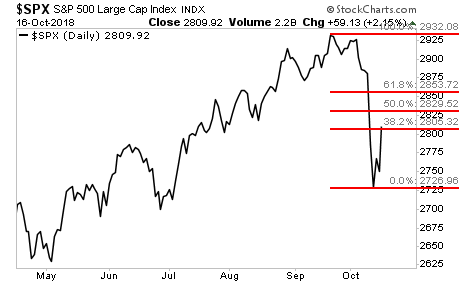

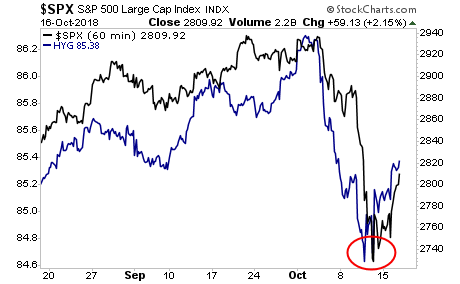

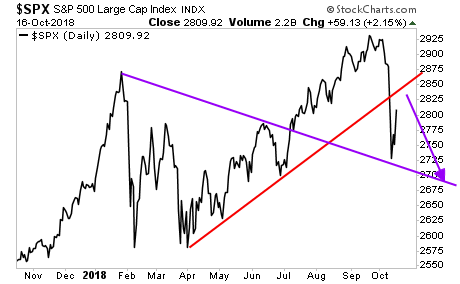

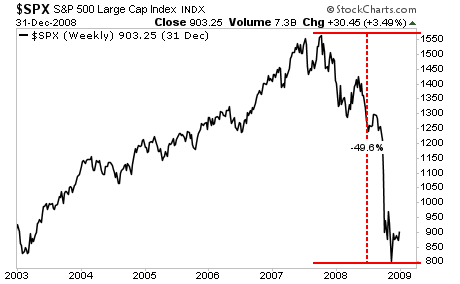

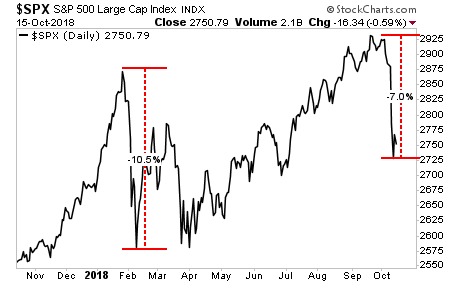

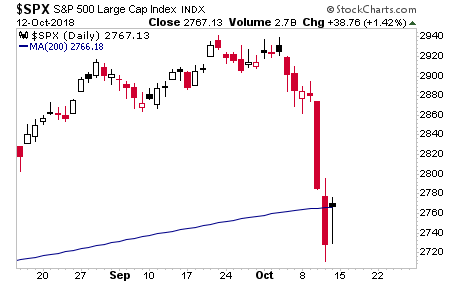

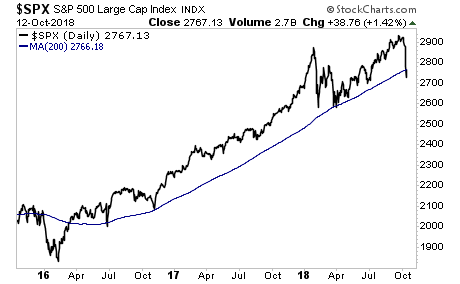

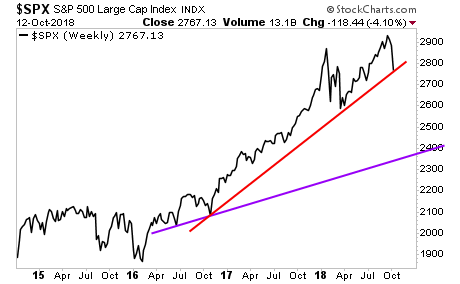

It is looking increasingly likely that the bull market is OVER.

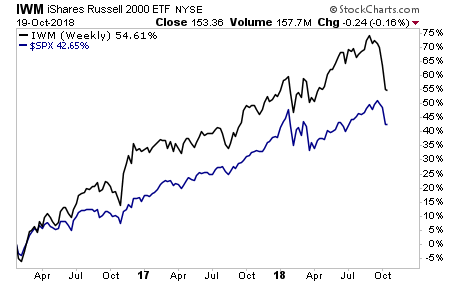

The Russell 2000 (IWM) has lead the S&P 500 throughout the bull market begun January 2016. Over that time period, the Russell 2000 rose 54% compared to the S&P 500’s performance of 42%.

————————————————-

Who said getting rich from trading was hard?

Since inception in 2015, this trading system has produced average annual gains of 41%.

And it’s doing this with just one trade once per week. In fact we just closed a 15% gain last week. And we only held it 24 hours!

We are closing the doors on this system to new clients on Friday this week.

To lock in one of the last slots…

————————————————-

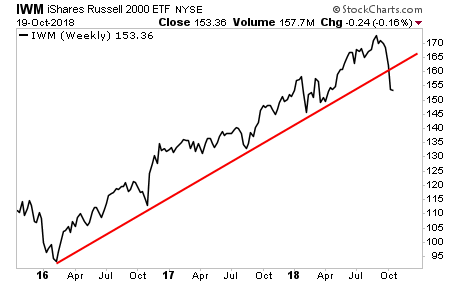

This is of major importance because the Russell 2000 actually peaked back in July and has since broken its bull market trendline.

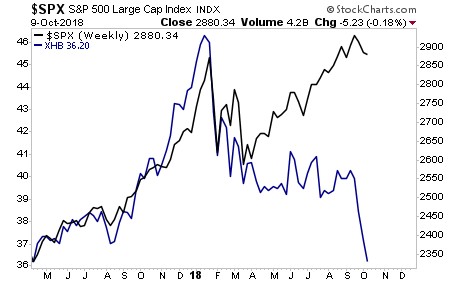

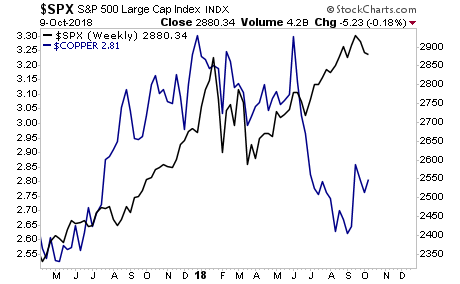

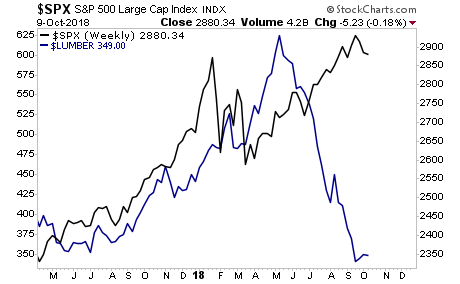

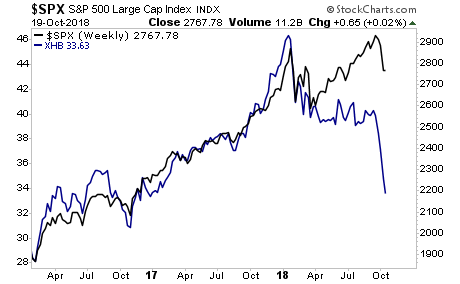

You can add this to the string of MAJOR warnings we’re getting about stocks. If you think the market is healthy, take a look at the homebuilder ETF (XHB) relative to the S&P 500.

So you’ve got the “growth index” (the Russell 2000) ending its bull market… while economically-sensitive sectors like homebuilders are in full-scale Meltdown Mode.

The message here is clear: BUCKLE UP.

On that note, we offer a FREE investment report outlining when the bubble will burst as well as what investments will pay out massive returns to investors when this happens. It’s called The Biggest Bubble of All Time (and three investment strategies to profit from it).

We made 100 copies to the general public.

As I write this there are only a handful left.

To pick up your FREE copy…

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research