To understand the financial markets, you need to understand the hierarchy of asset classes.

That hierarchy is as follows:

Globally, the stock market is about $69 trillion in size, trading about $191 billion in shares per day.

The bond markets are well north of $140 trillion, and trade about $700 billion in volume per day,

The bond market is the SMART money and reacts to major policy changes before stocks.

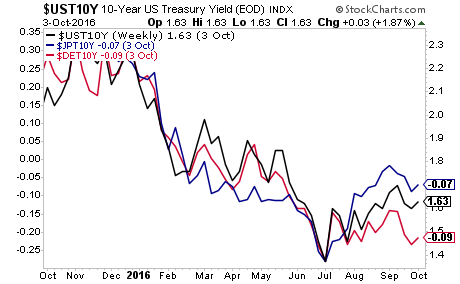

On that note, the bond market has realized QE is ending in Europe and Japan.

———————————————————————–

This Might Be the Single Best Options Trading Service on the Planet

In the last week, while 99% of traders were getting killed we locked in THREE new double digit winners.

As a result of this, our options trading newsletter, THE CRISIS TRADER has now produced an astounding 124% return on invested capital thus far in 2016.

We have a success rate of 70% meaning we make money on SEVEN seven out of TEN trades. And thanks to careful risk management we’ve already produced a return on invested capital of over 124% thus far in 2016.

You can try this service for 30 days for just 99 cents.

To take out a $0.99, 30-day trial subscription to THE CRISIS TRADER…

———————————————————————–

On that note, in July the bond markets signaled that something BIG is coming to the markets. The yields on 10-Year Treasuries, 10-Year JGBs and 10-Year Bunds rocketed higher.

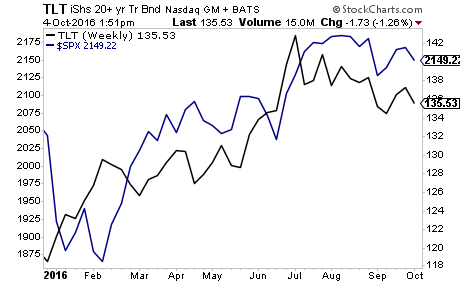

This is a MASSIVE problem for the markets. Stocks have started tracking bonds this year. And with bonds now selling off, stocks are on BORROWED TIME.

You’ve been warned. Globally over $555 TRILLION in derivatives trades based on interest rates. If the bond market really starts to go then we’re facing a Crisis that will be exponentially larger than 2008.

Seriously at this point, if you’re not taking out a trial subscription to our Private Wealth Advisory newsletter, I don’t know what else to tell you.

First of all, I’ve lead subscribers to close 112 STRAIGHT WINNING TRADES. This is a record in investing, even greater than our 74 trade winning streak back in 2012.

In September alone we closed WINNERS of 6%, 8%, 11%, 14% and 19%.

And the last time we closed a LOSER was in NOVEMBER 2014.

So… you’re talking about closing nothing but winners for nearly TWO YEARS STRAIGHT, SETTING A RECORD FOR LONGEST WINNING STREAK.

If you don’t believe me, you can take out a trial for 30 days for 98 cents.

If you find Private Wealth Advisory is not what you’re looking for, simply email us and you won’t be charged another cent.

However, I have no doubt you, like our other subscribers will stay with us. Most subscribers make enough money on a single one of our trades to cover the cost of an entire YEAR’S subscription (just $199).

Indeed, less than 10% of subscribers choose NOT to stay with us. And the ones that DO cancel do so because they’re simply not active investors and prefer owning a single mutual fund.

I know you’re not that kind of investor. You’re looking for regular market crushing gains and minimal losers to grow your capital like a rocket ship.

To take out a 30 day trial subscription to Private Wealth Advisory for just 98 cents.

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

PS. I almost forgot, a 30 day trial subscription to Private Wealth Advisory for just 98 cents comes with SIX SPECIAL INVESTMENT REPORTS.

- The Crash Trigger: The Signal That Flashed Before 1987, 2000, and 2008

- The War on Cash: the Fed’s Secret Plan to Outlaw Cash

- Protect Your Portfolio From a Crash

- Protect Your Savings from a Bank Failure

- The Inflation Secrets Your Broker Won’t Tell You About

- Bullion 101: How and Why to Buy Gold and Silver

These reports are yours to keep EVEN IF YOU CHOOSE TO CANCEL YOUR SUBSCRIPTION.

How’s that for a NO RISK offer?

To take out a 30 day trial subscription to Private Wealth Advisory for just 98 cents.