As I keep warning, the Fed is going to hike rates until something breaks.

And by “something,” I don’t meant a garden variety correction in the markets; the Fed has made it EXPLICIT that it would only consider slowing the pace of rate hikes if the markets entered a meltdown so massive that it actually impacted consumer spending.

If you don’t believe me, consider yesterday’s Fed FOMC announcement. Following the worst month for stocks since 2008… a month in which some 89% of global assets went red of the year… the Fed didn’t even blink.

Yesterday, the Fed:

1) Hiked rates again.

2) Reiterated that it will hike rates THREE more times in 2019 (rather than reducing the intended number to two or even one).

3) Made it clear that it will hike until it sees a negative impact on the REAL economy (the labor market or consumer spending).

Put simply, yesterday the Fed broadcast to stocks “you’re on your own.”

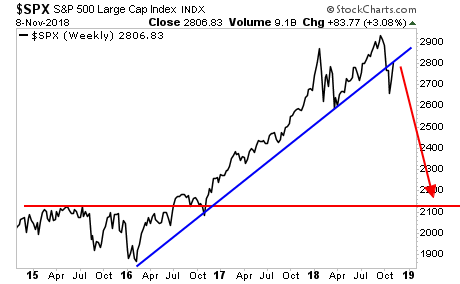

I routinely say that stocks are the last asset class to “get it.” Well they “got it” yesterday, slamming into former support. The stage is not set for a bloodbath as stocks meltdown to 2,100.

If you want a template for where we are right now, it’s “late 2007″… which means 2019 will be when the next crisis hits.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here.

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research