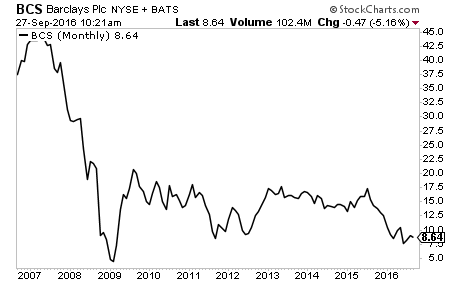

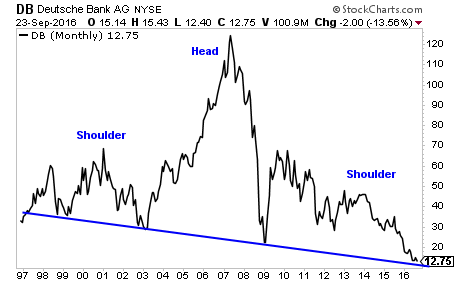

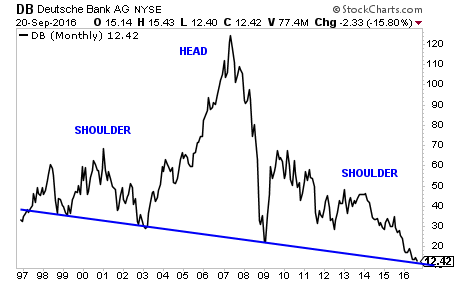

Let’s talk about Deutsche Bank (DB).

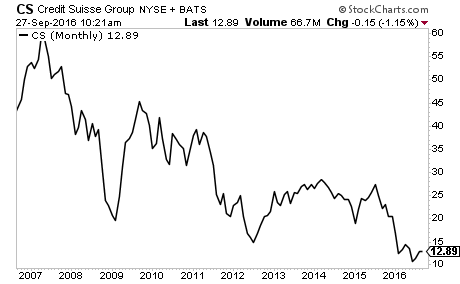

Deutsche Bank is the 11th largest bank in the world. It has assets of $1.8 trillion and over ~$60 trillion in derivatives on its books.

From a balance sheet perspective, DB’s balance sheet is 50% the size of Germany’s GDP. By way of comparison, imagine if JP Morgan was a $9 TRILLION bank. That’s effectively DB’s status in Germany.

However, it’s DB’s derivative book that is the real problem as far as the markets are concerned. As I mentioned before, DB has ~$60 trillion in derivatives. And unlike the other derivatives giant of the financial world (JP Morgan with $52 trillion in derivatives), DB is based in Europe.

What are the differences?

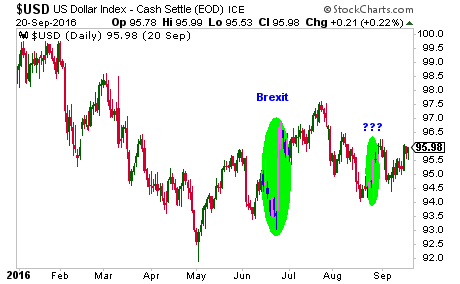

Europe is where Negative Interest Rate Policy (NIRP) Brexit and exposure to a banking system that is entirely too laden with debt has proven a disastrous cocktail.

———————————————————————–

The Single Best Options Trading Service on the Planet

Yesterday, while 99% of traders were getting killed we locked in THREE new double digit winners.

As a result of this, our options trading newsletter, THE CRISIS TRADER has now produced an astounding 270% return on invested capital thus far in 2016.

We have a success rate of 70% meaning we make money on SEVEN seven out of TEN trades. And thanks to careful risk management we’ve already produced a return on invested capital of over 124% thus far in 2016.

You can try this service for 30 days for just 99 cents.

To take out a $0.99, 30-day trial subscription to THE CRISIS TRADER…

———————————————————————–

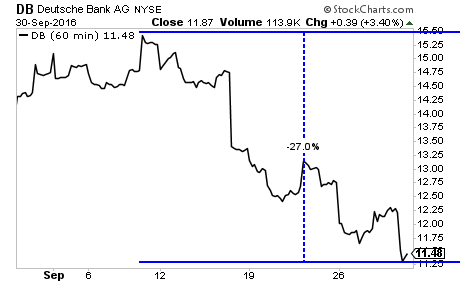

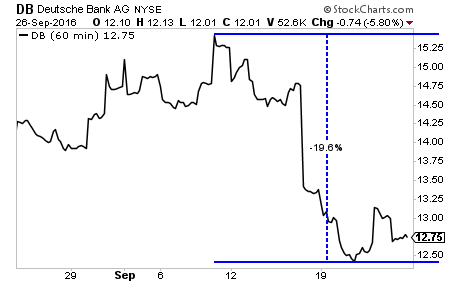

What precisely has hit DB remains to be seen. But something happened in the first two weeks of September that triggered a market meltdown. DB shares have fallen straight down a total of 27% since that time.

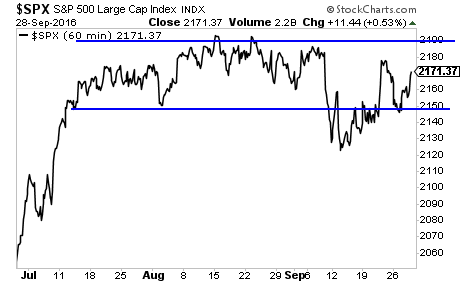

Now we are in full-blown panic mode. This bank is too big to bailout and too big to bail-in. Moreover that massive derivatives book connects DB to over 200 financial entities. Unwinding it will be catastrophic.

This could very well lead to a 2008 type Crash. To be blunt, I don’t see how Germany or the ECB can contain it.

Seriously at this point, if you’re not taking out a trial subscription to our Private Wealth Advisory newsletter, I don’t know what else to tell you.

First of all, I’ve lead subscribers to close 112 STRAIGHT WINNING TRADES. This is a record in investing, even greater than our 74 trade winning streak back in 2012.

In September alone we’ve closed WINNERS of 6%, 8%, 11%, 14% and 19%.

And the last time we closed a LOSER was in NOVEMBER 2014.

So… you’re talking about closing nothing but winners for nearly TWO YEARS STRAIGHT, SETTING A RECORD FOR LONGEST WINNING STREAK.

If you don’t believe me, you can take out a trial for 30 days for 98 cents.

If you find Private Wealth Advisory is not what you’re looking for, simply email us and you won’t be charged another cent.

However, I have no doubt you, like our other subscribers will stay with us. Most subscribers make enough money on a single one of our trades to cover the cost of an entire YEAR’S subscription (just $199).

Indeed, less than 10% of subscribers choose NOT to stay with us. And the ones that DO cancel do so because they’re simply not active investors and prefer owning a single mutual fund.

I know you’re not that kind of investor. You’re looking for regular market crushing gains and minimal losers to grow your capital like a rocket ship.

To take out a 30 day trial subscription to Private Wealth Advisory for just…. 98 cents.

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

PS. I almost forgot, a 30 day trial subscription to Private Wealth Advisory for just 98 cents comes with SIX SPECIAL INVESTMENT REPORTS.

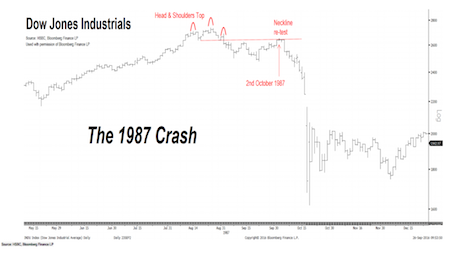

- The Crash Trigger: The Signal That Flashed Before 1987, 2000, and 2008

- The War on Cash: the Fed’s Secret Plan to Outlaw Cash

- Protect Your Portfolio From a Crash

- Protect Your Savings from a Bank Failure

- The Inflation Secrets Your Broker Won’t Tell You About

- Bullion 101: How and Why to Buy Gold and Silver

These reports are yours to keep EVEN IF YOU CHOOSE TO CANCEL YOUR SUBSCRIPTION.

How’s that for a NO RISK offer?

To take out a 30 day trial subscription to Private Wealth Advisory for just 98 cents.