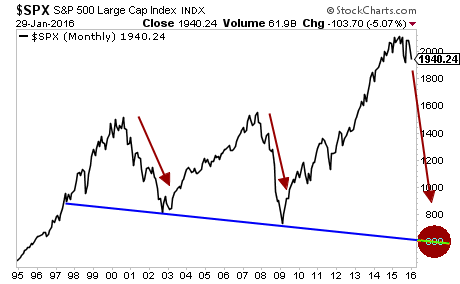

As usual, the markets have yet to adjust. Eventually they will. When they do, the S&P 500 will be below its March 2009 lows.

Another Crisis is coming. Smart investors are preparing now.

If you’re an investor who wants to increase your wealth dramatically, then you NEED to take out a trial subscription to our paid premium investment newsletter Private Wealth Advisory.

Private Wealth Advisory is a WEEKLY investment newsletter with an incredible track record.

Last week we closed three more winners including gains of 36%, 69% and a whopping 118% bringing us to 65 straight winning trades.

And throughout the last 14 months, we’ve not closed a SINGLE loser.

In fact, I’m so confident in my ability to pick winning investments that I’ll give you 30 days to try out Private Wealth Advisory for just 98 CENTS

If you have not seen significant returns from Private Wealth Advisory during those 30 days, just drop us a line and we’ll cancel your subscription with no additional charges.

All the reports you download are yours to keep, free of charge.

To take out a $0.98, 30-day trial subscription to Private Wealth Advisory…

Best Regards

Graham Summers

Phoenix Capital Research