The word for this week is “caution.”

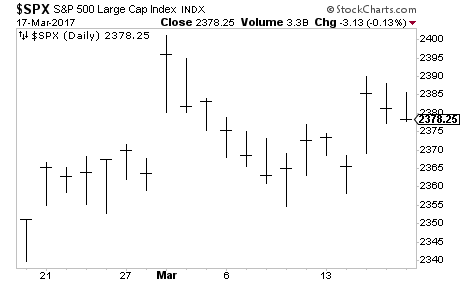

We’ve now had two inside days (days in which the high and low for the day were within the boundaries of the previous day’s high and low). This indicates traders are unwilling to commit to either long or short… and the market is preparing for a violent move.

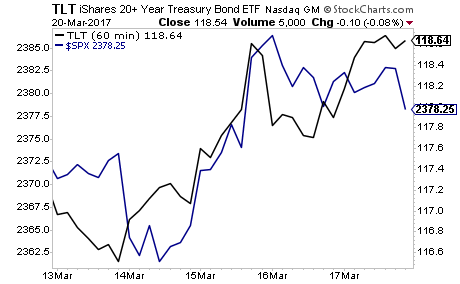

Meanwhile, a “flight to safety” is underway “behind the scenes” with investors pouring into bonds while moving out of stocks. The long bond ETF (TLT) rallied last week, while stocks ended the week rolling over.

This is NOT what you usually expect during options expiration week. And it would suggest that stocks are at risk of a sharp sell-off.

If you’re looking for active real time “buy” and “sell” alerts to help you make money from the markets I strongly urge you to take out a 98 cent trial to my Private Wealth Advisory newsletter.

Private Wealth Advisory is a weekly investment advisory that tells investors what stocks and ETFs to buy and sell… and when to do so.

Does it work?

A full 86% of our investments made money in the last 26 months. Yes, 86%, meaning we make money on more than 8 out of 10 closed positions.

Currently our portfolio is chock full of winners too, including gains of 10%, 12%, 15%, 25% even 33%.

Just yesterday we closed out two more winners of 8% and 9%.

Best of all, you can explore Private Wealth Advisory for 30 days for just $0.98.

To do so…

Graham Summers

Chief Market Strategist

Phoenix Capital Research