The rally of the last month has many scratching their heads.

That is, until you realize:

- Most of it was driven by “short-covering.”

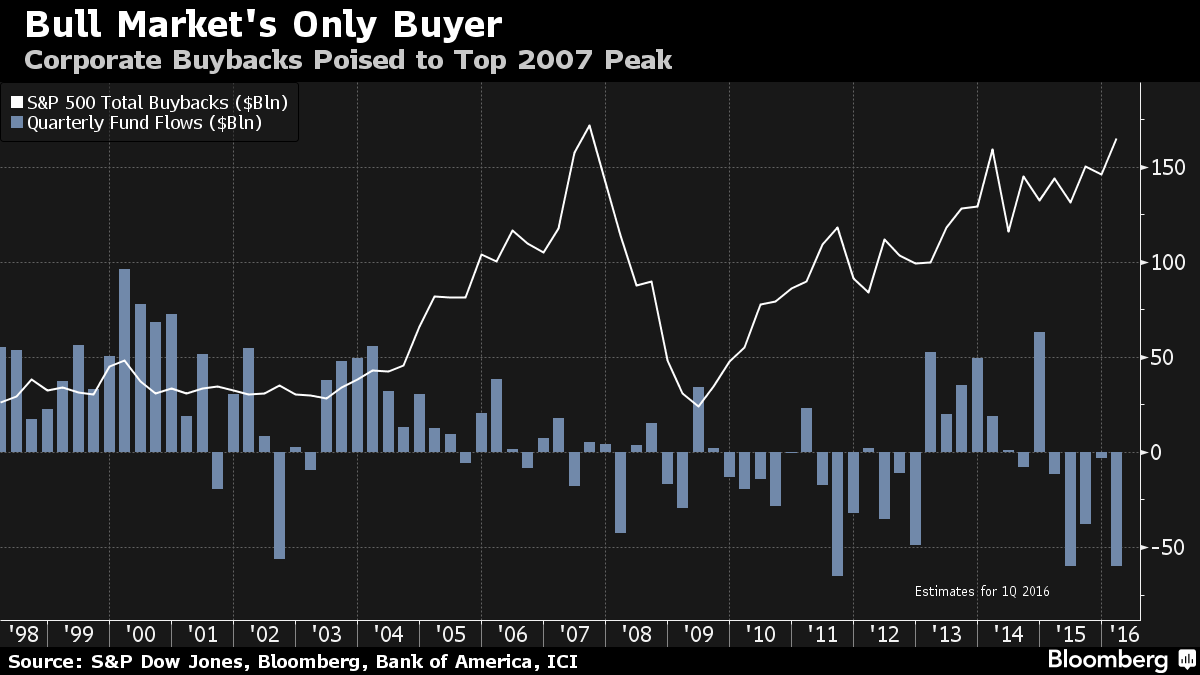

- The primary buyers of stocks today are corporations buying back their stock to juice EPS, not actual investors.

- Actual investors have been selling the farm.

Central Banking manipulation only works as long as a reasonable number of investors continue to “drink the Kool Aid.”

Unfortunately we are now well past that point.

The Fed failed to raise rates last week, despite virtually every data point the Fed claims to care about hitting its desired levels. At this point, even former Fed cheerleaders like CNBC’s Steve Liesman are questioning the Fed’s credibility.

———————————————————————–

The Single Best Options Trading Service on the Planet

Our options service THE CRISIS TRADER is absolutely KILLING it.

We have a success rate of 72% meaning we make money on more than seven out of 10 trades.

Even if you include ALL of our losers, we finished 2015 UP 35%

Over the same time period, the S&P 500 was DOWN.

This continues this year. Already we’ve closed out FIVE double digit winners in 2016. Including a 43% gain closed within 24 hours of us opening it!

Our next trade goes out this morning… you can get it and THREE others for just 99 cents.

To take out a $0.99, 30 day trial subscription to THE CRISIS TRADER...

———————————————————————–

Regarding #2, the only real buyers of the market at these levels are corporations looking to increasing EPS by reducing their number of share outstanding via buybacks.

Standard & Poor’s 500 Index constituents are poised to repurchase as much as $165 billion of stock this quarter, approaching a record reached in 2007. The buying contrasts with rampant selling by clients of mutual and exchange-traded funds, who after pulling $40 billion since January are on pace for one of the biggest quarterly withdrawals ever.

Source: Bloomberg

Note that in the above article, REAL investors are engaged in “rampant selling” of stocks. Put another way, REAL investors are getting out of Dodge!

And the blackout period for Corporate Buybacks starts today. Put another way, the ONLY buyer of stocks is stopping buying.

U.S. stocks are entering part of the year when one of their biggest support systems is turned off.

Buybacks, which reached a monthly record in February and have surged so much they make up about 2 percent of daily volume, are customarily suspended during the five weeks before companies report quarterly results, according to Goldman Sachs Group Inc. With the busiest part of first-quarter earnings seasons beginning in April, the blackout is getting started now.

Source: Bloomberg

A bear market is looming, are you prepared?

If you’re an investor who wants to protect yourself from the coming bear market, then you NEED to take out a trial subscription to our paid premium investment newsletter Private Wealth Advisory.

Private Wealth Advisory is a WEEKLY investment newsletter with an incredible track record.

To wit… in the last 16 months we’ve closed out 75 straight winning trades.

Did I say, “75 straight”winning trades”?!?

Yes, I did.

For 16 months, not only have Private Wealth Advisory subscribers locked in 75 CONSECUTIVE winners including gains of 18%, 36%, 69%, even 119%…

But throughout that ENTIRE TIME we’ve not closed a SINGLE loser.

As you can imagine, this track record is a getting a ton of attention, so we are going to be closing the doors on our current offer to explore Private Wealth Advisory at the end of this month.

So if you want to try Private Wealth Advisory for 30 days for just 98 cents, you need to get moving, because the clock is ticking and slots are quickly running out.

To lock in one of the remaining slots…

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research