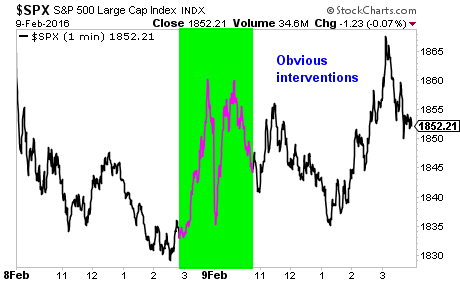

The Central Banks are getting desperate. The interventions are so obvious now you’d have to be on drugs not so notice them.

On Monday afternoon, at 3PM “someone” stepped in to prop up stocks. They did it again yesterday at 10AM. These were obvious interventions.

How do we know this was intervention and not real buying?

Because no real buyer guns the markets 20+ points higher in a matter of minutes.

Real investors carefully try to buy stock without gunning the market higher. If the market explodes higher, you get a worse entry point.

Why are Central Banks desperately trying to “save” stocks?

Because the markets have lost faith in their abilities.

———————————————————————————

The Single Best Options Trading Service on the Planet

Our options service THE CRISIS TRADER is absolutely KILLING it.

We have a success rate of 72% meaning we make money on more than seven out of 10 trades.

Even if you include ALL of our losers, we finished 2015 UP 35%

Over the same time period, the S&P 500 was DOWN.

This continues this year. Already we’ve closed out FIVE double digit winners in 2016. Including a 43% gain closed within 24 hours of us opening it!

Our next trade goes out this morning… you can get it and THREE others for just 99 cents.

To take out a $0.99, 30 day trial subscription to THE CRISIS TRADER...

———————————————————————————

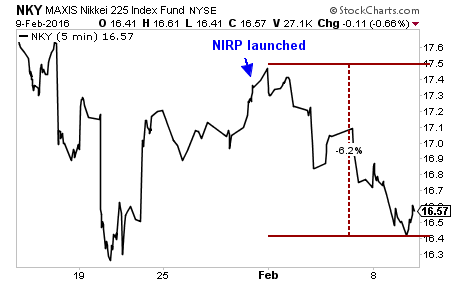

The Bank of Japan launched Negative Interest Rate Policy or NIRP two Fridays ago. Japanese stocks rolled over and crashed just one day later. They’ve since lost over 6%.

Consider that for a moment. The Bank of Japan, launched NIRP for the first time in history, and instead of exploding higher, stocks collapse.

Japan ALSO had to cancel a bond auction for the first time in history because investors didn’t want to buy bonds at negative rates.

The End Game has begun for Central Banks. Desperate interventions may push stocks higher temporarily, but the next Crisis has officially begun.

If you’re an investor who wants to increase your wealth dramatically, then you NEED to take out a trial subscription to our paid premium investment newsletter Private Wealth Advisory.

Private Wealth Advisory is a WEEKLY investment newsletter with an incredible track record.

Yesterday we closed out THREE more double digit winners (all of them opened just two weeks ago) bringing our current winning streak to 71 straight winning trades,

And throughout the last 14 months, we’ve not closed a SINGLE loser.

With a track record like this, we’re getting a LOT of attention, so we’re going to be raising the price of a Private Wealth Advisory in the next few weeks.

However, you can try it right now for 30 days for just 98 cents… but you better move fast, because these slots are selling out!!!

To lock in a $0.98, 30-day trial subscription to Private Wealth Advisory…

Best Regards

Graham Summers

Phoenix Capital Research