Yesterday, the Fed made the single largest announcement of the last 10 years.

The media didn’t catch it. Nor did the markets.

The reason?

Everyone is so busy focusing on whether or not the Fed wants to hike rates, that they’re not looking for other items…

Other items…. such as the fact the Fed has decided it is going to pop the stock market bubble.

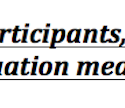

I know media doesn’t believe this. Heck, 99% of investors don’t believe it. After all, the Fed has spent eight years pushing stocks higher through liquidity injections and verbal interventions.

In this context, it’s all but impossible to imagine that the Fed wants stocks to fall.

But it does.

In fact, I’m taking the words straight from the Fed’s yesterday FOMC statement.

In the assessment of a few participants, equity prices were high when judged against standard valuation measures.

That is an incredible statement.

It tells us:

1) The Fed is openly discussing stocks prices.

2) The Fed is openly discussing whether stocks are in a bubble (when prices are high against standard valuations).

3) MORE THAN ONE Fed member believes that stocks ARE in a bubble.

Remember, this is THE FED we are talking about; not some fund manager or guru on TV. This is the entity in charge of assessing risks to the financial system. And SEVERAL members have determined stocks are such a risk.

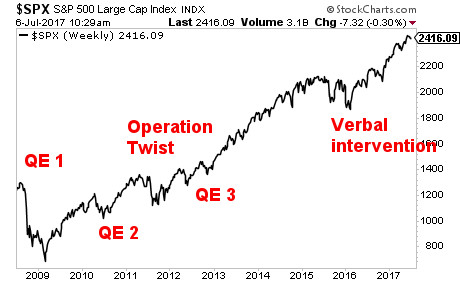

Just how big is the bubble that even THE FED is discussing it?

BIG. As in DWARFING the 2007 Bubble.

A Crisis is coming.

And smart investors will use it to make literal fortunes.

We offer a FREE investment report outlining when the market will collapse as well as what investments will pay out massive returns to investors when this happens. It’s called Stock Market Crash Survival Guide.

We made 1,000 copies to the general public.

As I write this, only 35 are left.

To pick up one of the last remaining copies…

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research