In December, Jerome Powell confirmed that he is going to implement a financial reset.

That reset will crash stocks.

We know this because the Fed didn’t even HINT at tapering its Quantitative Tightening program at this latest Fed FOMC despite stocks staging the worst December since the Great Depression.

This tells us that the Powell Fed is going to normalize the Fed’s balance sheet no matter what. And THAT is the real issue for the financial markets (the withdrawal of liquidity) NOT rate hikes/cuts.

This is what the market is reacting to. Stocks now know that the era of easy money is over. The Fed is being run by a man who doesn’t see it has his job to create/sustain asset bubbles.

And that is why The Fed Has Confirmed It Will Crash Stocks

In December, Jerome Powell confirmed that he is going to implement a financial reset.

That reset will crash stocks.

We know this because the Fed didn’t even HINT at tapering its Quantitative Tightening program at this latest Fed FOMC despite stocks staging the worst December since the Great Depression.

This tells us that the Powell Fed is going to normalize the Fed’s balance sheet no matter what. And THAT is the real issue for the financial markets (the withdrawal of liquidity) NOT rate hikes/cuts.

This is what the market is reacting to. Stocks now know that the era of easy money is over. The Fed is being run by a man who doesn’t see it has his job to create/sustain asset bubbles.

And that is why we are going to crash.

Think of it this way, the era from 2008-2018 was a time in which stocks got bubbly, disconnecting from economic realities. Once Jerome Powell took the helm at the Fed, the markets slowly began to realize that this era is OVER. As a result, we’ve seen numerous asset classes begin to crash as their respective bubbles burst and they drop to price levels that are fundamentally sound.

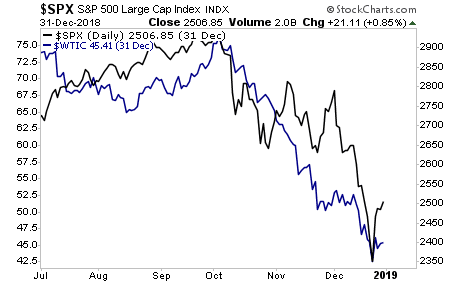

Stocks are now going to play catch up. Oil has already broadcast that this stock market bounce won’t last.we are going to crash.

Think of it this way, the era from 2008-2018 was a time in which stocks got bubbly, disconnecting from economic realities. Once Jerome Powell took the helm at the Fed, the markets slowly began to realize that this era is OVER. As a result, we’ve seen numerous asset classes begin to crash as their respective bubbles burst and they drop to price levels that are fundamentally sound.

Stocks are now going to play catch up. Oil has already broadcast that this stock market bounce won’t last.

On that note we just published a 21-page investment report titled Stock Market Crash Survival Guide.

In it, we outline precisely how the crash will unfold as well as which investments will perform best during a stock market crash.

Today is the last day this report will be available to the public. We extended the deadline based on yesterday’s sucker rally, but this it IT… no more extensions.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research