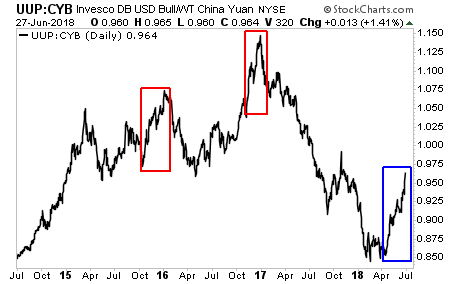

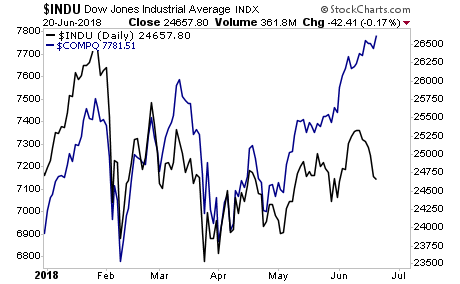

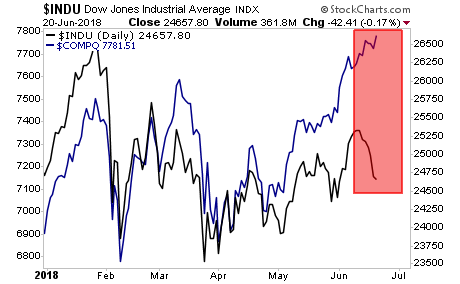

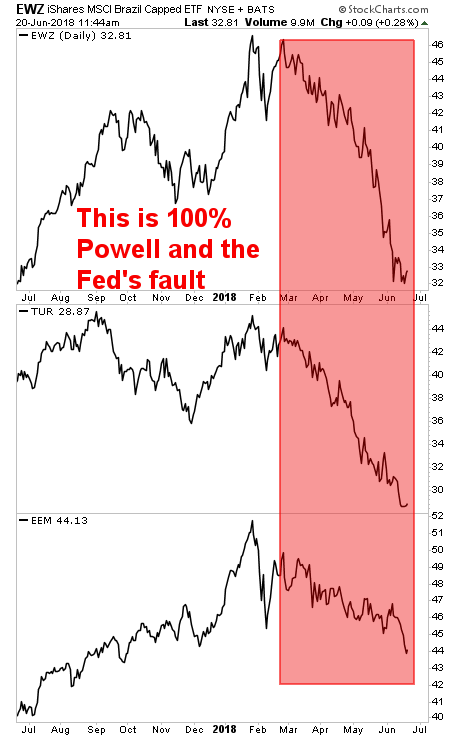

As we noted earlier this week, China, tired of the “back and forth” with the Trump administration on trade negotiations, has resorted to devaluing the Yuan.

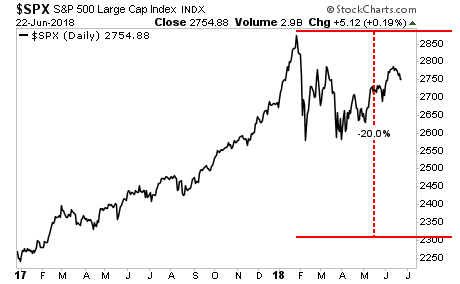

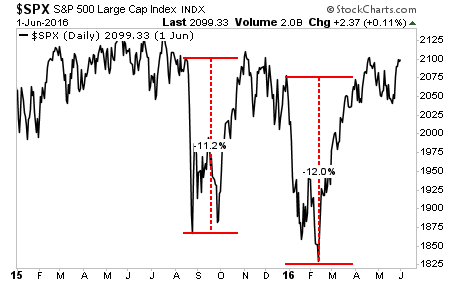

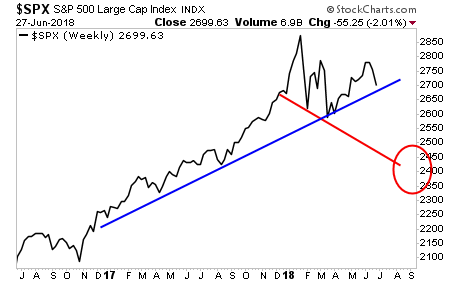

The goal here was to induce another sharp sell-off in stocks, similar to the ones induced by China’s August 2015 and January 2016 devaluations. By the way, those last two devaluations (red boxes) resulted in the S&P 500 dropping 11% and 12% in less than one week.

—————————————————————-

10 of Our Last 11 Trades Were Double Digit Winners

Our options trading system is on a HOT streak: 10 of our last 11 trades were double digit winners!

Don’t believe me?

You can see EVERY trade we’ve made this year HERE.

As a result we’re now up 35% this year alone… beating the S&P 500 by an astonishing 34%.

Best of all, this system couldn’t be easier: we only trade one trade, once per week… and we’re CRUSHING the market.

To join us today, take out a 60 day trial subscription.

If you’re not seeing SERIOUS returns within the first 60 days, we’ll issue a full refund, NO QUESTIONS ASKED.

To take out a trial subscription…

—————————————————————-

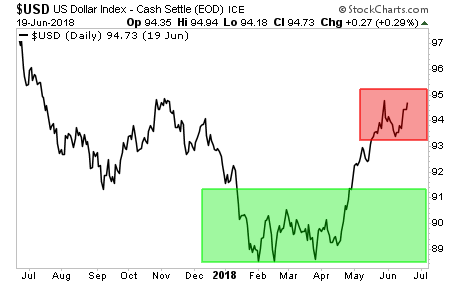

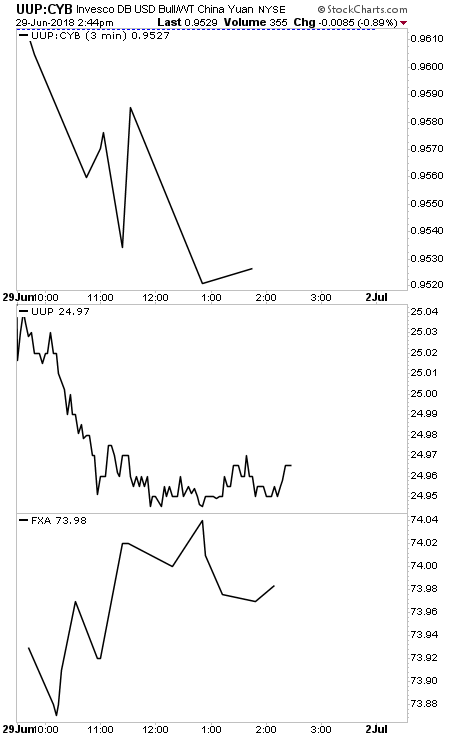

Fast forward to today and the $USD:Yuan pair is down SHARPLY. The $USD index is also sharply down. And the highly inflationary Australian Dollar is up sharply.

Of course, one day does not make a trend. But today is the best day for stocks, from a currency perspective, in several weeks.

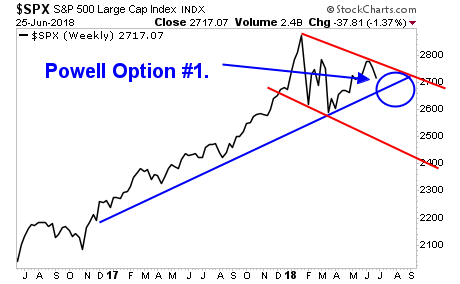

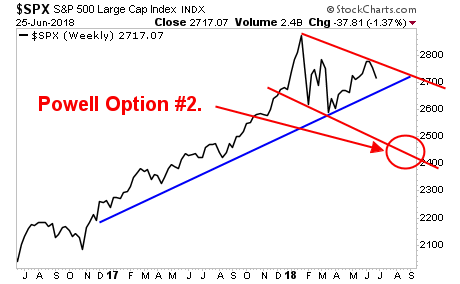

However, underneath this good news is some VERY bad news… the Fed’s QT program is still ongoing… in fact it will increase from $30 billion to $50 billion per month starting in July.

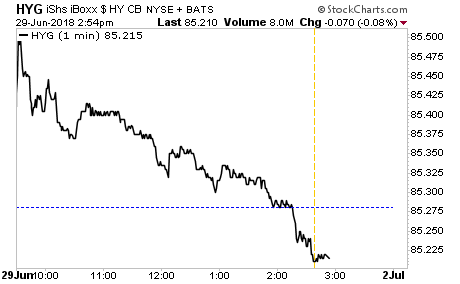

So while President Trump may have solved things with China… the Fed is still presenting the markets with a major problem. Indeed, if with the good news in currency land, various risk proxies such as High Yield Credit are DOWN for the day.

With that in mind, we stand by our current thesis that unless the Fed “pumps the brakes” on its QT programs and rate hike schedule, stocks are on VERY thing ice.

How thin?

Most Emerging Markets are already down 20% this year. If US stocks were to play “catch up” it would mean the S&P 500 at 2,300-2,400.

The time to prepare for this is NOW before the carnage hits.

On that note, we are already preparing our clients with a 21-page investment report that shows them FOUR investment strategies that will protect their capital when and if a stock market crash hits.

It’s called The Stock Market Crash Survival Guide… and it is available exclusively to our clients.

To pick up one of the 100 copies…use the link below.

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research