A tectonic shift is taking place in stocks.

And those who have taken notice will be making SERIOUS money from it.

Let me explain…

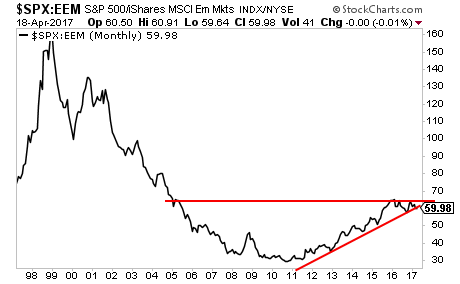

Below is a chart of the S&P 500 priced in Emerging Market Stocks.

When the black line falls Emerging Markets are outperforming US stocks. When the black line rises, US stocks are outperforming Emerging markets.

As you can see, from 1999 until roughly 2010, Emerging markets demolished stocks by a wide margin.

This trend then reversed in 2011, with the S&P 500 dramatically outperforming Emerging markets.

However, that trend now appears to be reversing. The chart has failed to break out to new highs and is now in danger of breaking its bull market trendline.

When this happens, we will once again be entering a period in which Emerging markets outperform US stocks.

We took note of this in our paid weekly investment advisory Private Wealth Advisory back in November.

Since that time we’ve already shown our subscribers EIGHT double digit winners from the Emerging Market space.

And we’re just getting started.

As the Emerging Market trend strengthens, we’ll be seeing truly MASSIVE returns (the last time this happened triple, even QUADRUPLE digit winners were possible).

If you need help doing this, I strongly urge you to try out our weekly market advisory, Private Wealth Advisory.

Private Wealth Advisory uses stocks and ETFs to help individual investors profit from the markets.

Does it work?

Over the last two years, we’ve maintained a success rate of 85%, meaning we’ve made money on more than EIGHT out of every ten trades we make.

Yes, this includes all losers and every trade we make. If you followed our investment recommendations, you’d have beaten the market by a MASSIVE margin.

However, if you’d like to join us, you better move fast…

… because tonight at midnight, we are closing the doors on our offer to try Private Wealth Advisory for 30 days for just $0.98.

This is it… no more extensions… no more openings.

To lock in one of the remaining slots…

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research