Let’s take a step back and look at the big picture for stocks today.

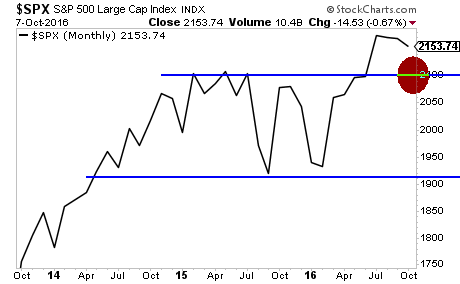

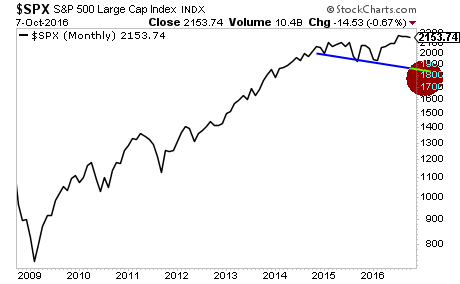

After QE 3 ended in October 2014, the S&P 500 traded within a large range between 2100 and 1900 for two years.

This range was broken in mid-2016 when the market spiked above the upper line of resistance. The reason for this breakout was the belief that Central Banks were preparing to engage in another round of monetary stimulus, combined with the potential for “helicopter” money or direct fiscal stimulus from governments.

Since that time, the two Central banks currently engaged in stimulus (the ECB and the BoJ) have both failed to increase their current programs. Not just that, but they’ve also both urged their respective Governments to begin fiscal stimulus.

This is a clear abdication of responsibility for the global economy. And it signals that Central Banks have realized that QE and NIRP cannot and will succeed in generating the desired inflationary goals (the ECB itself admitted it won’t hit its inflation targets this decade).

So this breakout is looking a lot like a false breakout now. Indeed, stocks have rolled over and are now moving back to test former resistance at 2,100.

Will this hold?

It better… because if that breakout is proven to be a false breakout, the result will be a VERY violent move downward.

We believe the markets may very well be on the verge of the next Crisis. Europe’s largest banks are fast approaching insolvency while stocks continue to price in economic perfection.

This whole scenario is feeling a lot like 2008.

If you’ve yet to take action to prepare for this, we offer a FREE investment report called the Financial Crisis “Round Two” Survival Guide that outlines simple, easy to follow strategies you can use to not only protect your portfolio from it, but actually produce profits.

We made 1,000 copies available for FREE the general public.

As we write this, there are less than 50 left.

To pick up yours, swing by….

http://phoenixcapitalmarketing.com/roundtwo.html

Best Regards

Phoenix Capital Research

Our FREE e-letter: www.gainspainscapital.com