They’re coming for your money.

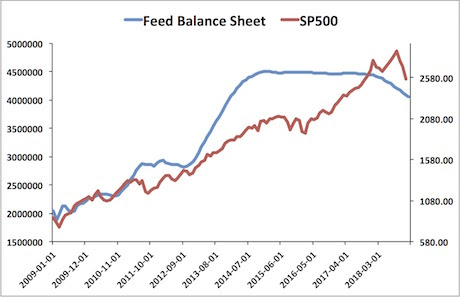

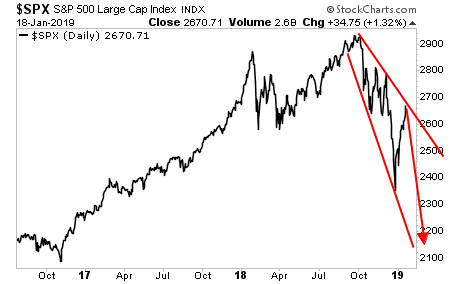

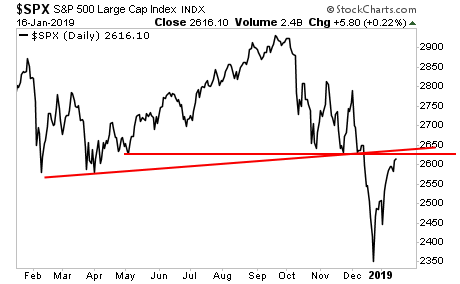

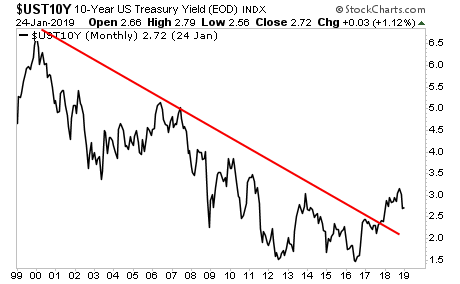

The Everything Bubble has burst and the debt markets are in distress. We’ve already seen yields rise above their long-term downtrend, suggesting that higher debt costs are now a reality.

Because any real structural solution to this (cutting social programs/ defaulting on debts) means political suicide, the political elite are desperate for capital to continue funding the bloated government budget.

Already Oxfam is proposing a 1% tax wealth tax to solve the “crisis.”

If you think that’s bad, consider that the IMF has proposed a 10% wealth tax on total net worth.

And we are seeing Presidential hopefuls such as Elizabeth Warren calling for a 2% tax on wealth for those worth more than $50 million.

All of this is being sold as “making things fair” or “battling inequality” but the reality is that none of these organizations or people really care about that stuff. If they did care they would be proposing solutions that had a chance of possibly working (even a lifetime 100% wealth tax on anyone worth more than $1 million wouldn’t cover the US deficit for more than a year or two).

What they care about is finding money to continue funding Big Government.

If you think this will stop at those with net worth in the eight figures, you’re mistaken. Nebulous financial concepts such as “fairness” are ALWAYS moving goalposts in the hands of socialists.

Indeed, already legislation is in place to use savings deposits to prop up any systemically important financial institution during the next crisis.

I’m not talking about savings deposits over $1 million… I’m talking about savings deposits PERIOD.

This is just the beginning. We’ve uncovered a secret document outlining how the Fed plans to both seize and STEAL savings.

We detail this paper and outline three investment strategies you can implement right now to protect your capital from the Fed’s sinister plan in our Special Report The Great Global Wealth Grab.

We are making just 100 copies available for FREE the general public.

You can pick up a FREE copy at:

http://phoenixcapitalmarketing.com/GWG.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research