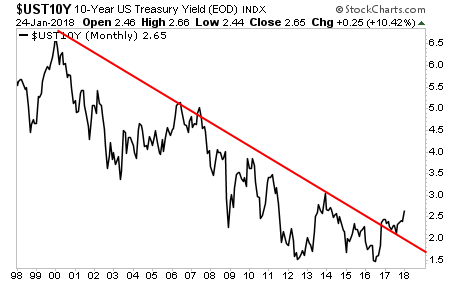

The single most important bond in the world is the US 10-Year Treasury bond.

According to modern financial theory, this bond, with a duration that is meant to cover a full economic cycle, is generally considered the “risk free” rate of the return for the entire financial system.

Corporate debt, mortgage rates, auto loans, even stock dividends are all perceived in terms of their value/risk relative to the yield on the 10-Year US Treasury bond.

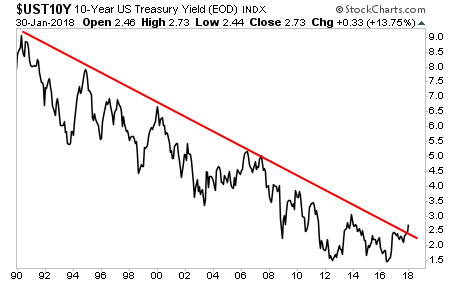

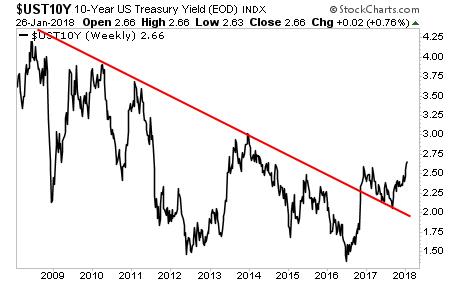

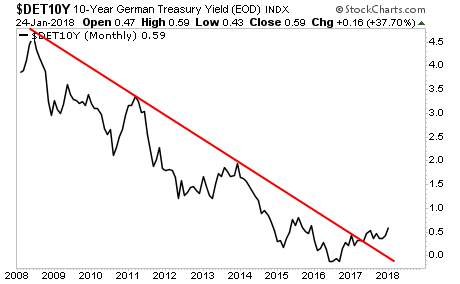

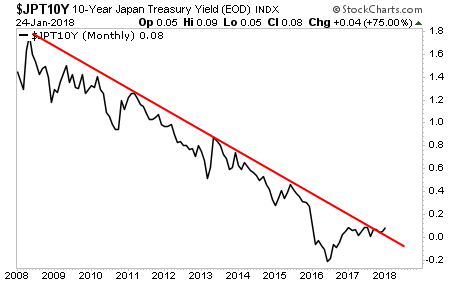

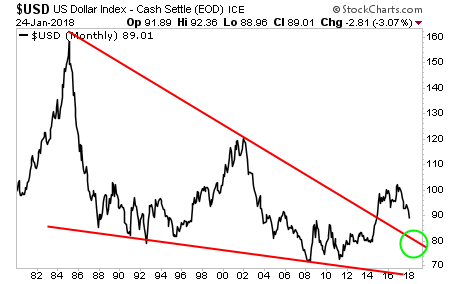

With that in mind, the yield on this bond has just broken above the trendline that has guided it lower for the last 25 years.

Put another way, for the first time in over 25 years, the bond market is at real risk of moving into a bear-market.

Why does this matter?

Bonds trade based on inflation.

If inflation rises, so do bond yields.

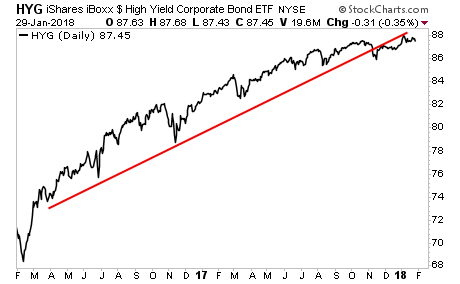

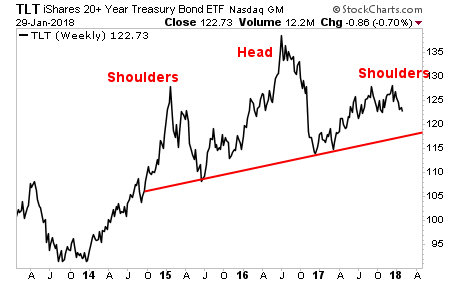

When bond yields RISE as they are right now, bond prices FALL.

And when bond prices FALL, the massive debt bubble begins to burst.

Globally the world has added over $60 trillion in debt since 2009… and all of this was based on the assumption that bond yields were going LOWER not HIGHER

All of this is at risk of blowing up as rates continue to rise. The time to prepare for this is NOW before things blow up.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s in terms of Fed Policy when The Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here:

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research