The Fed is truly terrified of what’s coming.

Last Friday, a number of Fed officials gave speeches at prominent Central Banking conferences.

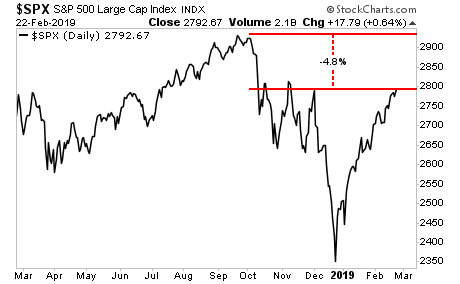

The contents of these speeches reveal a degree of terror that runs completely counter to what is happening in the markets today. To look at the surface of things, the stock market has surged over 18% in the last eight weeks and is now less than 5% of its all-time highs.

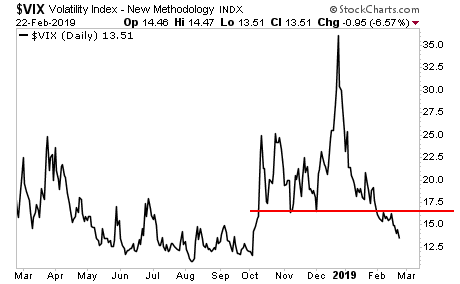

Meanwhile, the Volatility Index, or VIX has broken below 15 and is close to erasing ALL of the spike that was induced by the October- December sell-off.

Against this backdrop of market calm, the Vice Chair of the Fed, Richard Clarida (he’s also the Fed’s highest ranking economist and the primary advisor to the Fed Chair, Jerome Powell) stated that the Fed might consider introducing new easing tools in the future, including policies that the Fed had previously rejected as being too extreme.

We are talking about:

1) Targeting bond yields, much as the Bank of Japan has done.

2) Potentially buying stock directly via futures, index funds, and ETFs.

3) Negative Interest Rate Policy

And more.

Let me ask you… if everything is going well, and the financial system is stable, why is the Fed’s #2 guy talking about potentially introducing policies that are so extreme, the Fed previously rejected them when dealing with the 2008 crisis?

The answer is simple… the Fed knows that another crisis is at our doorstep and that when it hits, the Fed will be forced to engage in even more extreme policies than it did in 2008 to hold the system together.

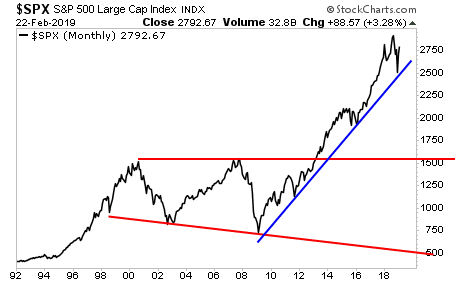

In chart form, the Fed knows that in December we came DARN close to breaking the bull market from the 2009 low. And it knows that once that line goes it’s nothing but a massive air pocket to below.

Put simply, a Crash is coming… and the Fed is preparing for it now.

You should too…

On that note we just published a 21-page investment report titled Stock Market Crash Survival Guide.

In it, we outline precisely how the crash will unfold as well as which investments will perform best during a stock market crash.

Today is the last day this report will be available to the public. We extended the deadline based on yesterday’s sucker rally, but this it IT… no more extensions.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research