The Fed wants to start shrinking its balance sheet. That it may not start doing this right away or could reverse this at any time is irrelevant right now…

The IMPORTANT THING is the Fed BROADCASTING what it wants.

This is just like the 2013 QE taper: the Fed broadcast that it was coming for months before it started doing it.

The Fed’s current balance sheet reduction plan is the same thing.

What you or I think about this doesn’t matter: we’re not in charge of Fed policy.

The Fed has decided it’s time to drain liquidity. And it’s going to be doing it no matter what the data says. That the Fed is making a mistake or out of its mind is not our concern.

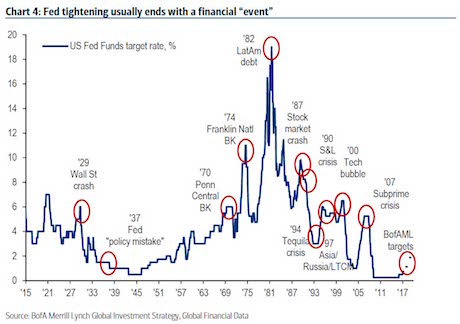

What WE need to be concerned with is the fact that ANYTIME the Fed embarks on this kind of tightening, it ALWAYS ends with a financial “event.”

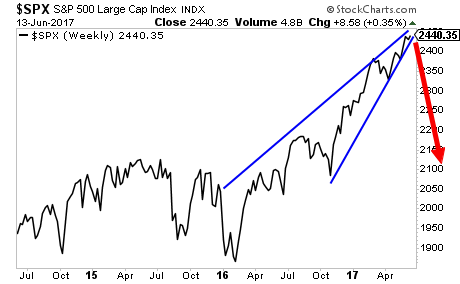

What would an “event” look like for today’s market?

The Fed just sent a clear signal. The time to start preparing is now.

And smart investors will use it to make literal fortunes from it.

We offer a FREE investment report outlining when the market will collapse as well as what investments will pay out massive returns to investors when this happens. It’s called Stock Market Crash Survival Guide.

We made 1,000 copies to the general public.

As I write this a mere 99 are left.

To pick up your FREE copy…

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research