The EU debt bomb is about ready to go off.

If you wanted to find a place in which Central Banking monetary insanity will result in an epic systemic blow up, Europe is the best place to start. True, Japan is further down the monetary insanity rabbit hole… but Japan is a single country with a single central bank that controls a single currency.

Europe, on the other hand, is an amalgamation of 24 countries, all in various stages of insolvency, and none of which have a Central Bank that can print the Euro (only the European Central Bank can do this).

Which is why, when you consider the absolute insanity of Europe’s debt bubble, you begin to see why this will likely prove ground zero for the next major crisis.

Consider the following…

The yield on Italy’s 2-Year Government Bond is 1.31%.

The yield on the 2-Year US Treasury is currently 2.82%.

Put another way, based on the ridiculous policies of the European Central Bank (ECB)’s QE program, the US’s debt is being priced as more than TWICE as risky as Italy’s…

————————————————-

Who said getting rich from trading was hard?

Since inception in 2015, this trading system has produced average annual gains of 41%.

And it’s doing this with just one trade once per week. In fact we just closed a 15% gain last week. And we only held it 24 hours!

We are closing the doors on this system to new clients on Friday this week.

To lock in one of the last slots…

————————————————-

The US is the largest most dynamic economy in the world… which is currently growing at 4.2%. It has the largest most powerful military and controls the reserve currency of the world.

Italy’s economy, on the other hand, is roughly the size of the economies of New York and Virginia combined…is growing at 0.2%… has a debt to GDP of 131%… and has to rely on the ECB for access to Euros.

Which of these two countries would be a safer country to lend money?

Which is why the markets are beginning to sense that Italy is in trouble.

The yield on Italy’s 10-Year Bond has broken its downtrend and is now rising rapidly.

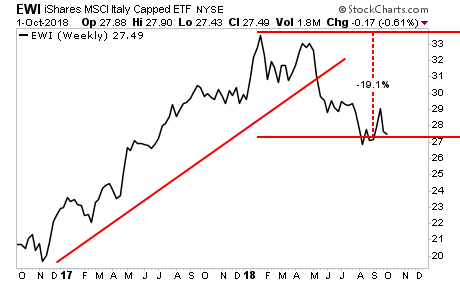

While Italian stocks are about to enter a bear market.

Again, this is a MASSIVE deal. And while 99% of investors are focusing on US stocks hitting new highs… a €2.47 TRILLION debt bomb is getting ready to go off across the pond.

The whole situation is getting eerily similar to late 2007. And now, like then, the vast majority of investors have no clue how to invest during the coming crisis . Which is why smart investors who put capital to work here stand to make LITERAL fortunes.

We offer a FREE investment report outlining when the bubble will burst as well as what investments will pay out massive returns to investors when this happens. It’s called The Biggest Bubble of All Time (and three investment strategies to profit from it).

We made 100 copies to the general public.

As I write this there are only a handful left.

To pick up your FREE copy…

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research