While there are no guarantees in the markets… sometimes you get a significant “tell” from related assets.

With that in mind, let’s take a look at some charts comparing various economic growth asset classes vs. the S&P 500.

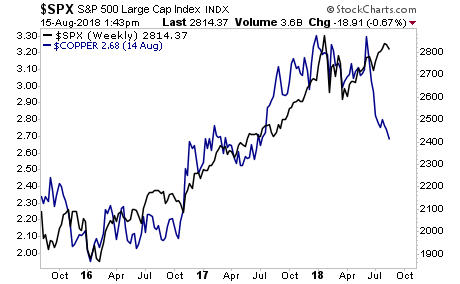

Take a look at Copper vs. the S&P 500:

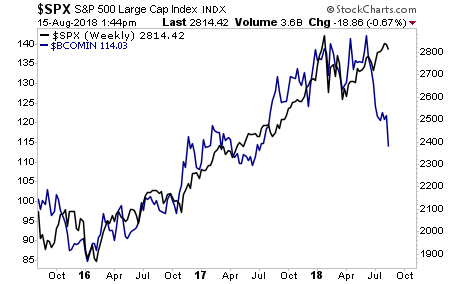

Here are industrial metals vs. the S&P 500.

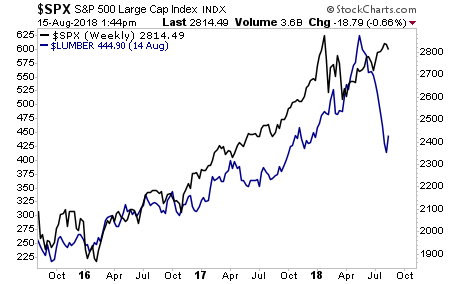

Here’s Lumber (another “growth” sensitive commodity) vs. the S&P 500.

Looking at these three charts, it would appear stocks are due for a “wake up call.” Food for thought on this Friday.

For more investment insights, join our FREE daily e-letter Gains Pains & Capital. You can sign up here:

https://phoenixcapitalmarketing.com/evergreen3reports.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research