Let me let you in on a little secret…

Central Bankers don’t actually WANT inflation.

The Fed’s “inflation target of 2%” is a giant ruse. The Fed has no clue how to create or control inflation. They even admitted this in the minutes of the July 2017 FOMC meeting.

So if the Fed has no clue how to create or control inflation… why even bother with a target to begin with?

Because having a “target” gives the Fed some goal that it can claim to pursue, while it papers over declining living standards in the United States.

Put another way, the inflation is a distraction from the real scheme that has been playing out since the early ‘70s.

That scheme involves issuing endless amounts of debt and credit to cover up the fact that incomes are not rising in line with costs of living in the US.

We see this all the time (why are two parents required to work to makes end meet when one parent could cover an entire family back in 1970?) but because the erosion of “quality of life” is so gradual, no one ever flips out.

—————————————————————-

That Makes SEVEN Straight Double Digit Winners!

Our options trading system is on a HOT streak, having locked in SEVEN double digit winners in the last four weeks.

I’m talking gains of 14%, 16%, 20% and 22%… and we held each of them less than 10 days.

Best of all, this system couldn’t be easier: we only trade one trade, once per week… and we’re CRUSHING the market.

To join us today, take out a 60 day trial subscription.

If you’re not seeing SERIOUS returns within the first 60 days, we’ll issue a full refund, NO QUESTIONS ASKED.

To take out a trial subscription…

—————————————————————-

The problem with this scheme (issuing endless debt and credit) is that if it persists long enough… REAL inflation hits.

And that is a MASSIVE problem for the Fed.

Why?

Because bonds trade based on inflation. When inflation rises, bond yields rise to account for it.

When bond yields RISE, bond prices FALL.

When bond prices fall, the Bond Bubble bursts.

When the Bond Bubble bursts, the EVERYTHING bubble follows.

Which brings us to today…

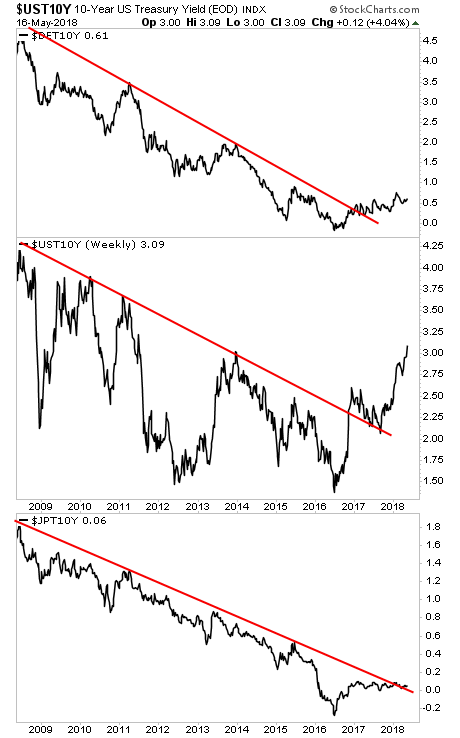

As I write this, the yields on Germany’s, the United States’, and Japan’s government bonds are ALL breaking out to the upside having broken multi-year trendlines.

This is a MASSIVE deal. It is telling us that it is getting harder and harder for these countries to service their debt loads.

Eventually this is going to trigger a debt crisis. And when it does, the crisis will be far larger than that of 2008.

It will take time for this to unfold, but as I recently told clients of my Private Wealth Advisory report, we’re currently in “late 2007” for the coming crisis.

The time to prepare for this is NOW before the carnage hits.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here:

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research