Last week’s breakdown caused considerable technical damage to the bull market in stocks. We are now at the proverbial “line in the sand” at which stocks MUST bounce or the bull market is OVER.

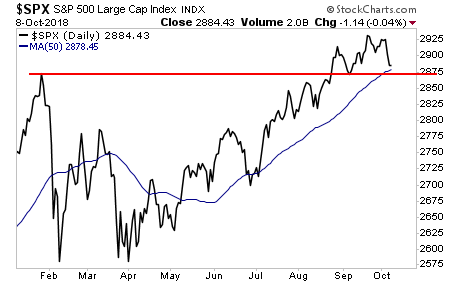

The S&P 500 has both its 50-Day Moving Average (DMA) and critical support from the January 2018 top just below current levels.

This is a MAJOR confluence of support here. If the S&P 500 CANNOT hold this level, then it’s GAME OVER for the bull market in stocks.

————————————————-

Who said getting rich from trading was hard?

Since inception in 2015, this trading system has produced average annual gains of 41%.

And it’s doing this with just one trade once per week. In fact we just closed a 15% gain last week. And we only held it 24 hours!

We are closing the doors on this system to new clients on Friday this week.

To lock in one of the last slots…

————————————————-

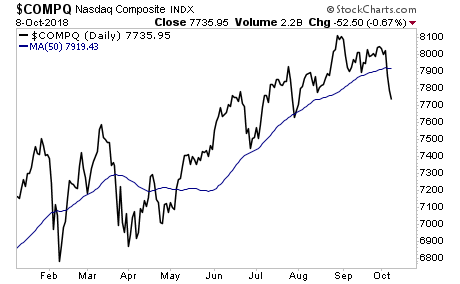

Unfortunately it’s not looking good. The NASDAQ, which has lead the broader market during the rally, has already collapsed well below its comparable levels.

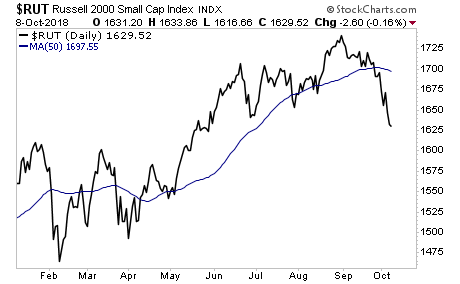

The picture is even worse for the microcap index, the Russell 2000.

Did the next crisis just start? We are about to find out!

If you are not already taking steps to prepare for this, we offer a FREE investment report outlining when the bubble will burst as well as what investments will pay out massive returns to investors when this happens. It’s called The Biggest Bubble of All Time (and three investment strategies to profit from it).

We made 100 copies to the general public.

As I write this there are only a handful left.

To pick up your FREE copy…

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research