This ratio is telling us something HUGE is coming.

This ratio is telling us something HUGE is coming.

The financial system just gave us a big “tell.”

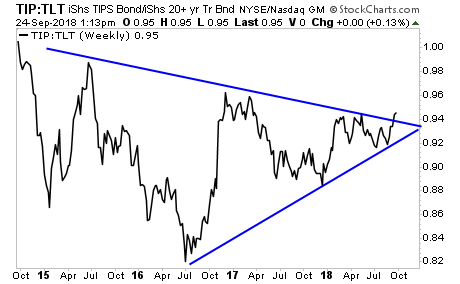

First and foremost, the US Dollar has taken out both its bull market trendline AND critical support.

The technical damage here is severe. We will get bounces, but the bull run is over. This is effectively the currency market saying “inflation is a coming.”

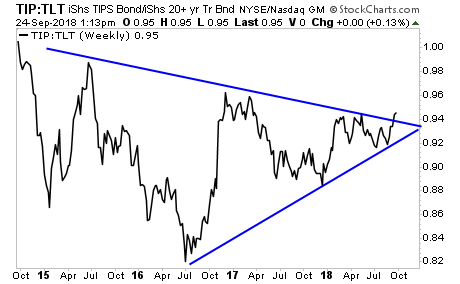

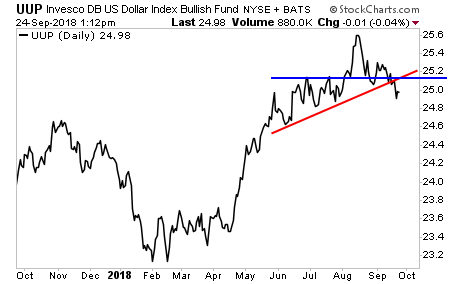

Secondly, the TIP: TLT (inflation/ deflation) ratio has broken out of a massive triangle pattern to the upside (in the INFLATION direction).

This is the bond market saying “inflation is coming.”

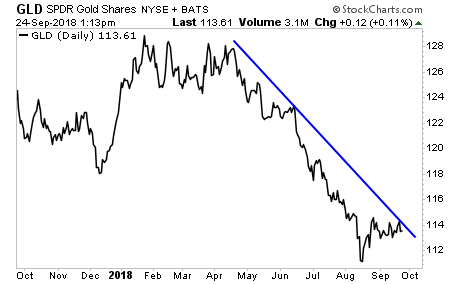

And finally, Gold is about to break its downward trendline.

The markets are speaking… but few are listening. But those who are know that inflation is coming are already establishing an investment plan that will benefit.

On that note we offer a Special Investment Report concerning FIVE investments you can use to make inflation pay you as it rips through the financial system in the months ahead.

The report is titled Survive the Inflationary Storm

We made 100 copies available to the public.

Currently there are just 67 left.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/inflationstorm.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

Our piece on the sovereign bond bubble, which I call “the Everything Bubble,” received a lot of attention last week.

With that in mind, today we’re delving deeper into the issue of rising bond yields.

A large part of the move in stocks from 2008-2016 was based on the fact that bond yields were so low. By cornering the bond market, the Fed made bonds much less attractive to investors… which in turn drove investors to seek out riskier assets (like stocks) to boost returns.

This was called the “TINA” trade as in “There Is No Alternative.”

That trend is now over. The yield on the two-year Treasury is now 2.81%. The current dividend on the S&P 500 is 1.78%. Put another way, you could make more money, with less risk and volatility in Treasuries than stocks.

What does this mean?

Stocks just lost a LOT of appeal as far as yield hungry investors are concerned.

And that’s the GOOD news. The BAD news is that it’s looking more and more as if the bond bubble is bursting.

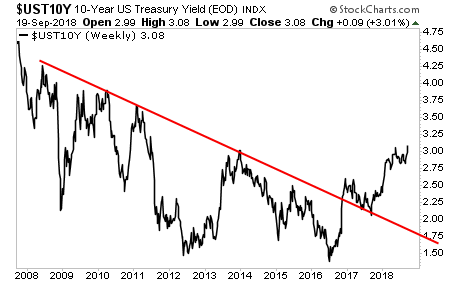

Around the globe, bond yields are now rising, having broken decade long downtrends.

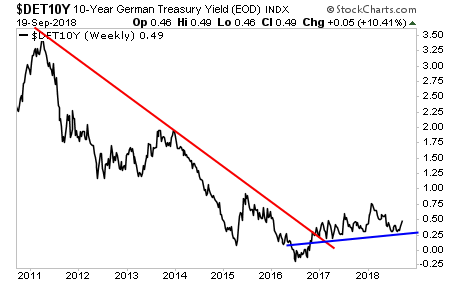

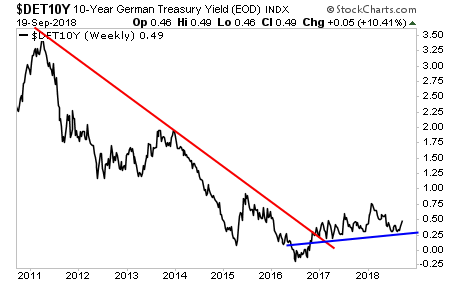

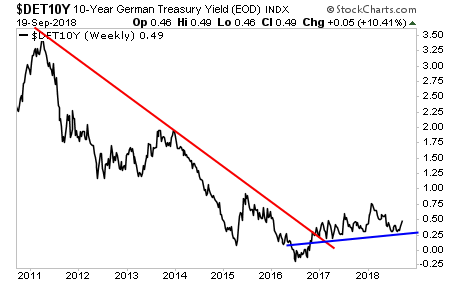

Germany’s 10-Year Government Bond Yields:

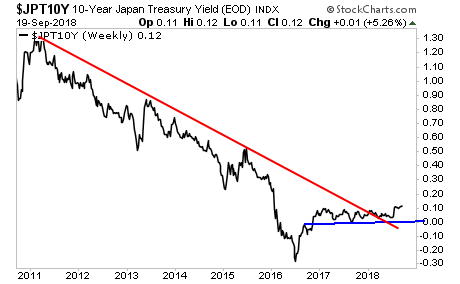

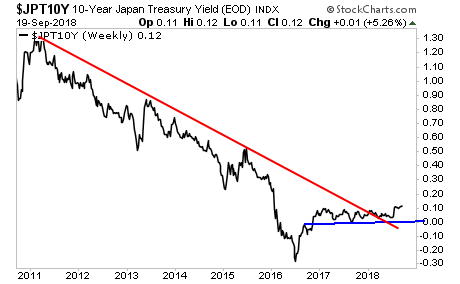

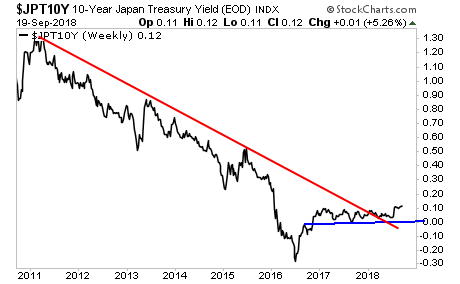

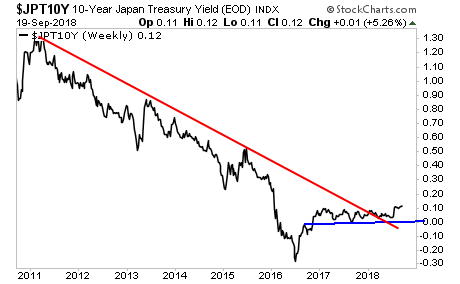

Japan’s 10-Year Government Bond Yields:

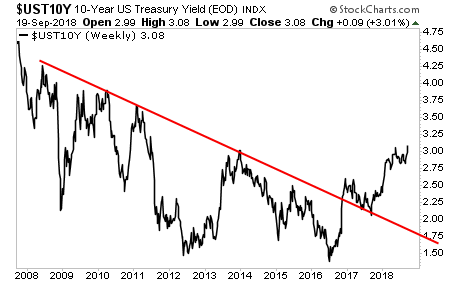

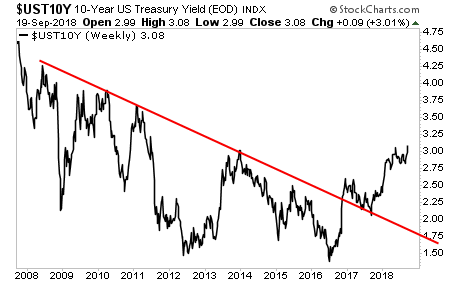

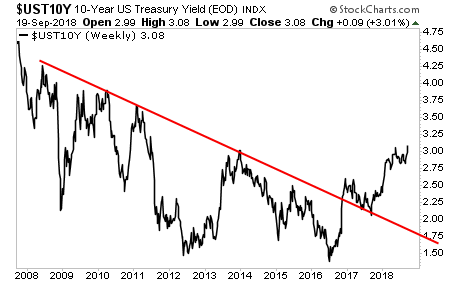

And worst of all, the US’s 10-Year Government Bond Yields:

Why does this matter?

When bond yields rise, bond prices FALL.

If bond prices fall far enough, the bond bubble begins to burst.

Let’s be clear here… if the stock market drops, it’s a problem for stock speculators… but if the bond market blows up, ENTIRE countries go bust.

All of the above charts are a MAJOR warning that the next crisis is fast approaching.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here.

Do NOT delay… there are fewer than 9 slots remaining.

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

Our piece on the sovereign bond bubble, which I call “the Everything Bubble,” received a lot of attention last week.

With that in mind, today we’re delving deeper into the issue of rising bond yields.

A large part of the move in stocks from 2008-2016 was based on the fact that bond yields were so low. By cornering the bond market, the Fed made bonds much less attractive to investors… which in turn drove investors to seek out riskier assets (like stocks) to boost returns.

This was called the “TINA” trade as in “There Is No Alternative.”

That trend is now over. The yield on the two-year Treasury is now 2.81%. The current dividend on the S&P 500 is 1.78%. Put another way, you could make more money, with less risk and volatility in Treasuries than stocks.

What does this mean?

Stocks just lost a LOT of appeal as far as yield hungry investors are concerned.

And that’s the GOOD news. The BAD news is that it’s looking more and more as if the bond bubble is bursting.

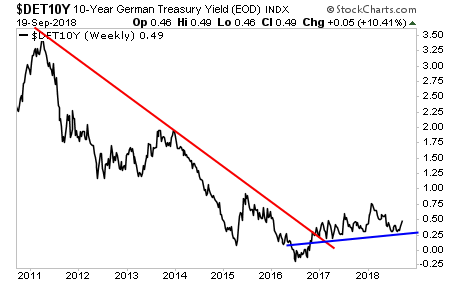

Around the globe, bond yields are now rising, having broken decade long downtrends.

Germany’s 10-Year Government Bond Yields:

Japan’s 10-Year Government Bond Yields:

And worst of all, the US’s 10-Year Government Bond Yields:

Why does this matter?

When bond yields rise, bond prices FALL.

If bond prices fall far enough, the bond bubble begins to burst.

Let’s be clear here… if the stock market drops, it’s a problem for stock speculators… but if the bond market blows up, ENTIRE countries go bust.

All of the above charts are a MAJOR warning that the next crisis is fast approaching.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here.

Do NOT delay… there are fewer than 9 slots remaining.

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

Our piece on the sovereign bond bubble, which I call “the Everything Bubble,” received a lot of attention last week.

With that in mind, today we’re delving deeper into the issue of rising bond yields.

A large part of the move in stocks from 2008-2016 was based on the fact that bond yields were so low. By cornering the bond market, the Fed made bonds much less attractive to investors… which in turn drove investors to seek out riskier assets (like stocks) to boost returns.

This was called the “TINA” trade as in “There Is No Alternative.”

That trend is now over. The yield on the two-year Treasury is now 2.81%. The current dividend on the S&P 500 is 1.78%. Put another way, you could make more money, with less risk and volatility in Treasuries than stocks.

What does this mean?

Stocks just lost a LOT of appeal as far as yield hungry investors are concerned.

And that’s the GOOD news. The BAD news is that it’s looking more and more as if the bond bubble is bursting.

Around the globe, bond yields are now rising, having broken decade long downtrends.

Germany’s 10-Year Government Bond Yields:

Japan’s 10-Year Government Bond Yields:

And worst of all, the US’s 10-Year Government Bond Yields:

Why does this matter?

When bond yields rise, bond prices FALL.

If bond prices fall far enough, the bond bubble begins to burst.

Let’s be clear here… if the stock market drops, it’s a problem for stock speculators… but if the bond market blows up, ENTIRE countries go bust.

All of the above charts are a MAJOR warning that the next crisis is fast approaching.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here.

Do NOT delay… there are fewer than 9 slots remaining.

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

Our piece on the sovereign bond bubble, which I call “the Everything Bubble,” received a lot of attention last week.

With that in mind, today we’re delving deeper into the issue of rising bond yields.

A large part of the move in stocks from 2008-2016 was based on the fact that bond yields were so low. By cornering the bond market, the Fed made bonds much less attractive to investors… which in turn drove investors to seek out riskier assets (like stocks) to boost returns.

This was called the “TINA” trade as in “There Is No Alternative.”

That trend is now over. The yield on the two-year Treasury is now 2.81%. The current dividend on the S&P 500 is 1.78%. Put another way, you could make more money, with less risk and volatility in Treasuries than stocks.

What does this mean?

Stocks just lost a LOT of appeal as far as yield hungry investors are concerned.

And that’s the GOOD news. The BAD news is that it’s looking more and more as if the bond bubble is bursting.

Around the globe, bond yields are now rising, having broken decade long downtrends.

Germany’s 10-Year Government Bond Yields:

Japan’s 10-Year Government Bond Yields:

And worst of all, the US’s 10-Year Government Bond Yields:

Why does this matter?

When bond yields rise, bond prices FALL.

If bond prices fall far enough, the bond bubble begins to burst.

Let’s be clear here… if the stock market drops, it’s a problem for stock speculators… but if the bond market blows up, ENTIRE countries go bust.

All of the above charts are a MAJOR warning that the next crisis is fast approaching.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here.

Do NOT delay… there are fewer than 9 slots remaining.

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research