The market riggers are now pulling the pin.

All market rigs end badly. And given the fact that this one has been particularly egregious, the results will be quite ugly.

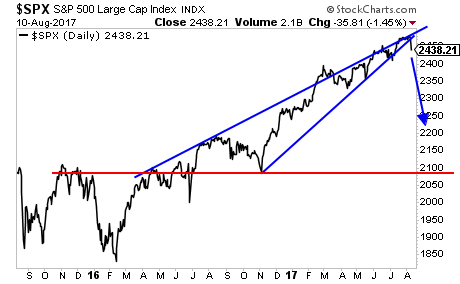

You cannot pin the S&P 500, perhaps the single most important stock index in the world, for weeks and expect it to end well. This is particularly true when you’re pinning it using Risk Parity Funds and their “buy/sell” algorithms.

Those same algorithms that have mindlessly bought stocks every time the VIX gets smashed, will mindlessly SELL stocks when the VIX explodes higher.

And the VIX will be exploding higher. Historically, the average level for the VIX since 1993 has been around 18-20. We’ve been stock at 9-10 for weeks now.

Not anymore. Today’s move could very well be the start of something big. The below chart predicts a move to 30 if not 40 in the coming weeks. If this was a chart for an individual stock, you’d say it was a screaming buy.

So what happens when the VIX spikes to 30-40 and the $500 billion worth of capital managed by Risk Parity Funds starts dumping stocks?

Buckle up, we’re about to fund out.

You’ve been warned.

On that note, we are already preparing our clients for this with a 21-page investment report titled the Stock Market Crash Survival Guide.

In it, we outline the coming collapse will unfold…which investments will perform best… and how to take out “crash” insurance trades that will pay out huge returns during a market collapse.

We’ve extended our offer to download this report FREE due to today’s market breakdown. But this is the last day this report will be available to the general public.

To pick up one of the last remaining copies…

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research