The Fed confirmed yesterday that stocks are in a bubble.

Lost amidst the usual Fed-speak about inflation and other items were the following nuggets.

1) “Equities” (read: stocks) were the primary reason the Fed discussed financial stability risks.

2) The Fed raised its assessment of financial stability from “notable” to “elevated.”

3) The Fed discussed “stock valuations.”

This is simply incredible. Remember, we’re talking about the Fed here… a group of people who go above and beyond to ignore risks in order to maintain the status quo.

Put another way, the stock market bubble is now so massive that even THE FED is talking about it. Indeed, the Fed is even openly states that the bubble might cause financial instability (read: a CRASH).

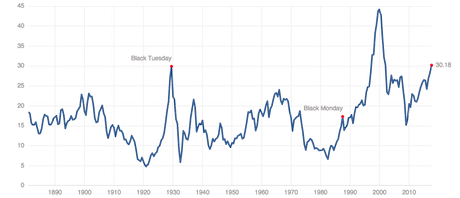

It’s not difficult to see what the Fed is talking about. Based on their cyclical adjusted price to earnings ratio (CAPE) stocks are in CLEAR bubble territory.

As you can see, stocks are currently as overpriced as they were at the 1929 peak. Indeed, the only time stocks were MORE expensive was the Tech Bubble: the single largest stock market bubble in history.

They say you don’t ring a bell at the top. But what the Fed did yesterday is DARN close.

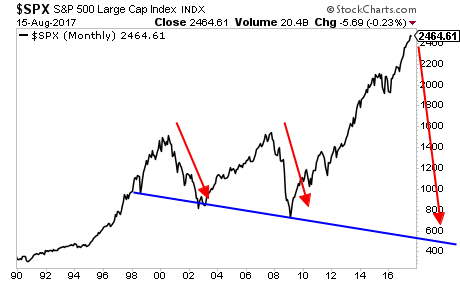

So what happens when the markets wake up to the fact that yet another massive bubble is beginning to burst?

You’ve been warned.

On that note, we are already preparing our clients for this with a 21-page investment report titled the Stock Market Crash Survival Guide.

In it, we outline the coming collapse will unfold…which investments will perform best… and how to take out “crash” insurance trades that will pay out huge returns during a market collapse.

We’ve extended our offer to download this report FREE due to today’s market breakdown. But this is the last day this report will be available to the general public.

To pick up one of the last remaining copies…

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research