Stock markets are rallying today on the belief that somehow the US and China will sign a trade deal at the upcoming G-20 meeting.

Investors are buying this narrative despite the facts that…

1) The Trump administration has already admitted that a deal is highly UN-likely.

2) The Trump administration has also admitted that the next round of tariffs (25%) will hit in January (meaning no deal by then).

3) The US and China have yet to reach ANY kind of remote agreement on anything. Indeed, they don’t even appear to be openly negotiating at the moment.

4) Large-scale trade deals that resolve decades-old structural issues between the two largest economies in the world do NOT get resolved by a 1-on-1 face to face meeting that lasts a few hours.

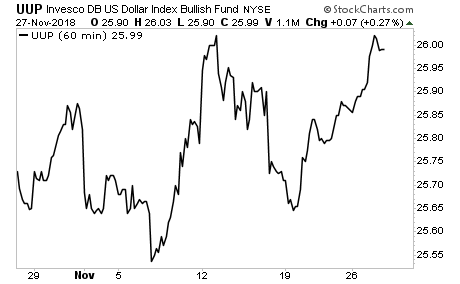

If you think I’m being overly negative, take a look at the currency markets.

The currency markets are the largest, most liquid markets in the world. Collectively they trade $5-$6 trillion PER DAY. As such, these markets are the first to note macro shifts.

With that in mind, the $USD has erased the initial drop that occurred when President Trump first started talking about a trade deal. The $USD is now re-challenging the recent highs.

Put another way, the currency markets are “buying” the notion of a trade deal one bit.

Let me ask you, who’s got a better grip on what’s happening in the world… the mainstream media or the currency markets?

Better yet, which would you rather base an investment decision on… the largest, most liquid markets in the world… or the mainstream media?

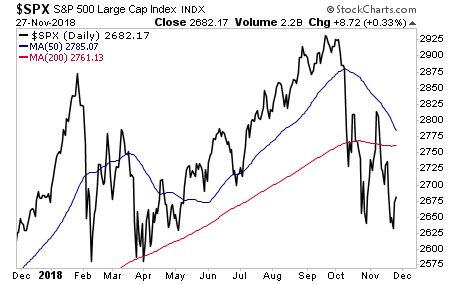

Also… if stocks really believed a trade deal was coming… wouldn’t they have at least reclaimed their 200-DMA?

The next leg down hits soon. And when it does, we’re going to new lows.

If you are not already preparing for this, NOW is the time to do so.

On that note we just published a 21-page investment report titled Stock Market Crash Survival Guide.

In it, we outline precisely how the crash will unfold as well as which investments will perform best during a stock market crash.

Today is the last day this report will be available to the public. We extended the deadline based on yesterday’s sucker rally, but this it IT… no more extensions.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research