As I warned yesterday, the Fed has discovered that:

1) It is impossible to normalize monetary policy in an Everything Bubble.

And…

2) The Everything Bubble is now bursting.

The Fed now has a choice: implement monetary policies even more extreme than the ones it used in 2008-2012 or… let the Everything Bubble burst and the whole system come crashing down.

The Fed has obviously chosen option #1.

If you think I’m being overly dramatic about what’s happening here, consider that the President of the NY Fed (the branch of the Fed in charge of financial markets) announced yesterday that the Fed is consider NEGATIVE Interest Rate Policy (NIRP).

If everything is fine… if the financial system is stable… and we are nowhere near a crisis… why would the head of the NY Fed be suggesting the Fed consider cutting rates to NEGATIVE during the next downturn?

—————————–

Who said getting rich from trading was hard?

Since inception in 2015, this trading system has produced average annual gains of 41%.

And it’s doing this with just one trade once per week. In fact we just closed a 12% gain last week.

We are closing the doors on this system to new clients on Friday this week.

To lock in one of the last slots…

——————————

This…

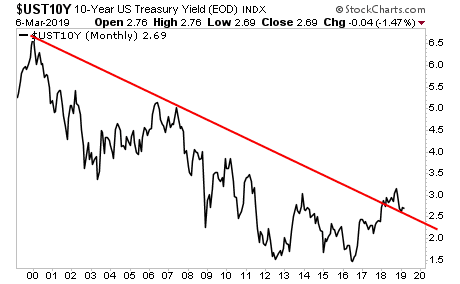

This is the yield on the 10-Year Treasury, the single most important bond in the financial system. As you can see, it’s broken a multi-decade downtrend to the upside.

When bond yields rise, bond prices fall.

When bond prices fall, debt deflation hits the financial system.

When debt deflation hits the financial system, the financial system BLOWS UP.

THIS is why the Fed is in a panic. It’s why the Fed has stopped hiking rates. And it’s why the Fed is desperate to launch even MORE extreme monetary policy as soon as possible.

If you aren’t actively taking steps to prepare for this, you need to start NOW.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here.

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research