The Fed has now created the single most dangerous stock market environment possible…

That’s when the economy is slowing… and stocks are RALLYING based on hopes that the Fed will soon introduce more monetary easing.

This is precisely what happened in 2008. And it’s when CRASHES happen.

And that’s when the opportunity for truly MASSIVE returns appears.

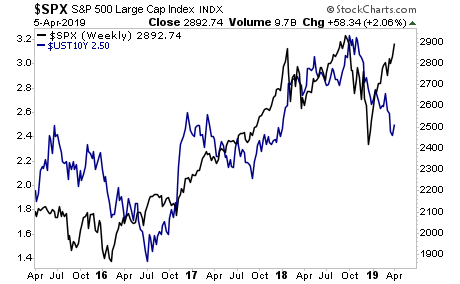

Take a look at the below chart. This is a chart of the S&P 500 stock market against the yield on the 10-Year US Treasury. And remember, bonds, particularly Treasury bonds, are considered the SMART money for a reason.

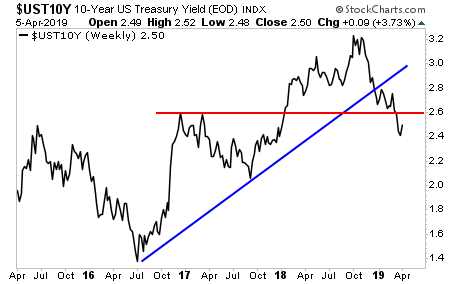

The S&P 500 is trading as though the US is about to enter an economic NIRVANA. The Treasury yield is trading as though the Trump economic boom is OVER: the yield has broken its bull market trendline from mid-2016 (blue line). It’s also broken below critical support (red line).

You can ignore bonds all you like, but they are almost always correct. They were right in 2000… and in 2008. What are the odds they’re wrong now?

Which means…

A Crash is coming… and 99% of investors will panic when it hits…

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here.

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research