The market bounced hard last week when a British MP was killed.

The consensus view is that this tragedy will somehow turn Brits against a Brexit. Britain is voting whether or not to leave the EU this coming Thursday.

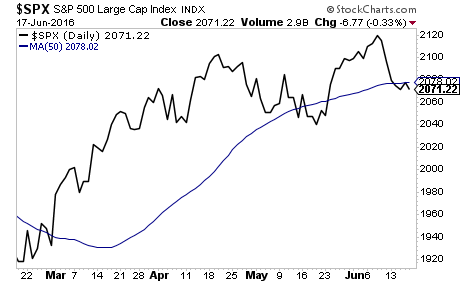

From a technical perspective, the S&P 500 tried several times to break above its 50-DMA last week. All of those attempts failed. Moreover, the 50-DMA is now flat: momentum from the February low is ending.

The Single Best Options Trading Service on the Planet

THE CRISIS TRADER has produced an astounding 248% return on invested capital thus far in 2016.

We have a success rate of 72% meaning we make money on more than seven out of 10 trades. And thanks to careful risk management we’ve seen triple digit returns on invested capital every year since inception.

Our next trade goes out this morning… you can get it and THREE others for just 99 cents.

To take out a $0.99, 30-day trial subscription to THE CRISIS TRADER...

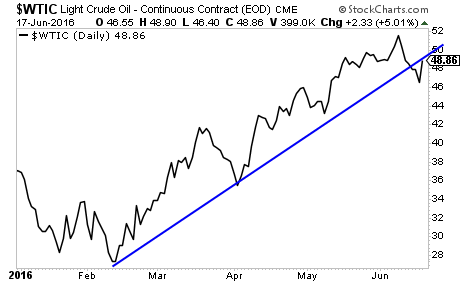

I’ve noted before that this rally has a seasonal basis.

Oil usually leads stocks in a rally into the summer. However, last week oil took out its trendline:

If you are not preparing for a bear market in stocks, you NEED to do so NOW.

I can show you how.

To wit… in the last 18 months we’ve closed out 86 straight winning trades.

That’s correct…

For 18 months, not only have Private Wealth Advisory subscribers locked in 84 CONSECUTIVE winners including gains of 18%, 36%, 69%, even 119%...

But more importantly, throughout that ENTIRE TIME we’ve not closed a SINGLE loser.

86 closed winners… and not one closed loser… in 18 months.

Based on what’s happening in the markets today, we’ve decided to extend our deadline on our current offer to try Private Wealth Advisory by another 24 hours.

So tonight (MONDAY) at midnight, we are closing the doors on our offer to try Private Wealth Advisory for 30 days for just $0.98.

This is it… no more extensions… no more openings,

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research