Sentiment is now completely disconnected from reality.

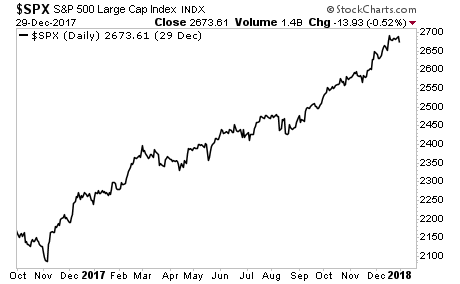

Currently, sentiment suggests that stocks are in a raging bull market and will never fall. This sentiment is based on the fact that much of last year (2017) the US stock markets rose virtually non-stop.

However, that era is now OVER. And globally the markets are moving into “risk-off” mode.

Don’t believe me?

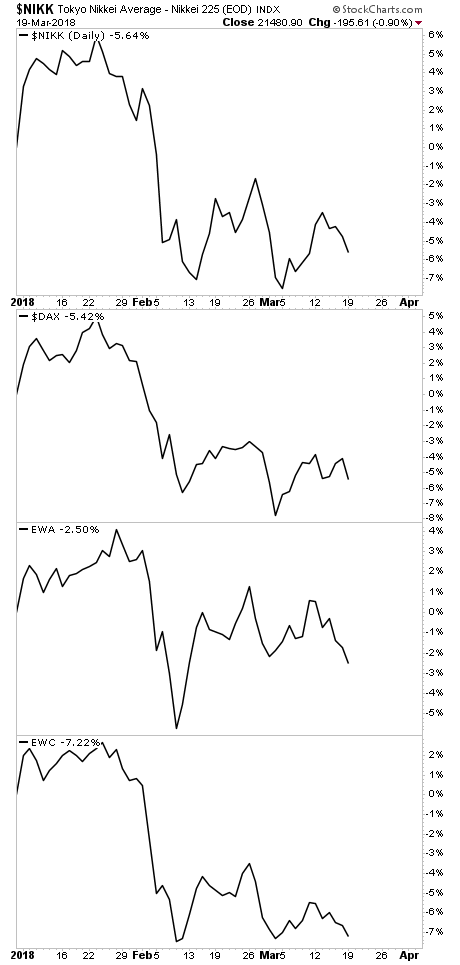

Consider that most global markets are in fact now DOWN for 2018.

That is not a typo.

Japan’s Nikkei, Germany’s DAX, Australia’s stock market, Canada’s stock market… ALL of them are in the red thus far in 2018.

The reason?

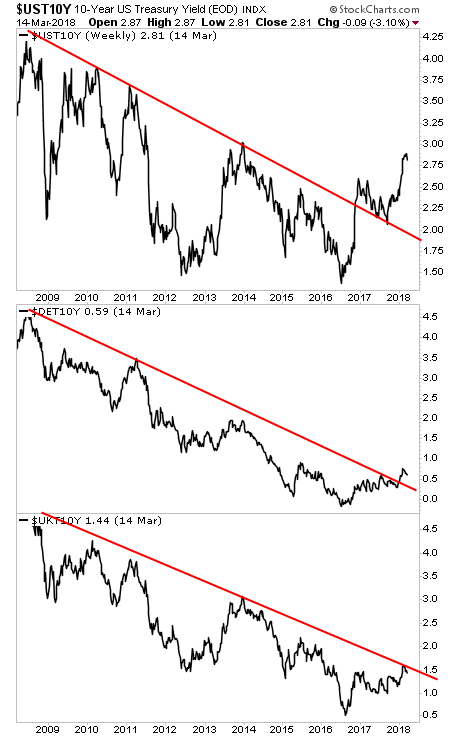

Globally the bond market is forcing ALL risk assets to be repriced.

As I’ve noted time and again, following 2008, Central Banks created a bubble in sovereign bonds. And because these bonds are the bedrock for the current financial system, when they did this they created a bubble in everything (what I call the “Everything Bubble”).

However, this bubble, is now beginning to burst. Bond yields are rising around the globe.

This is a MAJOR warning for stocks. Despite spending over $14 TRILLION trying to corner the bond markets, Central Banks are STILL beginning to lose control. The Everything Bubble is beginning to burst.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here:

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research