Deposits That Go To Zero and Capital Controls for Two Years

Canada has joined the “bail-in” posse.

Canada will introduce legislation to implement a “bail-in” regime for systemically important banks that would shift some of the responsibility for propping up failing institutions to creditors.

The proposed plan outlined in the federal budget released on Tuesday would allow authorities to convert eligible long-term debt of a failing lender into common shares in order to recapitalize the bank, allowing it to remain operating.

Source: CNBC

The above story suggests that only bondholders would be at risk of a bail-in but we all know that is just some sugar to make what’s coming go down easier.

What’s coming?

Savings deposits being used to bail-in banks. Legislation is in the works in Canada, New Zealand, the UK, Germany, and even the US to do precisely this.

———————————————————————————

The Single Best Options Trading Service on the Planet

Our options service THE CRISIS TRADER is absolutely KILLING it.

We have a success rate of 72% meaning we make money on more than seven out of 10 trades.

Even if you include ALL of our losers, we finished 2015 UP 35%

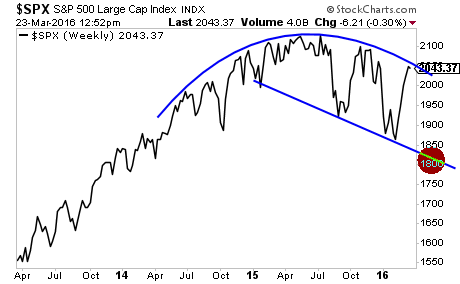

Over the same time period, the S&P 500 was DOWN.

This continues this year. Already we’ve closed out FIVE double digit winners in 2016. Including a 43% gain closed within 24 hours of us opening it!

Our next trade goes out this morning… you can get it and THREE others for just 99 cents.

To take out a $0.99, 30 day trial subscription to THE CRISIS TRADER...

———————————————————————————

This whole template was laid out in Europe in 2012. Europe is ground zero for Keynesian Central Planning: a massive welfare state overseen by non-elected officials and Central Bankers who willingly break the rule of law whenever it suits them,

The guinea pig for the template was Cyprus.

The quick timeline for what happened in Cyprus is as follows:

- June 25, 2012: Cyprus formally requests a bailout from the EU.

- November 24, 2012: Cyprus announces it has reached an agreement with the EU the bailout process once Cyprus banks are examined by EU officials (ballpark estimate of capital needed is €17.5 billion).

- February 25, 2013: Democratic Rally candidate Nicos Anastasiades wins Cypriot election defeating his opponent, an anti-austerity Communist.

- March 16 2013: Cyprus announces the terms of its bail-in: a 6.75% confiscation of accounts under €100,000 and 9.9% for accounts larger than €100,000… a bank holiday is announced.

- March 17 2013: emergency session of Parliament to vote on bailout/bail-in is postponed.

- March 18 2013: Bank holiday extended until March 21 2013.

- March 19 2013: Cyprus parliament rejects bail-in bill.

- March 20 2013: Bank holiday extended until March 26 2013.

- March 24 2013: Cash limits of €100 in withdrawals begin for largest banks in Cyprus.

- March 25 2013: Bail-in deal agreed upon. Those depositors with over €100,000 either lose 40% of their money (Bank of Cyprus) or lose 60% (Laiki).

The most important thing we want you to focus on is how lies and propaganda were spread for months leading up to the collapse. Then in the space of a single weekend, the whole mess came unhinged and accounts were frozen.

One weekend. The process was not gradual. It was sudden and it was total: once it began in earnest, the banks were closed and you couldn’t get your money out.

Depositors lost between 40% and 60% of their savings above €100,000 as it was converted into bank equity. However, once it became equity, it could go to ZERO just like any stock.

That’s precisely what happened.

Account holders at Bank of Cyprus lost almost half their money above the €100,000 level, receiving stock in the bank as compensation. Those shares have since plummeted in value.

Uninsured depositors in Laiki Bank, also known as Cyprus Popular Bank, the nation’s second-largest lender, lost everything because the bank failed.

Source: NY TIMES.

As for those trying to get their money out of Cyprus, it took TWO YEARS before the final capital controls were lifted.

And the last remaining restrictions on transfers of money outside of Cyprus, imposed two years ago, will be lifted next month (APRIL 2015), said Chrystalla Georghadji, the governor of the country’s central bank.

Source: NY TIMES.

So… depositors had 40% to 60% of their deposits above €100,000 converted into bank equity… equity which could then go to ZERO… and those who tried to get their money out of the country had restrictions in place for TWO YEARS.

This is the template for what’s going to be implemented globally in the coming months. When push comes to shove, it will be taxpayers, NOT Central Banks who are on the hook for the next round of bailouts.

If you’re an investor who wants to protect yourself from the coming bear market, then you NEED to take out a trial subscription to our paid premium investment newsletter Private Wealth Advisory.

Private Wealth Advisory is a WEEKLY investment newsletter with an incredible track record.

To wit… in the last 16 months we’ve closed out 77 straight winning trades.

That is not a typo…

For 16 months, not only have Private Wealth Advisory subscribers locked in 77 CONSECUTIVE winners including gains of 18%, 36%, 69%, even 119%…

But throughout that ENTIRE TIME we’ve not closed a SINGLE loser.

Indeed, we just closed out two more double digit winners yesterday: gains of 10% and 40% opened just a few weeks before

As you can imagine, this track record is a getting a ton of attention, so we are going to be closing the doors on our current offer to explore Private Wealth Advisory at the end of this month.

So if you want to try Private Wealth Advisory for 30 days for just 98 cents, you need to get moving, because the clock is ticking and slots are quickly running out.

To lock in one of the remaining slots…

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

Our FREE e-letter: http://gainspainscapital.com/

Follow us on Twitter: http://twitter.com/GainsPainsCapit