The Fed claims we’re not in a bubble.

This, like the Fed’s claims inflation is too low, is hogwash.

As I outline in my bestselling book The Everything Bubble: The Endgame For Central Bank Policy, the reality is that the Fed’s entire monetary focus is on papering over declining living standards in the US.

Since 1971, real incomes are down. This fact stares us in the face: before that time, one parent worked and most families got by, today both parents work and rely on debt to get by. Indeed, the fact is that most Americans are worse off than they were 10 years ago, 20 years ago, even 40 years ago.

The Fed tries to mask this by making debt as cheap as possible, and then “inflating the debt away” by debasing the US Dollar.

That, in a nutshell, is the Fed’s entire game.

Asset bubbles are a natural consequence of this, as the Fed is forced to maintain “loose money” policies ad infinitum (the alternative is to risk triggering a sovereign debt crisis/ debt deflationary spiral).

This latest bubble is perhaps the most egregious.

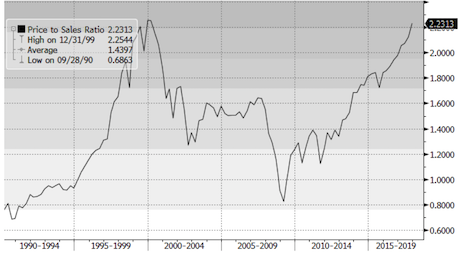

Talking heads like to talk about Price to Earnings (P/E) ratios, but earnings can be easily faked to make this multiple unrealistically low. Sales are much harder to fake: either the money comes in the door or it doesn’t.

With that in mind, consider that based on P/S, the market is right where it was at the peak of the 1999 Tech Bubble: arguably the most insane stock bubble of the last 100 years.

H/T Bill King

The big difference between this bubble and that of 1999 is that currently we are MUCH FARTHER down the monetary rabbit hall than we were during the late ’90s.

The Fed has already engaged in $3.5 trillion in QE. And it’s also employed Zero Interest Rate Policy (ZIRP) for seven years. And that is what lead to the current bubble.

So when this one bursts, the Fed will be forced to engage in even more extreme monetary policy. I’m talking about policies that will make ZIRP and $3T in QE look like child’s play.

It will take time for this to unfold, but as I recently told clients of my Private Wealth Advisory report, we’re currently in “late 2007” for the coming crisis.

The time to prepare for this is NOW before the carnage hits.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s to come when The Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here:

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research