The world will soon be facing a tsunami of defaults on bad debts. This will include municipal or local government defaults, governments “defaulting” on promises they’ve made to the people (Social Security, Medicaid), a default on the social contract between society and politicians such as the one in Cyprus (a default on the notions of private property and Democracy), stealth defaults on debts in the form of inflation and finally, of course, outright sovereign defaults.

The sovereign defaults will come last; all other options will be tried first.

The reason for this is that sovereign bonds (think of US Treasuries, German Bunds or Japanese Government bonds) are the senior most collateral posted by banks for the hundreds of trillions of Dollars worth of derivatives bets they’ve made with each other.

The minute an actual sovereign default occurs in Europe, Asia or the US, then the large global banks will all be vaporized. End of story. As is now clear, the Central banks do not care about ordinary citizens. They only care about propping up the big banks.

This is why Cyprus decided to default on the social contract with its people and steal their funds rather than simply instigating a formal default. And it’s why in general we’re going to see Governments implementing more and more theft in the form of “taxes” (Cyprus called its theft a tax) in the future.

Make no mistake, the words “wealth tax” mean freezing of assets and then taking some of your savings. Anyone with more than $100,000 in a bank account should be prepared for this.

This will be sold to the public as either an attempt to tax those with a lot of money because it’s only fair that they put in more to bailout the nation OR as a form of financial terrorism e.g. “either you take a 7% cut on your deposits and the bank stays afloat or the bank crashes and you lose everything.”

———————————————————————————

The Single Best Options Trading Service on the Planet

Our options service THE CRISIS TRADER is absolutely KILLING it.

We have a success rate of 72% meaning we make money on more than seven out of 10 trades.

Even if you include ALL of our losers, we finished 2015 UP 35%

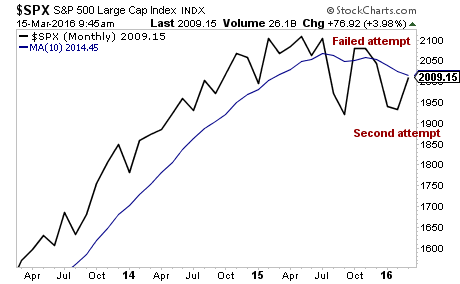

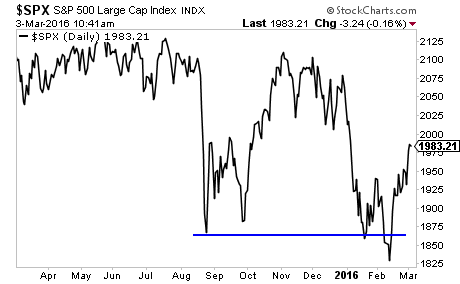

Over the same time period, the S&P 500 was DOWN.

This continues this year. Already we’ve closed out FIVE double digit winners in 2016. Including a 43% gain closed within 24 hours of us opening it!

Our next trade goes out this morning… you can get it and THREE others for just 99 cents.

To take out a $0.99, 30 day trial subscription to THE CRISIS TRADER...

CLICK HERE NOW!!!

———————————————————————————

This will be spreading throughout the world, GUARANTEED.

Spain, Canada (which allegedly has the safest banks in the world), New Zealand and now even Germany are implementing confiscation schemes for depositors in the event of a banking crisis.

It can happen in the UK and the US as well. I am not writing that to simply scare people. The FDIC, working with the Bank of England published a paper proposing precisely these methods to deal with Systemically Important Financial Entities (SIFIs). The paper was published in December 2012. Below are some excerpts worth your attention:

This paper focuses on the application of “top-down” resolution strategies that involve a single resolution authority applying its powers to the top of a financial group, that is, at the parent company level. The paper discusses how such a top-down strategy could be implemented for a U.S. or a U.K. financial group in a cross-border context…

These strategies have been designed to enable large and complex cross- border firms to be resolved without threatening financial stability and without putting public funds at risk…

Under the strategies currently being developed by the U.S. and the U.K., the resolution authority could intervene at the top of the group. Culpable senior management of the parent and operating businesses would be removed, and losses would be apportioned to shareholders and unsecured creditors. In all likelihood, shareholders would lose all value and unsecured creditors should thus expect that their claims would be written down to reflect any losses that shareholders did not cover. Under both the U.S. and U.K. approaches, legal safeguards ensure that creditors recover no less than they would under insolvency.

An efficient path for returning the sound operations of the G-SIFI to the private sector would be provided by exchanging or converting a sufficient amount of the unsecured debt from the original creditors of the failed company into equity. In the U.S., the new equity would become capital in one or more newly formed operating entities. In the U.K., the same approach could be used, or the equity could be used to recapitalize the failing financial company itself—thus, the highest layer of surviving bailed-in creditors would become the owners of the resolved firm. In either country, the new equity holders would take on the corresponding risk of being shareholders in a financial institution. Throughout, subsidiaries (domestic and foreign) carrying out critical activities would be kept open and operating, thereby limiting contagion effects. Such a resolution strategy would ensure market discipline and maintain financial stability without cost to taxpayers.

Title II of the Dodd-Frank Act provides the FDIC with new powers to resolve SIFIs [systemically important financial institutions] by establishing the orderly liquidation authority (OLA). Under the OLA, the FDIC may be appointed receiver for any U.S. financial company that meets specified criteria, including being in default or in danger of default, and whose resolution under the U.S. Bankruptcy Code (or other relevant insolvency process) would likely create systemic instability.

[In the US] Title II requires that the losses of any financial company placed into receivership will not be borne by taxpayers, but by common and preferred stockholders, debt holders, and other unsecured creditors, and that management responsible for the condition of the financial company will be replaced…

http://www.fdic.gov/about/srac/2012/gsifi.pdf

So… if a large bank fails in the US, the FDIC steps in and takes over, replacing management, and works to shrink the bank by writing-down liabilities and converting debt into equity.

In other words… any liability at the bank is in danger of being written-down should the bank fail. And guess what? Deposits are considered liabilities according to US Banking Law and depositors are creditors.

So… if a large bank fails in the US, your deposits at this bank would either be “written-down” (read: disappear) or converted into equity or stock shares in the company. And once they are converted to equity you are a shareholder not a depositor… so you are no longer insured by the FDIC.

So if the bank then fails (meaning its shares fall)… so does your deposit.

Let’s run through this.

Let’s say ABC bank fails in the US. ABC bank is too big for the FDIC to make hold. So…

- The FDIC takes over the bank.

- The bank’s managers are forced out.

- The bank’s debts and liabilities are converted into equity or the bank’s stock. And yes, your deposits are considered a “liability” for the bank.

- Whatever happens to the bank’s stock, affects your wealth. If the bank’s stock falls at this point because everyone has figured out the bank is in major trouble… your wealth falls to.

Let’s say you have $1,000,000 in deposits at financial institutions ABC. When ABC fails, your deposits are converted into $1,000,000 worth of ABC’s stock (let’s say you get 1,000,000 shares valued at $1 each for $1,000,000).

Now let’s say ABC’s shares fall in value from $1.00 to $0.50.

You just lost $500,000 of your wealth.

This is precisely what has happened in Spain during the 2012 banking crisis over there.

And it is perfectly legal in the US courtesy of a clause in the Dodd-Frank bill.

This is the template for what’s going to be implemented globally in the coming months. When push comes to shove, it will be taxpayers, NOT Central Banks who are on the hook for the next round of bailouts.

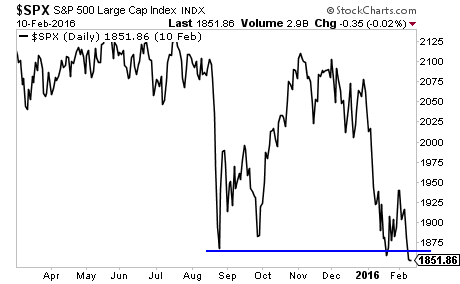

If you’re an investor who wants to protect yourself from the coming bear market, then you NEED to take out a trial subscription to our paid premium investment newsletter Private Wealth Advisory.

Private Wealth Advisory is a WEEKLY investment newsletter with an incredible track record.

To wit… in the last 16 months we’ve closed out 77 straight winning trades.

That is not a typo…

For 16 months, not only have Private Wealth Advisory subscribers locked in 77 CONSECUTIVE winners including gains of 18%, 36%, 69%, even 119%…

But throughout that ENTIRE TIME we’ve not closed a SINGLE loser.

Indeed, we just closed out two more double digit winners yesterday: gains of 10% and 40% opened just a few weeks before

As you can imagine, this track record is a getting a ton of attention, so we are going to be closing the doors on our current offer to explore Private Wealth Advisory at the end of this month.

So if you want to try Private Wealth Advisory for 30 days for just 98 cents, you need to get moving, because the clock is ticking and slots are quickly running out.

To lock in one of the remaining slots…

CLICK HERE NOW!

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

Our FREE e-letter: http://gainspainscapital.com/

Follow us on Twitter: http://twitter.com/GainsPainsCapit