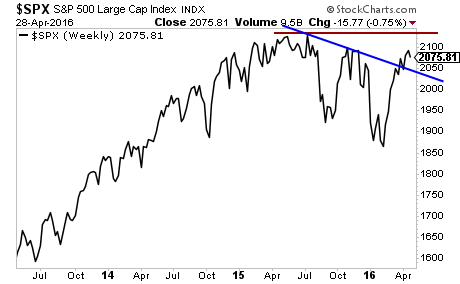

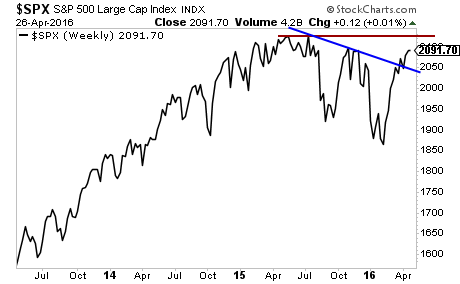

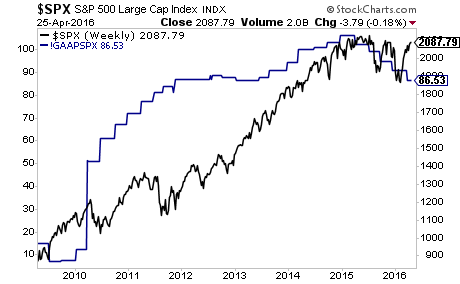

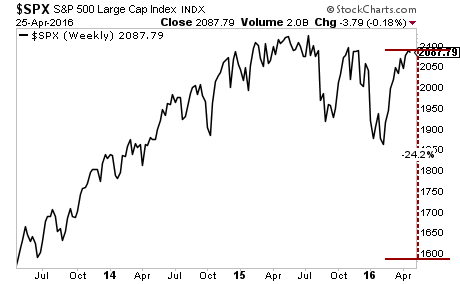

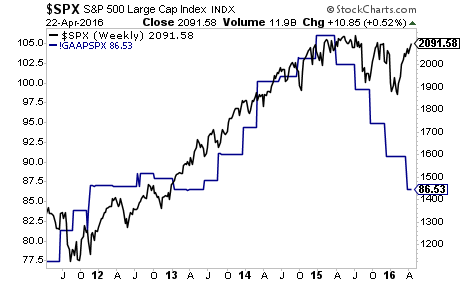

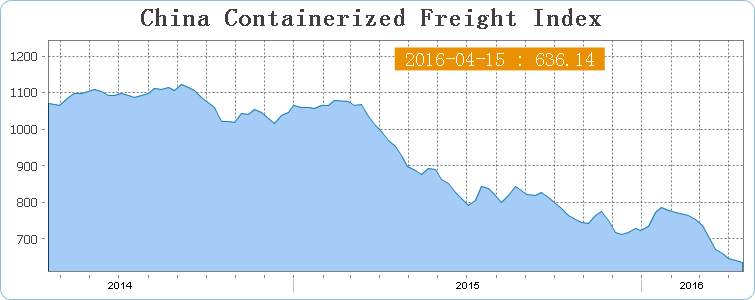

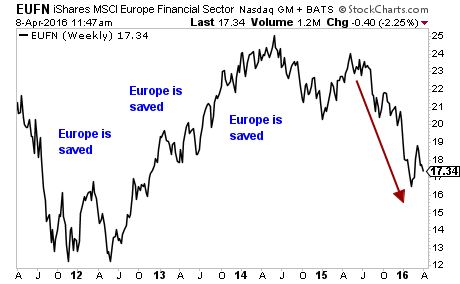

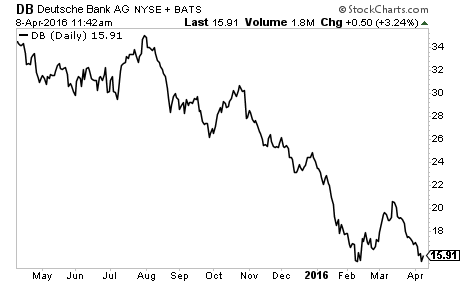

Ignore the bounce in stocks, something much larger is playing out beneath the surface.

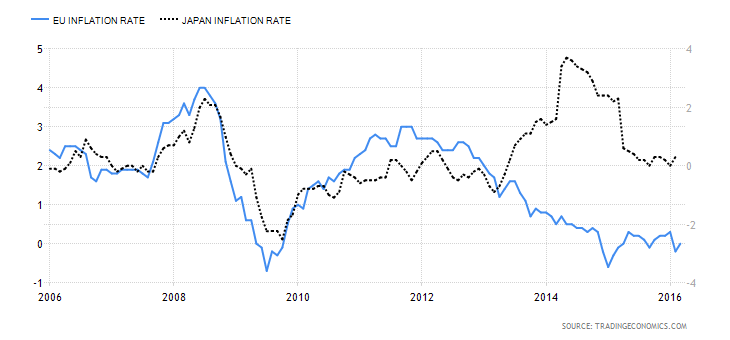

That “something” is key admissions from Central Banks that they have lost their ability to generate anything resembling a recovery. In particular the Bank of Japan has finally come clean in an admission so startling that it took three months for the media to even catch on.

In January 2016, the head of the Bank of Japan, Haruhiko Kuroda stated that Japan has a “potential growth rate of 0.5% or lower.”

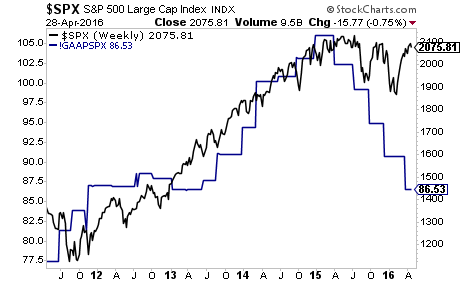

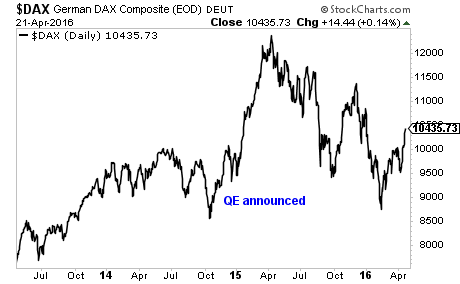

By way of context, remember that the Bank of Japan has been at the forefront for ALL monetary policy for decades. The US Federal Reserve launched its first QE program in 2008. The European Central Bank launched its first QE program in 2015. The Bank of Japan first launched QE back in 2001.

In short, the Bank of Japan has two decades of experience with QE. Indeed, Japan is responsible for the single largest QE program in history, its “Shock and Awe” program launched in April 2014 which equaled over 25% of Japan’s GDP.

Which is why when Kuroda admitted that Japan’s GDP growth “potential” is limited to 0.5% or lower, he was implicitly admitting that QE cannot generate growth.

Remember, Central Bankers speak in half measures. They NEVER admit failure directly. Their primary job is to maintain confidence in the financial system even if it entails lying.

———————————————————————–

The Single Best Options Trading Service on the Planet

THE CRISIS TRADER has produced an astounding 400% return on invested capital thus far in 2016.

We have a success rate of 72% meaning we make money on more than seven out of 10 trades. And thanks to careful risk management we’ve seen triple digit returns on invested capital every year since inception.

Our next trade goes out this morning… you can get it and THREE others for just 99 cents.

To take out a $0.99, 30-day trial subscription to THE CRISIS TRADER…

CLICK HERE NOW!!!

———————————————————————–

Which is why when Kuroda made this admission it was so striking that the media didn’t catch on for three months until today… and only in the form of realizing the financial limitations to the Bank of Japan’s QE programs.

Japan Is Fast Approaching the Quantitative Limits of Quantitative Easing

The Bank of Japan is running out of government bonds to buy.

The central bank’s would-be counterparties have become increasingly unwilling to sell the debt that monetary policymakers have pledged to buy, and the most recently issued 30-year Japanese bond didn’t record a single trade during a session last week as existing owners opted to hoard their holdings.

The central bank in the land of the rising prices sun has set a target of 80 trillion yen ($733 billion) in government bond purchases per year in its continued attempts to slay deflation, an amount that’s more than double the pace of new bond issuance planned by the Ministry of Finance and about 16 percent of gross domestic product.

But safe assets like government debt aren’t just attractive to central banks looking to force investors into riskier asset classes and push down the cost of borrowing or to pensioners looking for a reliable source of income—they’re also in high demand by financial institutions for use as collateral.

Source: Bloomberg

So…

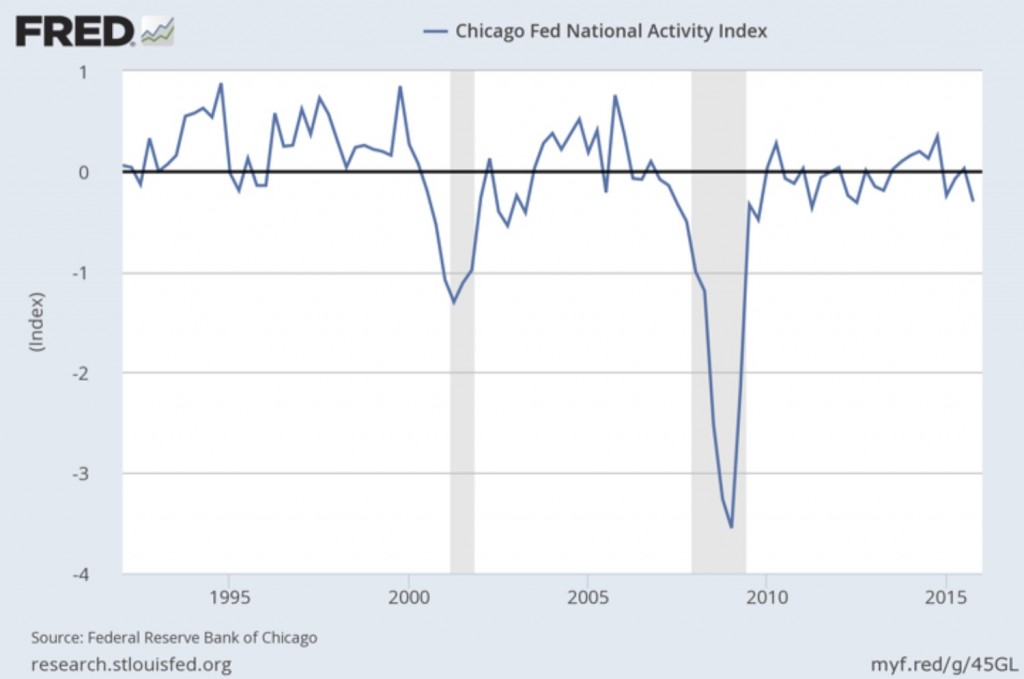

- The Head of the Central Bank that has been at the forefront of monetary policy for over 20 years has admitted that QE cannot generate economic growth…

- The Mainstream Media catches on three months later and begins to acknowledge the limitations of QE.

When tectonic shifts hit the financial system, it takes month for investors to grasp it… which is why investors continue to believe in hype and hope that Central Banks can somehow put off a bear market and crash forever.

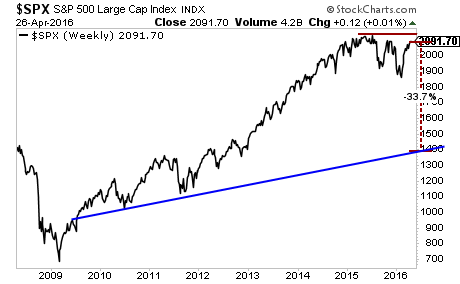

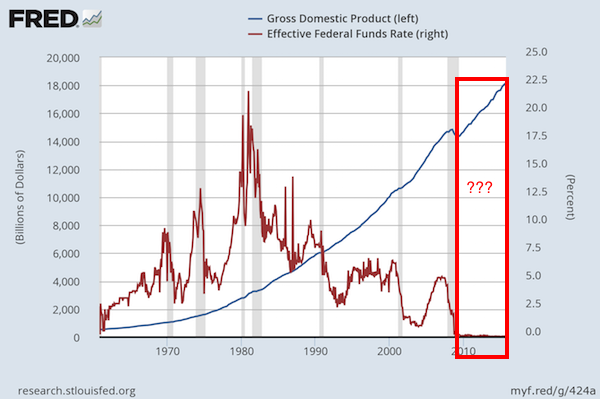

Central Banks couldn’t put off 2008… and that was back when they still had interest rate cuts and large scale QE programs as potential ammo to deal with market crises.

This time around…

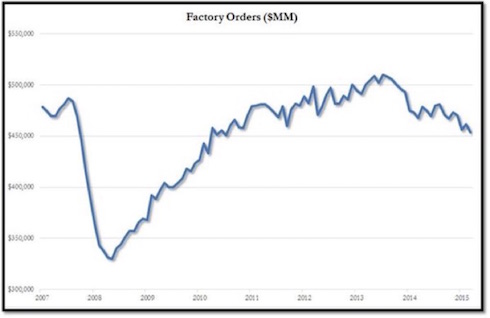

- The world is $20 trillion MORE in debt that in 2008.

- Corporations are MORE leveraged than in 2008.

And the big one…

- Central Banks have already deployed $14 trillion in QE and implemented NIRP and ZIRP

In the simplest of terms, the financial system is in worse shape than in 2008… at a time when Central Banks have spent virtually all of their ammo. So when the next Crisis hits, virtually nothing will be able to stop it.

The time to prepare for the next crisis is NOW before it hits.

If you’re an investor who wants to protect yourself from the coming bear market, then you NEED to take out a trial subscription to our paid premium investment newsletter Private Wealth Advisory.

Private Wealth Advisory is a WEEKLY investment newsletter with an incredible track record.

To wit… in the last 16 months we’ve closed out 77 straight winning trades.

That is not a typo…

For 16 months, not only have Private Wealth Advisory subscribers locked in 77 CONSECUTIVE winners including gains of 18%, 36%, 69%, even 119%…

But throughout that ENTIRE TIME we’ve not closed a SINGLE loser.

Indeed, we just closed out two more double digit winners yesterday: gains of 10% and 40% opened just a few weeks before

As you can imagine, this track record is a getting a ton of attention, so we are going to be closing the doors on our current offer to explore Private Wealth Advisory at the end of this month.

So if you want to try Private Wealth Advisory for 30 days for just 98 cents, you need to get moving, because the clock is ticking and slots are quickly running out.

To lock in one of the remaining slots…

CLICK HERE NOW!

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

Our FREE e-letter: http://gainspainscapital.com/

Follow us on Twitter: http://twitter.com/GainsPainsCapit