France holds the first round of its Presidential election this weekend.

The big worry for the markets is the fact that anti-Euro candidate Marin Le Pen could potentially win.

Now, the polls show Le Pen as having NO chance of becoming Prime Minister.

Of course, the polls also showed that BREXIT would not happen and Hillary Clinton had a 98% of becoming President.

We all know how those turned out.

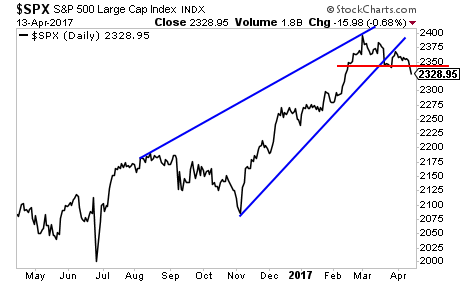

“So what?” one might ask, “why would a Le Pen victory matter? Both BREXIT and Trump’s Presidential election ignited massive stock market rallies… why wouldn’t France leaving the Euro do the same?”

One word…

Collateral.

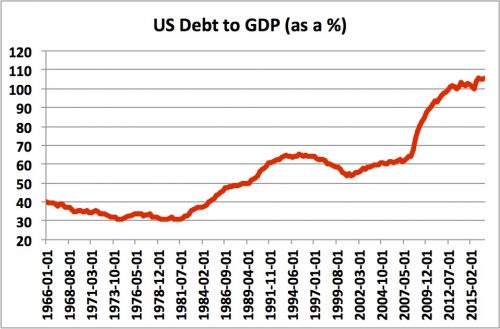

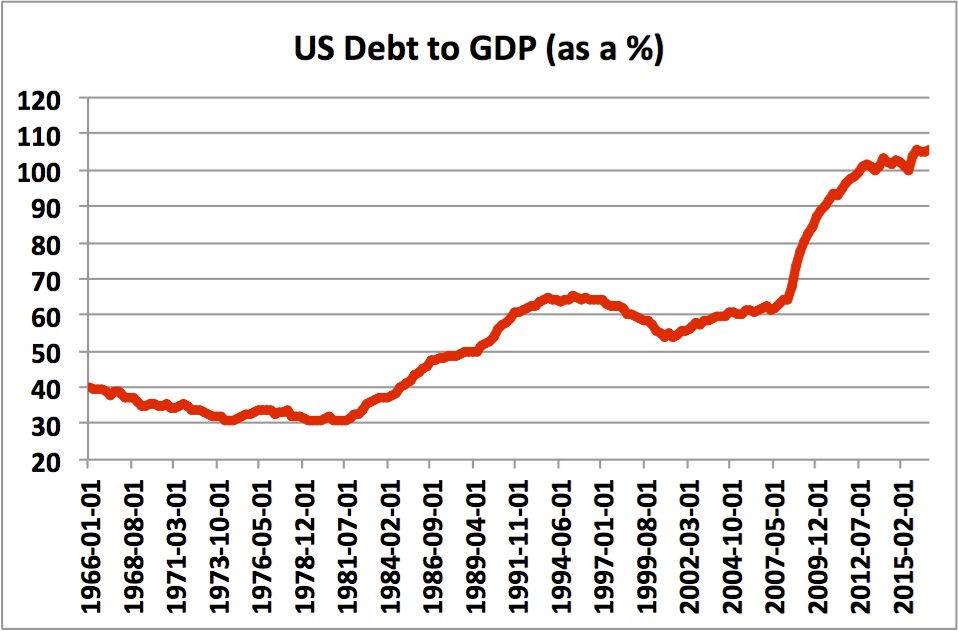

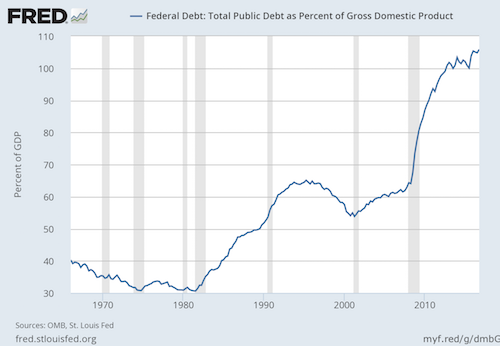

The big problem for EU members from is debt.

Yes, we all know that EU countries are saturated in debt… but the key issue here WHO owns this debt and WHAT it represents to them.

To citizens of a nation, sovereign debt represents payment of social entitlements in exchange for long-term debt servitude as a nation.

To politicians of a nation, sovereign debt represents a means of paying for welfare schemes promised on the campaign trail.

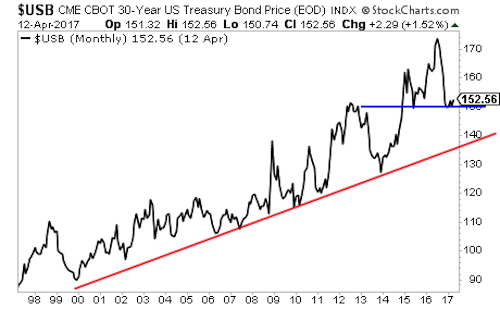

For banks… sovereign debt represents the senior-most collateral backstopping their massive derivatives portfolios.

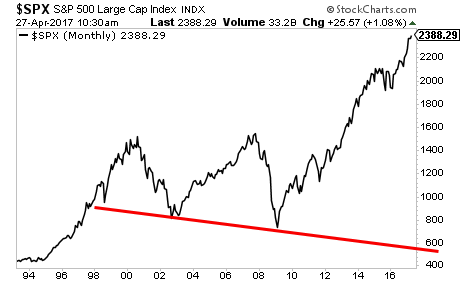

The derivatives markets, the same markets that triggered the 2008 meltdown, were never properly dealt with.

Today, at the time of this writing, there are over $700 TRILLION worth of derivatives in the financial system.

The bulk of this is owned/controlled by the large banks. And more than $500 TRILLION of this is related to interest rates or BOND YIELDS.

Why do banks own so many derivatives?

The Big Banks love derivatives because they represent a completely opaque asset class that can be priced/ traded/ etc. at whatever value the banks want.

Imagine being able to sell something of nebulous real value to anyone (corporates, other banks, pension funds, hedge funds and even countries buy derivatives from the big banks) at whatever value you want.

THAT’s what the derivatives markets represent to the big banks.

Now, of course, the banks all know the real deal here: that the derivatives they’re selling/ trading are in fact complete make believe of next to no real value.

Because of this, banks demand that other banks put up “collateral” to backstop these trades.

Collateral= an asset of actual, determinable value that would be posted if the derivative trade ever goes bad and a counter-party demands something of REAL value to cover the imploding value of the derivatives trade.

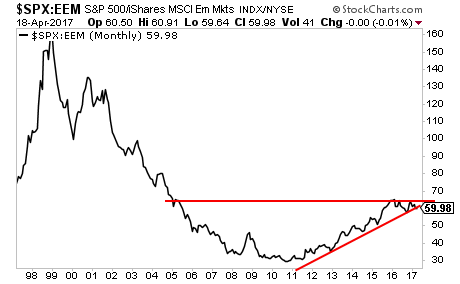

Sovereign bonds… as in the same bonds France issues… the same bonds that would be re-priced if France leaves the Euro… are some of the senior-most collateral backstopping these trades.

So… IF Le Pen wins… and IF she pushes for France to leave the Euro… and France subsequently has to revalue its bonds based on its new credit rating as a standalone country (not an EU member) we’re talking about over €2.2 TRILLION in sovereign debt needing to be re-priced.

Based on standard leverage for big banks’ derivatives portoflios, this debt is backstopping anywhere between €20 trillion and €50 trillion in derivatives trades (truthfully even €100 trillion isn’t out of the question).

In simple terms… France leaving the Euro represents another Lehman Brothers times 10.

THIS is why Le Pen potentially winning the French Presidential election is NOT another BREXIT or Trump situation… there is in fact real potential for a debt-driven derivatives bomb here.

Will Le Pen? We have no idea. But the stakes are VERY different here for the banks than BREXIT or Trump winning.

If you’re looking for a means to profit from this we’ve already alerted our Private Wealth Advisory subscribers to FIVE trades that will produce triple digit winners if France blows up the market.

And we’re just getting started.

If you need help doing this, I strongly urge you to try out our weekly market advisory, Private Wealth Advisory.

Private Wealth Advisory uses stocks and ETFs to help individual investors profit from the markets.

Does it work?

Over the last two years, we’ve maintained a success rate of 86%, meaning we’ve made money on more than EIGHT out of every ten trades we make.

Yes, this includes all losers and every trade we make. If you followed our investment recommendations, you’d have beaten the market by a MASSIVE margin.

However, if you’d like to join us, you better move fast…

… because tonight at midnight, we are closing the doors on our offer to try Private Wealth Advisory for 30 days for just $0.98.

This is it… no more extensions… no more openings.

To lock in one of the remaining slots…

Click Here Now!!!

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research