Dear Reader,

If you’re looking for answers as to why the US financial system is the way it is… or have questions about what’s coming down the pike in the financial markets, pick up a copy of our bestselling book The Everything Bubble: The End Game For Central Bank Policy on KINDLE today.

If you’ve yet to pick up a copy, grab one now. You’ll immediately know more about how the financial system works (as well as what’s come) than anyone else in your social circle.

If you’ve already bought a copy, PLEASE leave us a review on Amazon. It will help get the word out!

This book is a distillation of over a decade of work. It is divided into two sections (How We Got Here and What’s to Come).

How We Got Here outlines everything you need to know about how the US financial system was created, developed, and currently operates “behind the scenes.” Anyone who reads it will have a better understanding of these issues than 99% of the public.

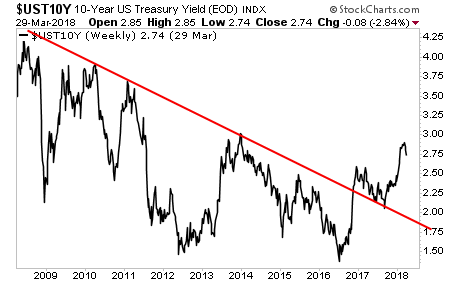

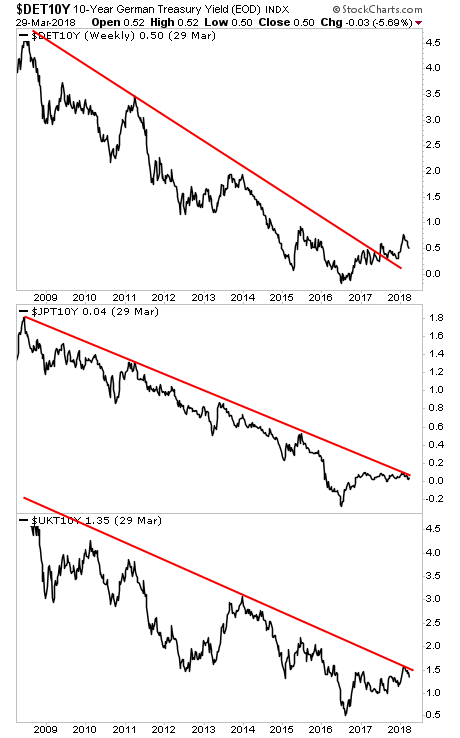

What’s to Come outlines what the next round of Federal Reserve policy will look like when The Everything Bubble (the bubble in sovereign bonds) bursts. It presents a road map for how the next crisis will play out as well as how the Fed will react to what’s coming.

Again, you can purchase the book by CLICKING HERE.

Thank you for your business. I hope you enjoy reading this book. I simply couldn’t be prouder of it.

Best Regards,

Graham Summers

Chief Market Strategist

Phoenix Capital Research