“How will we know when the Everything Bubble has burst?”

I had just finished a presentation on The Everything Bubble at an investment conference in Montreal when this question was asked.

My answer?

“You need to watch the junior debt markets. The tertiary bubbles in passive investing/ shorting volatility have already blow up. The issue now is whether this begins to spread to junior debt instruments like corporate debt. If that happens then yes, it’s time to start talking about a full-scale crisis”

We are now at that stage. The corporate debt market is putting it its worst year since… 2008.

Credit Markets Are Bracing for Something Bad

Cracks in corporate debt lead market commentary.

…the Bloomberg Barclays U.S. Corporate Bond Index losing more than 3.5 percent and on track for its worst year since 2008.

Source: Bloomberg.

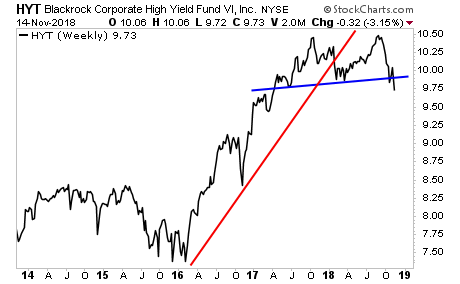

Indeed, not only has the junk bond market broken its bull market trendline (red line) but it’s taken out CRITICAL support (blue line) as well.

This tells us that the crisis is picking up steam. We are now in the “early 2008” stage for the next crisis.We all remember what comes next

If you are not already preparing for this, NOW is the time to do so.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here.

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research